2024 In Review: Climbing to New Heights

We began 2024 buoyed by the momentum of 2023’s economic and market rebound but entered the year mindful of a complex and evolving global landscape. Key elections loomed across several major economies, central bankers geared up to pivot from two years of restrictive policies, and markets anticipated opportunities and risks in equal measure. Despite a choppy start, resilient consumer spending, business investment, and easing inflation trends provided the foundation for a positive year in the markets.

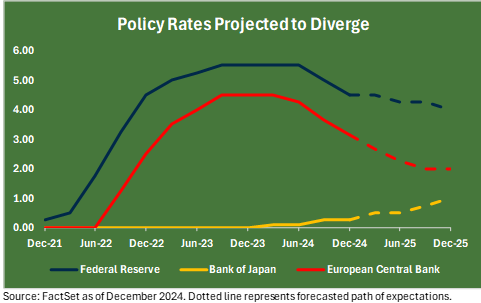

The Federal Reserve’s measured approach to easing monetary policy–lowering the federal funds[1] rate from 5.5% to 4.5%–boosted investor confidence. Meanwhile, corporate earnings and economic growth outpaced expectations, providing a strong tailwind for equities. Challenges persisted, including occasional signs of weakness in the labor market, currency volatility in Japan, and lackluster tech earnings in early August. Yet markets proved resilient.

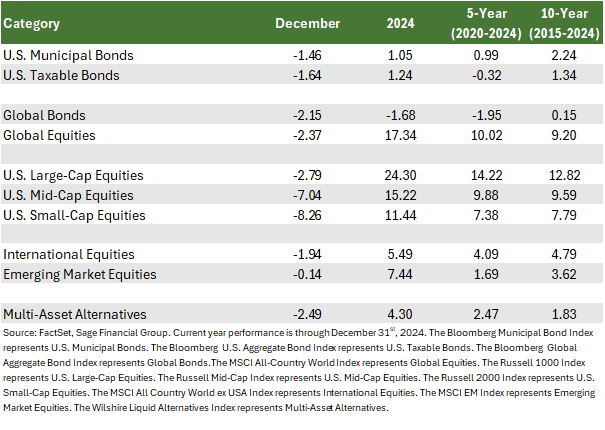

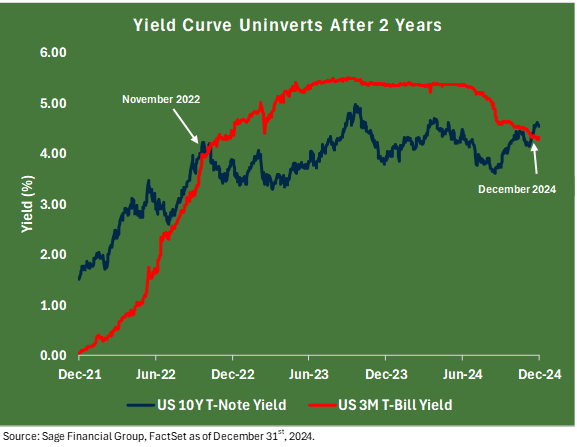

By year’s end, global equities had gained 17.34%, underscoring the strength of risk assets, while global bonds faced headwinds from rising interest rates, declining by 1.68%.

This piece explores the drivers of 2024’s market performance and highlights the key themes shaping our investment outlook for 2025.

YEARLY PERFORMANCE RECAP

FIXED INCOME IN 2024: A YEAR OF CONTRASTS

Fixed-income markets faced a challenging environment in early 2024, as persistently high inflation and expectations for a “higher-for-longer” rate policy weighed on performance. Investment-grade bonds declined by 3.28% through April.

By mid-year, a turning point emerged. In the U.S., signs of labor market softness, with a modest increase in the unemployment rate and cooling wage growth, hinted at progress toward the Federal Reserve’s inflation target. The Fed responded in September with a 50-basis-point reduction to the federal funds rate, and more minor cuts followed in November and December.

The long-standing inversion of the U.S. Treasury yield curve—where short-term rates exceeded long-term yields—finally reversed by year-end. Despite fears of an impending recession often associated with this signal, the economy demonstrated surprising resilience, avoiding the downturn many anticipated.

