Financial markets continued their upward trajectory this week. The S&P 500 finished the week up 3.6%, the technology-focused Nasdaq rose 1.3%, the small cap Russell 2000 advanced 4.1%, and international stocks, as represented by the MSCI ACWI Ex-USA, rose 4.5%. Investment-grade bonds, as measured by the Barclays Aggregate Index, finished the week up 0.2%.

Continued optimism around business re-openings, economic activity surrounding the Memorial Day weekend, and the potential development of a coronavirus vaccine contributed to the week’s positive market performance. The ongoing negotiations in the Senate on a new stimulus package aimed at the municipal bond market also played a role.

This week’s most significant developments were (1) fiscal policy, both in the United States and the European Union, and (2) rumblings of renewed geopolitical trade tension between the U.S. and China over Beijing’s new Hong Kong policy.

U.S. Fiscal Policy

We believe, the federal government has thus far done an admirable job responding to the economic fallout of the COVID-19 crisis. In our view, additional aid for states and municipalities may help solidify the path to economic recovery.

The most recent round of potential fiscal stimulus has stalled in the Senate since it was passed in the House on May 15th. The GOP-led Senate has shown little enthusiasm for the bill in its current form. The White House, however, signaled its support for another stimulus package last week, and on Tuesday, Senate Republicans signaled that a new stimulus bill would likely be needed in the near future.[1]

The bill that passed the House would be the fifth batch of fiscal stimulus. Its potential provisions include a second installment of stimulus checks for certain individuals, enhancements to the payroll tax credits established by the CARES Act in March, expansion of the Paycheck Protection Program, and more than $1 trillion in additional aid to state and local governments impacted by the pandemic. Senator McConnell indicated that aid to municipalities is a non-starter unless the bill also includes liability protections for businesses.[2]

The amount of money given to states and municipalities is an area of particular interest. Municipal bonds have lagged in their recovery, and stimulus funds for municipalities with higher unemployment costs could help support municipal bond prices. There are also lingering questions about unemployment benefits in the bill, especially as states continue to reopen for business. Ohio Senator Rob Portman, for instance, recently proposed a $450 per week back-to-work bonus to encourage people to return to work. [3] The details of this potential legislation are still in flux, but we anticipate more clarity by mid-June.

In the meantime, the most significant questions about the shape of the economic recovery are (1) how long the progressive reopening of businesses will take, and (2) what the accumulated, residual effect will be on businesses of all sizes, and communities.

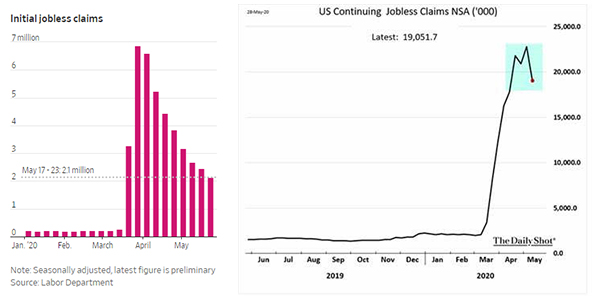

The GOP’s reticence to offer additional unemployment support is bolstered by the steady decline in new unemployment filings over the past eight weeks. Continuing unemployment claims—the number of people collecting unemployment for two or more weeks—also is declining. It fell this week to 19.05 million (not seasonally adjusted), down 16.4% from the previous week’s total.

There is no guarantee that business will resume operations with 100% of their pre-COVID staff, but the unemployment reporting trend is certainly encouraging. Equally important, while American’s long-term expectations for recovery have lowered, which may affect economic activity in the months to come, consumer confidence has stabilized and seems to be progressively improving each week.

EU Fiscal Policy

In the EU, there is more certainty around a proposed stimulus package. The European Commission recently introduced Next Generation EU, a €750 billion ($826 billion) stimulus that will help some of the hardest-hit southern European countries like Spain and Italy.

Next Generation EU is the largest European economic stimulus package since the Marshall Plan in 1948. €500 billion of the funds will be offered as free grants to member-states, and the remaining €250 billion will be made available to repair the single market from the effects of the COVID-19 pandemic by “support[ing] the healthcare sector, workers and businesses, and mobilizing finance from the markets to help save jobs.” [4]

The EU raised the necessary funds for this stimulus by temporarily lifting its “own resources” (customs duties, VAT, GNI, and other revenue streams for member states) ceiling to 2% of the EU’s gross national income. The cost of this stimulus package will be spread across 30 years, beginning in 2028.

This is the EU’s first widespread fiscal policy response during this crisis, and this stimulus could go a long way towards supporting international markets. Many notable policy figures, such as previous ECB Chairman Mario Draghi, have called for a coordinated fiscal response to economic pressures for a number of years, but structural challenges within the EU make fiscal stimulus difficult to achieve. Encouraged by this landmark, cyclical stocks such as banks fared particularly well this past week. The hope is that the stimulus will help to bring borrowing costs down further for specific EU member states.

Although the stimulus has restored investor optimism, as we’ve noted in previous commentaries, there is a difference between market performance and the performance of the economy overall. We do not feel the stimulus package is a panacea for the structural challenges facing the EU, but it is encouraging and will likely provide a short-term boost to investor sentiment.

U.S. & China Clash Over Hong Kong Autonomy

On the geopolitical front, tensions remain high between the U.S. and China following Beijing’s recent announcement that they would further curtail Hong Kong’s rapidly-dwindling autonomy. Secretary of State Mike Pompeo issued a statement Wednesday acknowledging this fact, saying, “No reasonable person can assert today that Hong Kong maintains a high degree of autonomy from China, given the facts on the ground. […] The United States stands with the people of Hong Kong as they struggle against the CCP’s increasing denial of the autonomy that they were promised.”

In response, Chinese foreign ministry spokesman Zhao Lijian told reporters, “If anyone insists on harming China’s interests, China is determined to take all necessary countermeasures. The national security law for Hong Kong is purely China’s internal affair that allows no foreign influence.” [5]

While the situation between the U.S. and China is still evolving, the standoff over Hong Kong’s autonomy comes at an inopportune time. The specter of a geopolitical power struggle could adversely affect trade between the world’s two largest economies and, if the current tension escalates, potentially hinder collaboration between the U.S. and China in developing a COVID-19 vaccine. As a result, we will be monitoring U.S./China relations closely during the coming weeks and months.

Closing Thoughts

As we continue to study the markets and watch the geopolitical front, we will keep a close eye on the pace of reopening across the country, the rate of new infections, and the work being done to research and develop a vaccine. At this point in time, as we reflect on progress, we are cautiously encouraged by the increasing optimism around a gradual economic recovery.

[1] CNBC, Congress will “probably” have to pass another coronavirus stimulus bill, Mitch McConnell says.

[2] Kiplinger, 5 HEROES Act Provisions with a Good Chance of Becoming Law.

[3] Wall Street Journal, GOP Considers Back-to-Work Bonuses.

[4] Markets Insider, EU plans a record-breaking $826 billion stimulus package.

[5] Bloomberg, U.S. Says Hong Kong’s Autonomy Is Gone, Sowing China Trade Doubt.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.