The market volatility we have experienced throughout 2022 continued to rear its head for most of May before stocks rallied in the final full week of the month. Equities finished the month roughly unchanged, and bonds had their first positive month of the year. May also saw elevated inflation readings showing early signs of the economy slowing as the Federal Reserve committed to meeting its policy objective of cooling price increases. Meanwhile, China has moved toward resuming manufacturing operations, a positive sign for supply chains.

Taken collectively, we see these as relatively positive developments from the last month and remain committed to helping clients put these developments in the context of broader investment objectives.

In this issue of Insights, we share our inflation outlook and its importance as an economic indicator, dig into the supply chain implications of China’s lockdowns, and look at how bonds have returned as an essential portfolio diversification tool.

Markets Bounce Back But Remain in Correction Territory

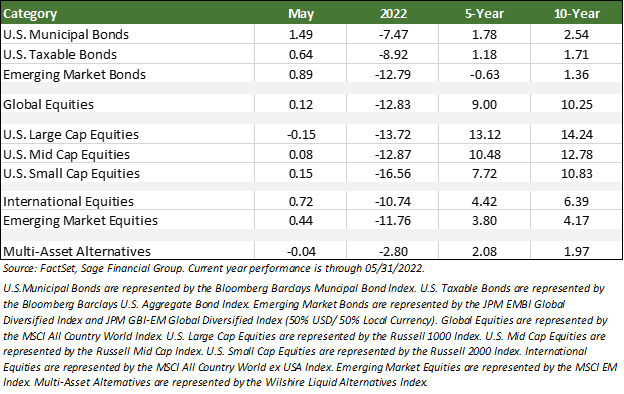

In equity markets, U.S. large-cap stocks essentially leveled out by month’s end, declining by 0.15% in May. They remain in correction territory, however, at 14.20% below all-time highs reached earlier this year. International stock indices have also seen declines this year, with the most widely quoted international stock index down 10.74% through May, while emerging market stocks are down 11.76%[1].

Despite near-universal declines for most asset classes this year, these figures only tell part of the story for disciplined investors. Sage’s investment principles and focus compel us to consider a broader context. Looking further back, the 5- and 10-year returns of Global Equities through May have been 9.00% and 10.25% annualized.

Regarding bonds, a decline in interest rates drove positive performance. However, through May, the 8.92% decline in the Bloomberg Barclay’s U.S. Aggregate Index is the second-largest 5-month decline since the index’s inception dating back to January 1976.

As we have noted throughout the year, Sage actively planned for this historically challenging period in the bond market. We continue to integrate nontraditional bond funds and alternative investments to provide diversification to traditional fixed income during these times of quickly fluctuating interest rates.

Economic Outlook: Inflationary Forces Appear to Balance, But Caution is Still Warranted

We understand the unease many feel about the markets and state of the world these days. We feel it, too. One tangible lever we can look to in understanding recent volatility is inflation. Much of the path forward depends on inflationary pressures and the ripple effects.

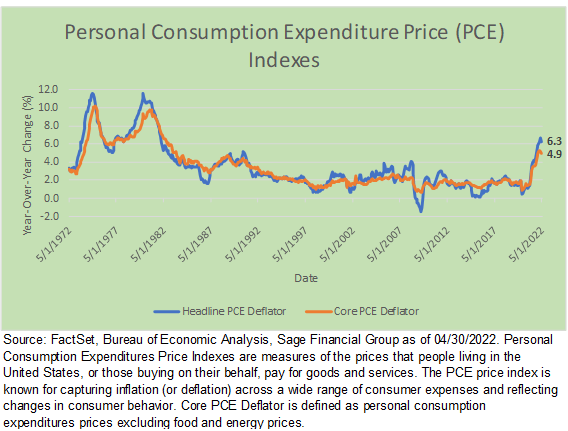

The Federal Reserve’s (Fed) preferred measure of inflation, the Personal Consumption Expenditures Price Index (or “PCE”), most recently rose by 0.25% month-over-month, the smallest monthly increase in 18 months. Headline PCE rose 6.30% year-over-year, down from 6.60% last month — the first decline in 18 months. Core PCE (price increases excluding food and energy) rose at a 4.90% annual rate, which was also a drop from the prior month. While there are too many variables to say definitively that inflation has peaked, we see these readings as a positive sign that price increases are decelerating.