Taxable bonds experienced modest gains of 1.24%, and tax-exempt bonds returned 1.05% for the year.

EQUITIES: STRENGTH AT HOME

Global equity markets were strong in 2024, led by outperformance in the U.S. The world’s largest economy represents roughly 25% of global GDP but now comprises nearly two-thirds of the global equity index[2].

U.S. Markets

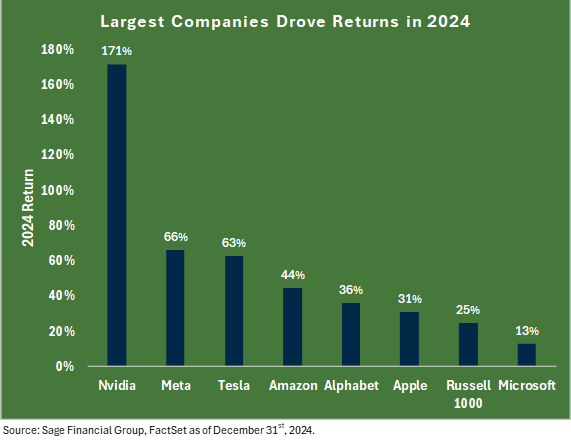

U.S. equities powered through 2024, with large-cap stocks delivering standout gains of 24.30%[3], marking the strongest back-to-back calendar year gains since 1996. Seven mega-cap technology firms continued their dominance, comprising nearly 31% of the large-cap equity market. These companies benefited from optimism surrounding artificial intelligence (AI) applications, which helped drive investor sentiment. Microsoft was the only outlier, underperforming its peers despite posting a respectable return of 12.92%.

Encouragingly, the market became incrementally more inclusive in the second half of the year. Stocks outside the mega-cap segment began to outperform the cap-weighted index, reflecting optimism about the new administration’s policies favoring domestic production and healthy earnings growth. Mid-cap and small-cap stocks gained 15.22% and 11.44%, respectively, bolstered by their exposure to U.S.-focused growth themes.

International Markets

International equities posted modest gains of 5.49% for non-U.S. large cap and 7.44% for emerging markets. Outside of the U.S., dollar strength created a currency headwind for investors overseas, and several idiosyncratic factors weighed on returns.

In Europe, the U.K. and France faced fiscal challenges that led to political challenges within leadership, while Japan grappled with bouts of currency volatility linked to inflation and rate adjustments. Emerging markets saw uneven performance, with China, in particular, struggling under the weight of muted domestic growth and unpredictable policy measures.

DIVERSIFIED PORTFOLIOS: THE CORE OF RESILIENCE

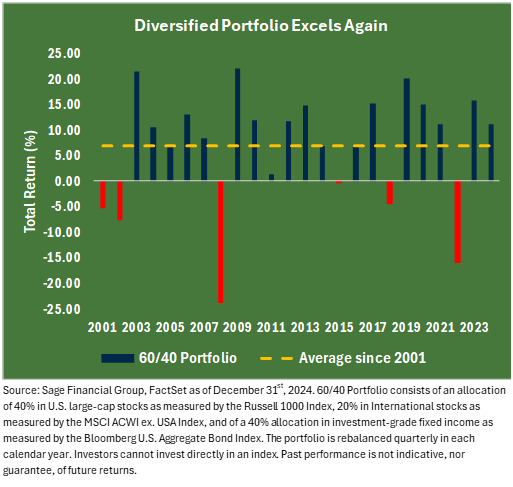

Over the past 24 years, a diversified portfolio comprising 60% stocks and 40% bonds, rebalanced quarterly, has delivered an average annual return of 6.94%. This balanced approach has proven effective even in periods of market stress, generating positive returns in 18 of 24 years. After the rare simultaneous decline in both stocks and bonds in 2022, this allocation rebounded, returning 11.13% in the most recent calendar period.

In 2024, Sage proactively adjusted portfolios to align with a shifting economic and market backdrop. For clients with moderate to aggressive risk profiles, we reduced reliance on non-traditional asset classes such as multi-asset alternatives, favoring high-quality bonds and floating-rate loans with attractive risk/reward profiles. Additionally, we repositioned emerging markets debt allocations into short-duration U.S. high-yield bonds, seeking to capitalize on better return potential while mitigating interest rate risk.

