Stocks and bonds lost ground in September, completing a third consecutive quarterly decline. Across the globe, central bankers continued to increase interest rates and the cost of borrowing at an unprecedented speed in an effort to control inflationary pressures.

This swift rise in interest rates has created the risk of a monetary policy-induced recession, along with a wide range of potential outcomes for the economy over the next few years. Nonetheless, the economy seems to be on much better footing than during previous sharp stock market downturns, such as in 2020 and 2007.

We maintain that a diversified portfolio provides investors the best opportunity to balance risk and return in pursuit of their financial goals. This year has been an anomaly as the market volatility has been widespread across stocks and bonds. But in most years, some investments will perform well even when others underperform, providing balance to portfolios. For example, going forward, the higher interest rates on bonds should help buffer the volatility of stocks. This is why we strongly believe that sticking to a customized, diversified investment plan is an appropriate course of action through volatility.

In this edition of Insights, we recap recent market performance, discuss some reasons why we are cautiously optimistic about valuations and interest rates, and reflect on slowing global growth.

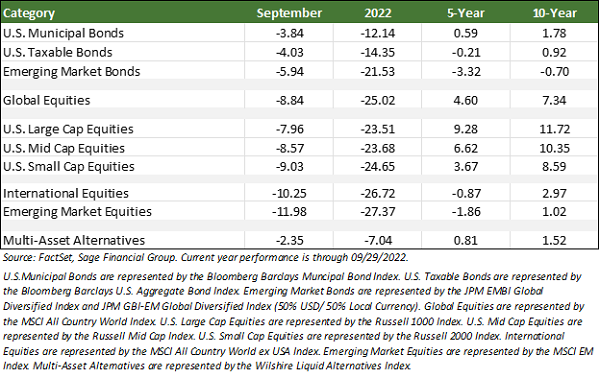

Performance Recap

Earlier in the summer, there was hope that inflation numbers were beginning to ease. This notion was swiftly quashed as housing inflation, a key part of the core inflation index, remained rigid, even as the smaller energy-related categories showed signs of alleviation. This was a primary driver of poor performance across markets.

- September was a dismal month for equity markets. Global equities fell by 8.84%. U.S. large-cap stocks declined by 7.96%, and the most widely quoted international stock index fell 10.25%[1].

- Taking a step back, it’s helpful to remember that global equities have returned on average 7.34% annually over the past 10 years. This year’s decline (25.02% year-to-date through September) stands in stark contrast to average yearly gains of more than 20% in 2019, 2020, and 2021.

- In the bond market, the dramatic increase in Federal Reserve policy expectations contributed to higher rates and, unfortunately, sharply lower bond prices. Investment grade bonds have fallen by 14.35% and remain a beaten-down asset class in 2022.

Valuations Become More Attractive

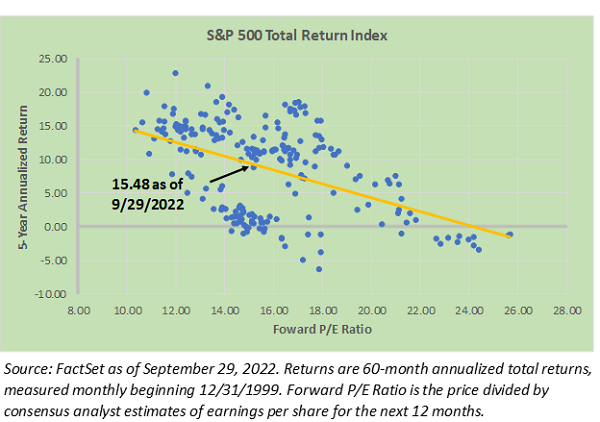

Despite an uncertain outlook, our analysis points to cautious optimism around valuations. Equity prices have declined despite resilient corporate earnings, which are expected to grow nominally 7.8% over the next 12 months, and bond yields have risen sharply as the Federal Reserve moves interest rates higher. These examples of valuation compression can be seen in both equities and bonds.

In our view, valuations have predictive power over 5-year periods for both stocks and bonds. Here’s an example. In less than one year, U.S. Large Cap stocks have experienced a decline in their price-to-earnings ratio from over 22.1x to 15.5x today. A forward P/E of U.S. Large Cap Stocks at 15.5x suggests positive future expected returns as equity investors can now pay a lower price for companies with strong corporate earnings, leading to valuation expansion.