Inflation matters for financial markets because higher prices disrupt economic growth in a few different ways. No one likes paying more, and inflation hurts consumers’ ability to buy the same amount of goods and services, ultimately decreasing company profit margins.

Nobel Prize-winning economist Milton Friedman famously said, “inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” In other words, when the money supply increases faster than the supply of goods, prices naturally rise in response to the imbalance. In 2021, we saw massive stimulus and extreme demand for goods, which led to higher prices. As discussed in the next section, China’s lockdowns simultaneously exacerbated this demand by limiting the supply of goods imported by other countries.

Like so many economic forces, there’s a psychological component to inflation as well. When workers grapple with rising prices, they start to demand higher wages. The resulting “wage-price spiral” – shown in the figure below – creates even higher expectations and inflation. Thus, the world’s central banks work very hard to avoid engrained inflation expectations and perceptions by slowing the economy when inflation heats up.

Right now, the important question is, “Where does inflation go from here?”

The Fed wants to see prices increasing at only 2.00% per annum — a rate determined to be neither stimulative nor contractionary. That’s a long way to go from 6.30% currently. But we note that, prior to 2021, this target was rarely achieved. In our view, looking at year-over-year PCE, the path to 2.00% may be difficult to achieve in the near term amid continued elevated pressures on input costs. Constraints in the U.S. and other countries regarding labor shortages, supply chain difficulties, and logistical costs (e.g., shipping and commodity prices remain higher than a year ago) must be addressed. That said, we have a balanced view regarding the path forward, including both positives and risks.

On the positive side, recent data points indicate inflation appears to be stabilizing. Cautiously, our reading offers some hope it has peaked. Commentary from business leaders on earnings calls and economists remains mixed, with the consensus favoring economic growth at a slower pace. For its part, the Fed is expected to consistently raise interest rates to fight inflation, which is in alignment with a view on a slowing economy.

However, as the Fed tightens interest rates to balance certain dynamics such as labor and housing, the resulting economic slowdown in the world’s largest economy raises the risk of “something breaking” within the economy. It’s these uncertainties amid a slowdown that have the potential to lead to a recession.

From an investment perspective, we once again note that we structure our portfolios to plan for a range of outcomes, including positive, base, and negative scenarios over the near and long term. We diversify across geographies and include a variety of different asset types. For example, we have been using less correlated asset classes such as alternatives and bonds to reduce risk during turbulent environments, as well as maintaining appropriate equity exposure to enhance a portfolio’s longer-term returns. Whatever path inflation and the economy at large take in the coming months, our investors can count on a disciplined strategy and sound portfolio construction that has taken all relevant factors into account.

China Begins to Emerge from Lockdowns, Relaxing Supply Chain Concerns

As we look at major factors driving inflation and broader market volatility, it’s worth spending some time on China and its manufacturing sector. China’s zero-COVID policy is a unique approach by the world’s second-largest economy to identify, isolate, and control the spread of the virus. This strategy has had negative global economic and financial market implications as the country has effectively locked down non-essential services in cities, including the coastal financial hub of Shanghai and the capital city of Beijing.

Yet, here again, developments last month present reasons to be cautiously optimistic. In the middle of May, Chinese Premier Li Keqiang, speaking in front of global leaders, announced China’s intention to strike a balance between containing COVID outbreaks and stabilizing the economy. This was a break from Chinese President Xi and a rare deviation from a high-ranking Chinese official to acknowledge the acute pain felt in the Chinese economy. According to a survey released by the European Chamber of Commerce in early May, 23% of European companies are considering moving operations out of China due to the challenges associated with the frequency of lockdowns. Shortly after, Apple announced plans to move at least some of its production out of China and into Vietnam.

Forward-looking markets reacted positively to developments from China toward the end of the month. Beginning on June 1, Shanghai began gradually reopening businesses such as shopping malls, department stores, and supermarkets aiming to return to normal. On top of a gradual reopening, the Chinese central bank -the People’s Bank of China – announced it lowered the mortgage lending rate floor for first-time buyers by 0.20%.