Why Diversification Matters in 2025

We believe combining portfolio diversification by asset class and geography with a disciplined commitment to an investment strategy increases the probability of achieving financial goals and realizing the benefits of sudden, unexpected, strong market returns. Key considerations include:

- Dynamic Adjustments: While responding to near-term market trends, our approach seeks to emphasize staying true to long-term objectives.

- Resilience Through Balance: By pairing growth-oriented equity strategies with income-focused fixed-income investments, portfolios are positioned to withstand volatility while capturing opportunities.

- Commitment to Discipline: A disciplined rebalancing process enhances the probability of achieving your financial goals and benefiting from sudden market upswings.

As we enter 2025, we believe that maintaining a diversified portfolio remains one of the most effective strategies for each client to maximize the probability of reaching financial goals. Our focus remains on positioning portfolios to grow and protect capital over time, always mindful of each client’s unique circumstances and objectives.

This past year, financial markets exhibited strength and continued positive momentum. Past performance does not indicate future results, although we believe forces are still in place to support the upward ascent of a diversified portfolio of stocks and bonds.

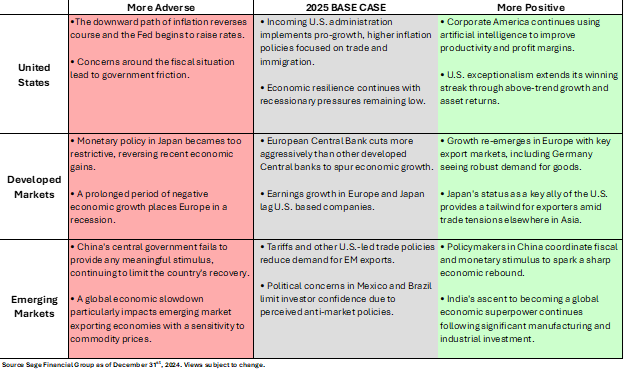

Our 2025 Investment Outlook

As in prior years, we set base case expectations along with more positive and adverse scenarios. We highlight some of the key points in each case below.

KEY THEMES FOR 2025: NAVIGATING OPPORTUNITIES AND RISKS

As we look toward 2025, several critical economic and market dynamics stand to shape the investment landscape. Our analysis highlights three major themes, each with the potential to influence portfolio performance and strategic decision-making in the year ahead.

- Theme #1: Generative AI as a Productivity Catalyst

- Artificial intelligence continues to boost the economy through higher productivity per worker and capital investment by businesses.

- Theme #2: Cross Currents of Policy

- President-elect Trump’s campaign focused on deregulation, tax cuts, and trade adjustments. The intended impact of these policy enactments is to stimulate domestic growth.

- Theme #3: Cash Balances As a Stabilizing Force

- Short-term interest rates continue to move lower, albeit at a modest pace, given the underlying health of the U.S. economy. With money market balances at all-time highs, we expect cash to come off the sideline to support stocks during periods of volatility.

Theme #1: Generative AI as a Productivity Catalyst

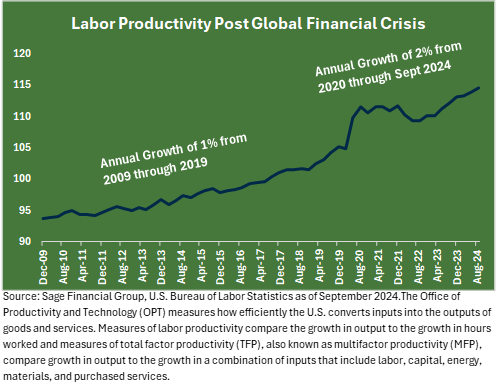

Technological innovation has long been a driver of economic growth, with artificial intelligence (AI) representing the next transformative wave. Historically, advancements in productivity have reshaped industries and economies—consider the transition from an agricultural economy in the 18th century to an industrial powerhouse in the 19th century.

Approximately 90% of U.S. workers were farmers before the Industrial Revolution. Due to innovations in farming equipment, such as the cotton gin and steel plow, the U.S. workforce became more concentrated in service industries, white-collar professional jobs, construction, and factories. Farms still produced the same output but needed fewer workers, boosting the economy to new heights.

