November was a strong month for stocks and bonds. During the bumpy period from August through October, we consistently emphasized the importance of remaining patient and disciplined. This position was rewarded last month as major market indices bounced back sharply, and we enjoyed the best month of performance thus far in 2023.

In this edition of Insights, we will review market performance and the economic data that sparked the rally, share our outlook for monetary policy from the Federal Reserve, and provide perspective on how stocks and bonds historically have performed after a Fed pause.

We continue to hope that these monthly communications provide insight and transparency into our thinking and how we seek to help you achieve your financial goals.

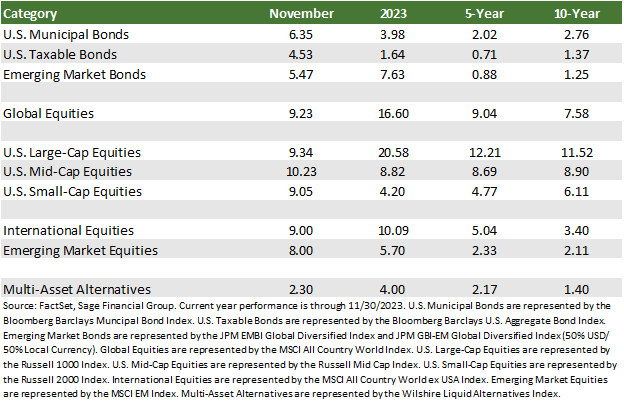

Market Overview

Investors had something to be thankful for in November as market indices snapped a three-month losing streak in response to several positive signals, including a labor market that is cooling at a controlled pace, inflation trending in the right direction, and a Federal Reserve that appears to have paused on rate hikes for the time being.

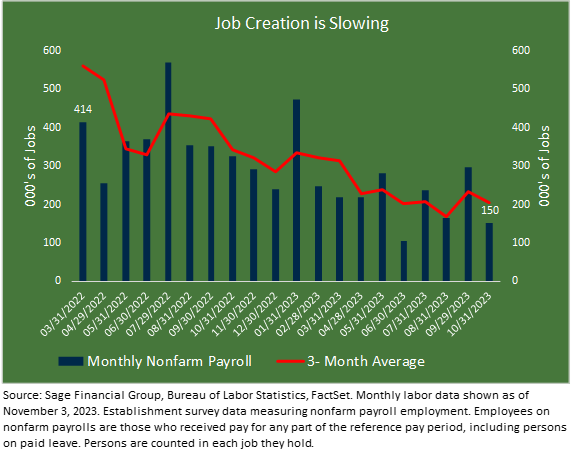

The release of the monthly jobs report, which showed fewer nonfarm jobs were added in October than the market expected, kickstarted the positive performance of bond and equity markets. Then, in a near-180-degree reversal from the prior month, sharply lower Treasury yields driven by the expectation of the Federal Reserve becoming accommodative earlier in 2024 added a strong tailwind.

Core bond returns snapped back more than 4.5% in just one month. As recently as October 19th, the U.S. 10-year Treasury yield hovered around 5%, a 16-year high. Since then, the 10-year Treasury yield has fallen by approximately 0.64% to 4.36% at the end of November. This swift decline in Treasury yields has erased all losses year-to-date for core investment-grade bonds. A one-month climb of 4.53% in November pushed core bonds back into positive territory.

In lockstep with their U.S. peers, emerging market bonds rose in November, albeit by a larger 5.47% increase. Many central banks outside of the U.S. are also experiencing an easing of inflationary pressures. With the immediate risks and fears of inflation abating, it appears that less restrictive monetary policy is becoming a global theme.

Globally, all equity markets performed well in November.

U.S. large-cap equities increased 9.34% for the month. However, much of this gain continues to be generated by the seven largest stocks in the index, up 75% this year.

Encouragingly, U.S. mid- and small-cap stocks rose 10.23% and 9.05%, respectively. In fact, on November 14th, small-cap companies had their strongest single day of performance in over a year. As markets remain forward-looking, the optimism here centered around a decline in rates, putting less stress on the balance sheets of smaller companies.

International equities, represented by the most widely referenced index[1], appreciated by 9.00%, while emerging markets equities climbed by 8.00%. While central banks are taking their foot off the gas pedal globally, investors are closely monitoring geopolitical events outside of the U.S. and the associated implications before deploying more investment capital into developed and emerging markets.