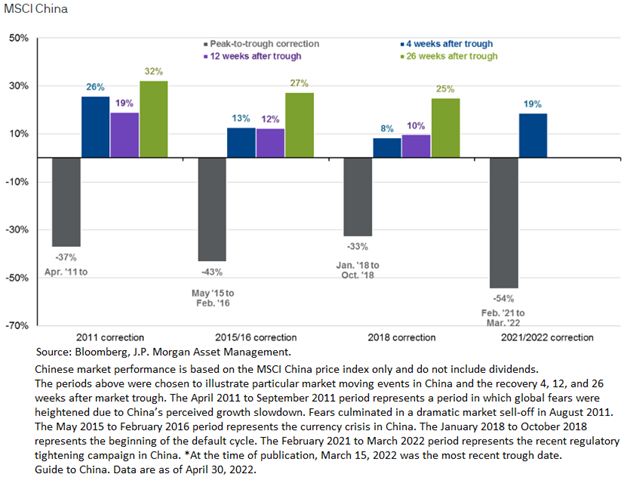

In analyzing Chinese equities, we note that over the prior decade, Chinese stocks experienced double-digit corrections before recovering. As Mark Twain said, “History never repeats itself, but it does often rhyme.” Unfortunately, Chinese equities are a volatile asset class. Historically, however, returns after major drawdowns have been positive, and over time we do think that there are opportunities in industries that benefit from innovation technology and the growth in the middle class.

For investors, much of the downside risk appears to be priced into the market at this point, with Chinese equities officially in a bear market and valuations below the 15-year average. Additionally, if lockdowns are continuously eased in China, it should support global supply chains and help with inflationary pressures felt around the world. We anticipate that emerging markets will continue to feel pressure — and experience volatility — until the growth outlook in China stabilizes.

The risk is that if COVID cases rise again and lockdowns resume, global growth will be dented, and inflation would remain pressured to the upside. It’s a development no one wants, but Sage continues to prepare for and protect against such outcomes by incorporating assets such as infrastructure and floating rate loans into portfolio planning.

Bonds Resume Their Role as Diversification Tool

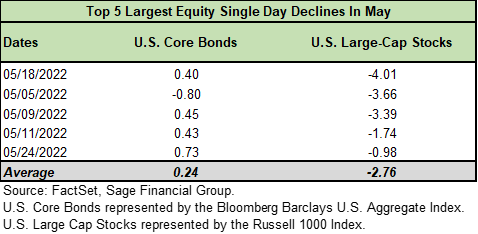

Some good news is that high-quality fixed income resumed its place as a diversifier in May. That is, when equities were falling in the middle of the month, bonds were gaining ground. For disciplined investors and diversification advocates, this is a welcome return to form for fixed income. Bonds traditionally offer an important counterbalance to equity markets. This type of diversification is highlighted in the table below. On average, during each of the 5 largest single-day declines in May, U.S. Large-Cap stocks fell by 2.76%, while U.S. Core Bonds provided a positive return of 0.24%, on average.

This table highlights the established benefits of a diversified portfolio, but we do recognize the grief the bond market has inflicted on investors year-to-date. While painful, history offers a more favorable longer-term outlook. Periods such as 1980, 1994, 2013, and 2018 all saw the Fed similarly tighten monetary policy. Historically, these challenging years for bond investors were followed by strong-performing periods over subsequent years in which the Fed eased its policy stance and volatility subsided.

Closing Thoughts

As investors, we navigate through what seems to be no shortage of challenges. Financial markets have always endured despite periods of war, disease outbreaks, and macroeconomic shocks. We understand that keeping these challenges in perspective is always easier said than done. We see now that 2021 proved to be a true outlier that saw very muted market volatility that trended upwards throughout the year. So far, 2022 is proving to be more challenging.

Nevertheless, we currently have a balanced view on the economy and financial markets, in which there are a variety of positives, as well as risks to work through. These types of environments can be volatile, and we aim to construct portfolios for a wide range of outcomes.

At Sage, we recognize that in an environment of unknowns like this, diversification is more important than ever. We continue to fall back on our understanding that in each of these volatile periods, although some longer than others, markets have never failed to regain a peak and subsequently pass it.

We are not immune to emotional reactions, nor do we claim to know precisely what will happen next. Our focus is to make sure the advice and recommendations we provide our clients are best suited to meet their goals and time horizon and to make sure that we can provide them with any additional support they may need during challenging times.

[1] U.S. Large Cap stocks are represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index.

Previous Posts

Our Perspective on the Current Market Environment

Sage Insights: Geopolitics, Earnings, and Investing Principles

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.