As we head into the final months of 2024, we are watching several key trends and topics that could shape financial markets in the near term. In this edition of Sage Insights, we’ll discuss three of them: the upcoming U.S. elections, the recent rise in U.S. Treasury yields, and the latest corporate earnings reports. Our goal is to help you make sense of these events from a long-term perspective and understand what they could mean for your portfolio.

Market Performance in October

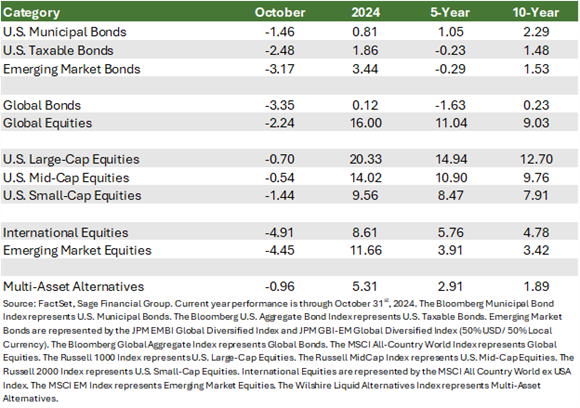

Equity markets experienced a modest pullback in October despite remaining on the path to delivering strong annual returns in 2024. Persistently higher Treasury yields weighed on the performance of U.S. and global fixed-income markets amid the growing expectation that the Fed would cut rates more gradually than anticipated just one month ago.

October’s market activity highlighted modestly negative performance across global asset classes:

Global fixed-income returns retreated 3.35% in October as economic strength pointed toward less need for rapid interest rate cuts in the U.S. and contributed to higher rates among longer-term bonds. This trend impacted non-U.S. bonds, which experienced currency weakness relative to dollar-denominated bonds.

- U.S. Taxable Bonds: Rising interest rates on U.S. Treasuries caused the value of investment-grade fixed income to fall 2.48% during October.

- U.S. Tax-Exempt Bonds: Declined 1.46%, with higher interest rates and U.S. election-related uncertainty impacting returns. This asset class historically experiences more significant moves around election periods.

- Emerging Markets Bonds: Dropped 3.17% due to a stronger U.S. dollar and a growing expectation of a slower rate-cutting cycle in the U.S., which delayed rate cuts from emerging central banks.

Global equities declined 2.24% amid a heightened geopolitical climate, an underwhelming start to earnings season from European companies, and a pullback from China following a breakout one month ago.

- U.S. Large-Cap Equities: Experienced a monthly 0.70% decline in October despite reaching an intra-month all-time high. Notably, the Russell 1000 Index remained stable, with the only daily move exceeding 1% on the month’s final day.

- U.S. Mid- and Small-Cap Equities: Posted negative returns in October. Mid-caps fell 0.54%, while small caps dropped 1.44%. Smaller companies remained out of favor as investors grappled with the implications the upcoming election could have on companies more closely tied to the U.S. economy.

- International Equities: Experienced a negative return, as measured by the most widely referenced index, dropping 4.96% in October, reflecting the U.S. dollar’s 3.17% rise. Emerging market stocks also declined, falling 4.45%. Europe’s leading companies, Novo Nordisk and ASML, experienced selling pressure during the month. The former declined on competition concerns from other weight-loss drug makers, and the latter reported reduced demand for its chipmaking machines. Chinese equities were also crucial contributors to the declines, with Chinese stocks reacting to delayed stimulus announcements.

Looking Toward Election Day

With Election Day approaching in the U.S., investors may be wondering how the outcome could affect the markets and their portfolios. Current polling remains formidably tight between the two candidates vying to sit in the Oval Office and lead the U.S. over the next four years.

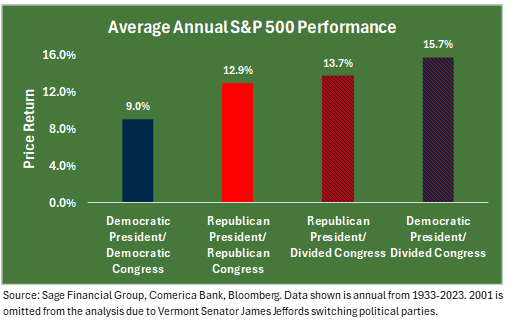

History reminds us that markets have demonstrated resilience under various political landscapes.