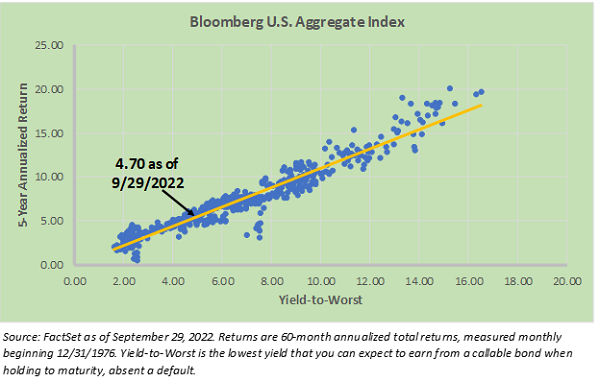

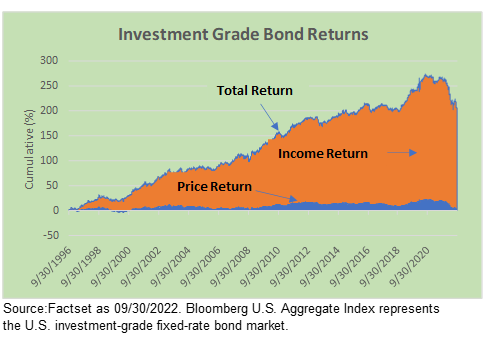

Yields on core bonds and subsequent 5-year returns also have a tight relationship, historically. While the decline in bond prices has been surprising to most investors, history suggests that future bond returns should increase as yields move higher. For example, when the Bloomberg U.S. Aggregate index’s yield-to-worst is 4.7%, historically, the future 5-year return has been around 4.7%.

For investors, this year has been unquestionably challenging across nearly all asset classes. That said, asset valuations now appear more attractive than in the beginning of the year and relative to history. Equities are now trading at below-average price-to-earnings ratios relative to the 25-year average. Bond yields are higher than they have been in over a decade, and nontraditional assets like preferred securities offer above-average yields. We continue to expect volatility, and the risks of economic deterioration remain. However, our analyses suggest that the risk/reward from a diversified portfolio at today’s prices is increasingly more attractive.

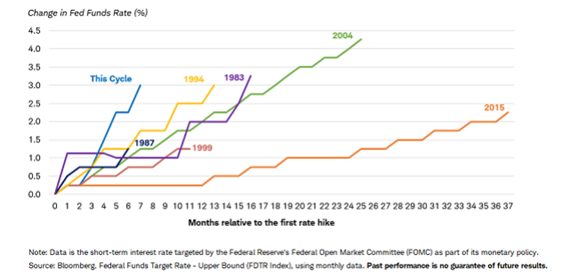

Historic Central Bank Tightening

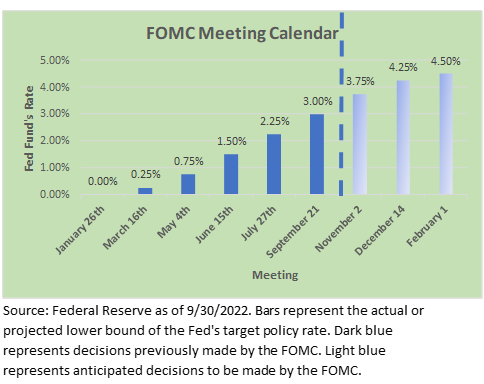

On September 21st, the Federal Open Markets Committee (FOMC) hiked interest rates for the 5th time in 2022, bringing its policy rate from 0% to 3% in just 6 months. As recently as November 2021, the FOMC expected to raise rates only once in 2022. However, the Fed and a significant number of market participants underestimated the effect of fiscal policy on inflation, as well as the persistent impact of China’s zero-tolerance policy toward COVID-19 and the Russian invasion of Ukraine. The resulting sharp reversal in policy direction has caused turmoil in financial markets.

The speed of such policy increases has been unprecedented. This most recent 0.75% policy hike marks the third consecutive increase of such magnitude. Prior to June of this year, the Fed had last increased rates by 0.75% in 1994 – nearly three decades ago.

Fed Chairman Powell and the Committee have become increasingly aggressive on inflation, beginning with the chairman’s speech at the Jackson Hole Symposium in late August. In that speech, Powell attempted to reset market expectations on the Fed ending their fight early in a quest to combat inflation. The current market expectations are shown below, which predict the Fed could raise rates by another 1.50% before taking a pause in February 2023.

The sharp rise in rates this year has been unsettling. However, our analysis suggests that bond total returns are driven primarily by income return (see chart below) and tend to follow yields closely over time. Additionally, as the economic outlook remains cloudy, higher-quality bonds may offer some portfolios downside protection through challenging periods. In preparation, we have been increasing allocations to asset classes that we believe are suited to perform well over various economic outcomes, such as core bonds, real estate, and infrastructure.

Slowing Global Growth

Fiscal and monetary policymakers face their own unique situations across both the Atlantic and Pacific oceans. The economic situations in Europe and China are two key drivers of global growth trends and investment returns.

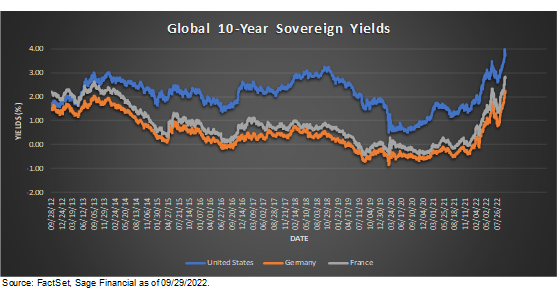

Europe is feeling pressure from the ongoing war in Ukraine. The European Central Bank has been forced to raise its policy rate for the first time since 2014. On balance, we believe that risks are shifted toward negative as of late.