Cooler Economic Data Fuels Hotter Market

On November 1st, the Federal Open Market Committee (FOMC) announced its unanimous decision to pause interest rate hikes, at least temporarily, keeping them unchanged at a target of 5.25% to 5.50%. Market participants generally expected this decision, so it had little impact on performance.

What came next, however, was unexpected and became the initial driver of November’s market rally. On November 3rd, the jobs report revealed that the U.S. economy added 150,000 nonfarm jobs in October, the second smallest monthly increase since the Fed began raising interest rates in March 2022. Even more surprising was the rate of deceleration month-over-month, which in the month prior was nearly double the number of jobs added.

The report also showed that wage growth had moderated, suggesting that inflationary pressures were easing, a welcome sign for companies who have felt margin compression. In response, interest rates declined, and equities rallied. More economically sensitive small-cap stocks rose by nearly 9% in November.

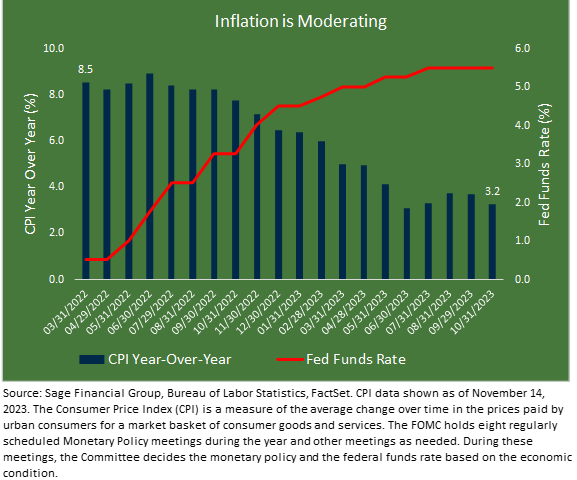

The monetary policy goals of the Federal Reserve include a dual mandate. Maintaining maximum sustainable employment is only one part of the equation. The other focuses on achieving price stability. For all of us, higher prices have impacted our lives in at least some capacity over the last two and a half years.

In March 2022, when the Fed began combating higher prices, many market forecasters, including Sage, thought inflationary pressures would diminish quickly. This proved to last longer than originally expected.

Three main areas of inflation focus are energy, shelter, and core goods:

- Energy reversed course in the most recent CPI report, falling roughly 5% last month. We observe this firsthand, with the price at the pump trending downward.

- Shelter accounted for nearly 70% of the most recent 3.2% year-over-year CPI increase. However, we expect this trend to decelerate as rental prices experience lagging effects.

- Core Goods marked their fifth consecutive month of price declines. Consumers have shown the propensity to pull back spending on a variety of apparel, furniture, and car purchases.

An easing of inflation is a welcome sign suggesting the Fed’s rate hiking policy has worked. It has now skipped rate hikes for two consecutive meetings this fall, with near certainty that December’s FOMC will follow this trend. However, Fed Chair Jerome Powell reiterated that the Committee would proceed “carefully” at upcoming meetings and continue to rely on economic indicators.

In an environment like the one we are in, where incoming economic data can swiftly impact market direction, we like the risk-reward tradeoff core bonds provide. The higher credit quality of core, investment-grade bonds allows them to absorb sudden market volatility. We like U.S. mid and small-cap stocks for a similar reason: they tend to perform well in this environment. Sage tactically balanced higher into these asset classes in many client portfolios in recent months.

Next Steps for Fed Policy

While the Fed’s decision to hold interest rates steady did not provide the same immediate jolt for financial markets as the jobs report, we believe it has positive long-term implications.

At their November meeting, Fed policymakers stated, “All participants judged that it would be appropriate for policy to remain at a restrictive stance for some time until inflation is clearly moving down sustainably toward the Committee’s objective.” We believe the incoming economic data continues to support this outlook from the Federal Open Market Committee, and we are cautiously optimistic that the pause in rate hiking will continue.

As shared in the previous section, we believe the incoming data continues to support this outlook from the Federal Open Market Committee. We are paying close attention to the word “sustainable,” which we interpret as several readings of deceleration in the labor market alongside moderate readings of inflation.

Market participants apparently agree that no additional rate hikes are likely at this time. Even more revealing, markets are currently pricing in a 50% probability of a rate cut occurring at the FOMC Meeting on March 20th, 2024.

From an economic perspective, it appears the rate hikes from the Federal Reserve have been sufficiently restrictive to slow down the economy. Lowering interest rates should put less stress on consumers and businesses alike.