- Democrat-Controlled White House and Congress: Historically, this scenario has been characterized by increased fiscal spending, which can stimulate economic growth in the short term. While concerns around higher taxes and regulation may arise, markets tend to perform well under unified Democratic control, with average large-cap stock returns showing solid growth.

- Republican-Controlled White House and Congress: In a Republican-dominated government, markets often respond positively to policies emphasizing tax cuts and deregulation. Historically, stocks have seen strong returns driven by a pro-business environment.

- Divided Government: A divided government—when one party controls the White House and the other controls one or both chambers of Congress—has historically been viewed as favorable by the markets. This scenario often leads to policy gridlock, limiting major legislative changes and providing a stable environment for businesses.

Here is what we have observed when segmenting performance based on government control:

While short-term volatility can occur around elections, we encourage our clients to remain focused on long-term fundamentals. It is important to remember that political changes often have a more negligible impact on market performance over time than factors like economic growth, productivity, and innovation.

Rising Treasury Yields and Fixed Income Strategies

Bond market performance has been positive over the past year. Interest rates peaked in October 2023 and subsequently declined based on the expectation that the Fed will finally reduce borrowing levels.

Since the Fed’s rate cut in mid-September, Treasury yields have surprisingly been on the rise again. Recent data shows that strength in the labor market and consumer spending has fueled higher yields, though inflation continues to decline gradually.

The consensus market expectation now is for a slower and smaller pace of future rate cuts. At the same time, investors are closely monitoring potential changes to tariff, tax, and immigration policies, all of which could impact rates.

We believe trying to predict the precise movements of interest rates can add risk to portfolios. Instead, for clients holding fixed-income securities, we use multiple fixed-income strategies with various degrees of interest rate sensitivity to help mitigate risks in this environment, including floating-rate loans, which tend to benefit from higher rates as coupon payments increase.

Corporate America Checks In

Corporate earnings provide a timely snapshot of how companies manage current economic conditions and can often signal broader market trends. As we progress through the third-quarter reporting season, expectations are for more modest earnings compared to the strong growth in the first half of the year. As of October 31st, earnings growth of the S&P 500 is 9% year-over-year, with eight of eleven sectors exceeding earnings expectations.

- Financial Sector: Banks kicked off earnings season with strong results, demonstrating resilience in a higher-rate environment. To date, approximately 80% of reporting companies have exceeded analysts’ low expectations.

- Consumer-Focused Companies: Given that consumers drive over two-thirds of the U.S. economy, we will be closely monitoring consumer sector results in light of recent strong GDP growth and retail sales data.

- “Magnificent 7”: These tech-heavy companies have driven much of the index’s performance in recent quarters and are expected to continue supporting equities through the remainder of 2024.

While we are optimistic about U.S. equity markets, the S&P 500’s current all-time highs suggest that maintaining exposure to smaller companies and international stocks may offer complementary growth opportunities.

Sage’s Investment Perspectives

Market reactions to U.S. election outcomes, rising Treasury yields, and corporate earnings will vary across sectors.

Equity Sectors:

- Under all political landscapes, U.S. large-cap stocks have averaged 9-13% in a single year, with some modest variation.

- Rising Treasury yields may weigh on growth stocks, particularly those in technology and other sectors with high valuations.

- Strong corporate earnings growth could boost stock prices and overall market sentiment, though weaker-than-expected results could lead to pullbacks.

Fixed Income:

- Rising yields reduce the value of existing bonds, especially long-term bonds.

- However, they also present opportunities for income-oriented investors, particularly in higher-yielding sectors like corporate bonds and emerging market debt.

- Strong corporate earnings could enhance the credit quality of corporate bond issuers, supporting returns in bond funds.

Closing Thoughts

As we move through the remainder of the year, staying focused on the time horizon of our clients’ goals remains essential. The U.S. elections, shifting Treasury yields, and fluctuating corporate earnings are all part of the ever-evolving market landscape. Still, we believe that disciplined, diversified portfolios are well-equipped to weather these changes and capture growth opportunities over time.

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’s written disclosure statement discussing our advisory services and fees is available for review upon request.