Countries such as Germany and France are facing the worst energy supply crunch in decades and are looking to build up supplies for the winter, which exacerbates price increases. Rising energy costs impose pain on economies in many ways, with households and factories suffering from an indirect result of a military conflict. An average European household has seen energy costs triple from 2021 levels, according to Goldman Sachs. Across the continent, this implies a €2 trillion increase in spending on heat and electricity. These soaring bills are placing stress on governments and forcing them to respond. Germany recently announced a $65 billion package of measures to fight higher prices, while France told its population to prepare for an era of energy “sobriety.”

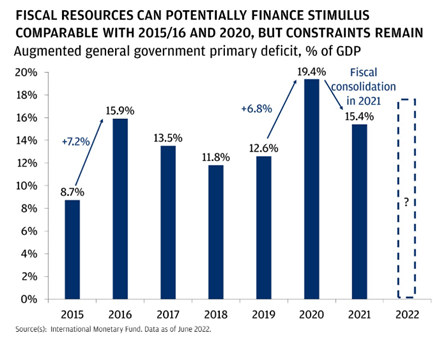

The economic pressure in China is uniquely different and relates in large part to the country’s drastic response to COVID-19. Fortunately, China is imposing fewer mass-scale lockdowns as its moves toward “dynamic zero-COVID.” If it continues to move in this direction, China could remove a massive drag on economic activity within the country. However, the country faces persistent problems in the property development sector.

There is a wide range of outcomes over the near term with respect to economic growth. In general, economic growth is slowing around the globe. Europe, in particular, faces unique challenges in energy markets that are pressuring businesses and consumers alike. In China, the combination of looser COVID-19 restrictions and more fiscal stimulus could provide ballast for portfolios as growth in Europe slows. Ultimately, we expect market volatility to persist and remain diversified across geographies and asset classes.

The Value of Staying Invested

It is extremely difficult to time the markets. This is an important point for us to return to again and again because, especially in years such as 2022, it can be emotionally very challenging for investors to accept. We understand the emotional pull to attempt to sell existing positions in order to miss a further decline in the market. But we believe that is a dangerous tactic because we don’t know for sure if there is a “next leg of the downturn,” and it requires impeccable timing to ease back in. Over the years, we have observed many investors who moved to cash at an inappropriate time and missed a sharp upswing in the markets, thus impacting long-range returns.

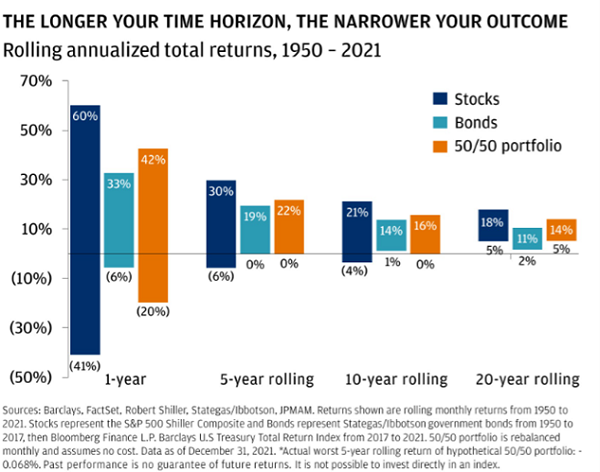

Single-year returns can vary widely. A portfolio comprised of 50% stocks and 50% bonds has seen declines as steep as 20% over rolling 1-year periods since 1950. However, over rolling 5-year periods since 1950, this same portfolio has not seen a loss.

Remaining invested over volatile periods can be challenging. Rising interest rates have taken a toll on near-term investment returns, and the swiftness of the rise took the world off guard. The reality of investing is that volatility can and does happen. Markets can and do exhibit weakness. Throughout the volatility of 2022, our message has remained the same: we believe that staying invested leads to a significantly improved range of outcomes over time. In fact, downturns can present investment opportunities.

Closing Thoughts

The purpose of your multi-asset portfolio is to help you achieve your financial goals through both good and bad markets and amid a host of external factors, including inflation, wars, and even pandemics.

While we expect market volatility to persist, we continue to maintain a balanced outlook on the economy yet also acknowledge the road ahead can go in a number of different directions. We also believe market volatility could create further opportunities for investors. We will continue to respond to market dislocations with thought and care, while maintaining our focus on your personal circumstances and financial goals.

Our focus remains on our founding principles — crafting portfolios that are well-diversified, structured to reduce volatility over time, and informed by our understanding of your financial goals, risk tolerance, time horizon, and return objectives.

[1] U.S. Large Cap stocks are represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index. Performance as of 09/29/2022.

Previous Posts

Sage Insights: Technical Recession, Economic Data versus Equity Markets, and A Broader Perspective

Sage Insights: Ongoing Inflation, China’s Evolving COVID Policy, and Geopolitics in Europe

Our Perspective on Continued Market Volatility

Our Perspective on the Current Market Environment

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product or any non-investment-related content, made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.