Consumers buying more homes and cars and businesses increasing their capex and hiring plans are good for the economy and financial markets. If modest economic growth and falling inflation continue, the Fed will likely cut its policy rate. Lower rates tend to push the prices of both stocks and bonds higher.

With this in mind, we believe that allocating now to high-quality fixed income will serve many investors well. November’s performance affirmed this, along with the fact that high-quality fixed income currently boasts yields north of 6% for the first time in over a decade.

Moreover, should yields begin to fall, these bonds can continue to provide elevated income and price appreciation. Simultaneously, we remain optimistic that infrastructure, real estate, and equities stand to benefit from falling inflation and Fed policy.

Longer-Term Perspective: What Happens After the Fed Is Done?

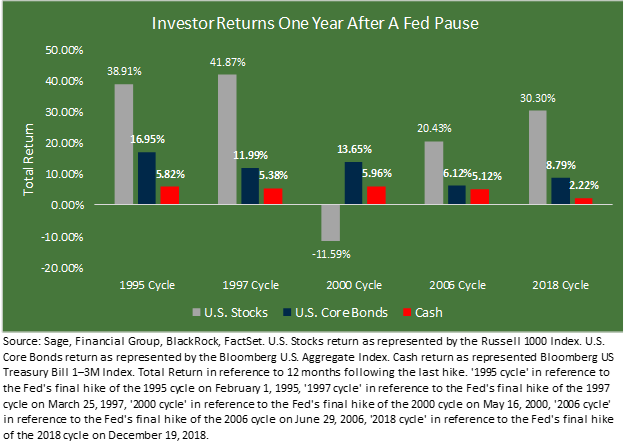

There are strong historical patterns to how stocks and bonds perform following the end of a Fed hiking cycle.

For stocks, which are included in portfolios for growth:

- Since the beginning of 2022, the primary concern facing investors has been this recurring theme of monetary policy. The Fed’s commitment to slow down the broader U.S. economy has created challenges for equity investors as the expectation for earnings growth has slowed.

- In our view, a pause from the Fed reduces the likelihood of negative equity returns as stocks have historically performed well over the next 12 months. On average, during the 12 months following the last 5 rate hiking cycles, the Russell 1000 Index rose 23.98% and was positive in 4 out of 5 periods.

- In our view, the final hike of this Fed cycle occurred in July, and since then, equities have risen by approximately 1.0% as investors have debated if that truly was the final hike. With levels of inflation and unemployment below the average level at the end of previous Fed hiking cycles, we believe the economy does not falter, and equities can provide returns in line with long-term averages.

Recently, a few clients have asked about the undeniably attractive 5% yields on some cash-like vehicles. Our response is always to encourage them to remain invested in the markets because, historically, investors who turn to large cash allocations for protection from market volatility tend to miss out on the upside of bond market rallies. At the end of the last 5 Fed hiking cycles, cash has underperformed core bonds over the next 12 months in each instance by an average of 6.6%. During these 5 periods, core bonds have return on average, 11.5%.

Given the fast-changing nature of financial markets, we try to remain proactive and not reactive. We believe the best approach is maintaining the customized portfolio that Sage designed for your risk/reward profile.

Closing Thoughts

November was a rewarding month for Sage investors. We are cautiously optimistic about what we see ahead and the positioning of our portfolios. However, we accept that markets can behave unpredictably and erratically, with significant fluctuations over short periods — and that trying to predict future outcomes with near precision can lead to sub-optimal outcomes. Our position is to remain vigilant and respond appropriately to market developments without overcorrecting in any one direction.

Our primary focus will always be helping you achieve your unique financial goals. We will continue to focus on managing risk and preparing for a spectrum of outcomes so that we can patiently weather unsettling periods like the one from August through October and enjoy the upside of months like this November.

[1]Emerging markets debt is represented by the JPM EMBI Global Diversified Index and JPM GBI-EM Global Diversified Index (50% USD/ 50% Local Currency). U.S. large-cap stocks are represented by the Russell 1000 Index. U.S. small-cap stocks are represented by the Russell 2000 Index. International stocks are represented by the MSCI All Country World ex USA Index. Emerging market equities are represented by the MSCI EM Index.

Previous Posts

- Sage Insights: Market Observations Through Uncertain Times

- Sage Insights: Market Observations Following a Rocky Month and Quarter

- Sage Recognized By Leading Financial Journals

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.