AI is poised to similarly revolutionize productivity by streamlining workflows and enabling businesses to achieve higher output with fewer resources.

From 2010-2019, U.S. labor productivity averaged a modest 1% annual growth. This lagged the historical average of 2-3%, reflecting slower adoption of transformative technologies. However, since 2020, productivity growth has accelerated to 2% annually, driven by automation and digitization—trends that AI is expected to amplify further.

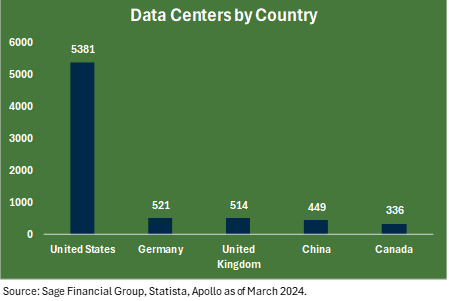

Investment Drivers: Business investment in AI-specific infrastructure, including data centers, power systems, and computing hardware, has surged. The International Data Corporation estimates global spending on AI infrastructure will exceed $500 billion by 2027[4], providing significant opportunities in sectors linked to this expansion.

We believe the latest technology boom related to AI is more durable than the technology boom of the 1990s. In large part, this is because companies like Amazon, Google, Meta, and Microsoft are profitable and consistently generate cash. As a result, we believe they are well-positioned to lead this technological revolution. In the 1990s, many more companies raced to build the infrastructure, while networking companies relied heavily on short-term, cyclical debt to finance their equipment purchases.

In the coming years, we expect productivity gains to enable firms to maintain profitability even in a tight labor market. Corporations that embrace AI’s capabilities to streamline key workflows should see more output and greater earnings power. If firms can continue to grow their businesses without the pressures of hiring new workers, we expect an environment with economic growth and little inflationary pressures. Business spending on data centers, power infrastructure, and hardware is expected to provide a tailwind for the economy.

Risks to Monitor: Optimism around AI remains high. However, risks remain, such as if AI does not live up to its potential or if the benefits are further away than anticipated. For example, optimism about AI could wane if the pace of improvement of large language models slows due to a lack of data or further technological advances. Private market investment in AI has boomed in recent years and could retreat on the reduced promise of the new technology.

Investor Takeaway: While the AI-driven productivity boom appears durable, diversification across sectors is essential to mitigate risks tied to this theme. Companies positioned as leaders in AI development or infrastructure stand to benefit, like cloud services, data center development, or power generation, but careful portfolio construction is key to managing uncertainties.

Theme #2: Crosscurrents of Policy

Policy changes often create ripples that extend across markets and economies. The decisive election of President-elect Trump in 2024 has ushered in a new era of policy focus, with deregulation, tax reform, and trade adjustments as central pillars. These initiatives have historically acted as catalysts for economic growth, and the administration’s plans are no exception.

Deregulation: Key sectors like energy, financial services, and AI infrastructure are expected to benefit from loosened restrictions, potentially spurring corporate investment and innovation. For example, deregulation in the 1980s supported transformative growth in finance and telecommunications, a precedent that could be repeated in this context.

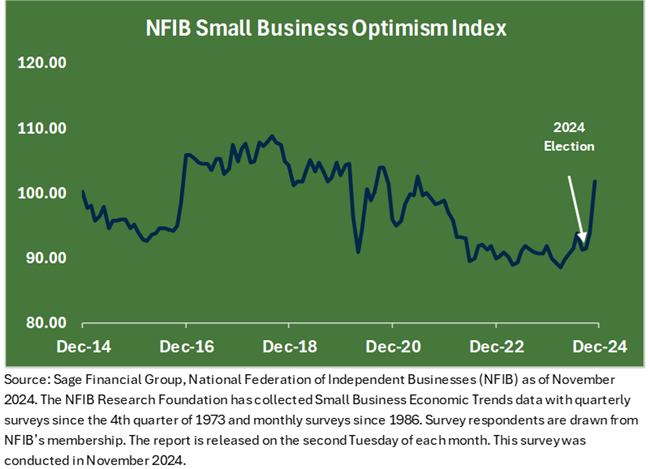

A survey of small businesses across the U.S. showed optimism jumping to its highest level in over four years, and November 2024 experienced the biggest monthly gain in 44 years.

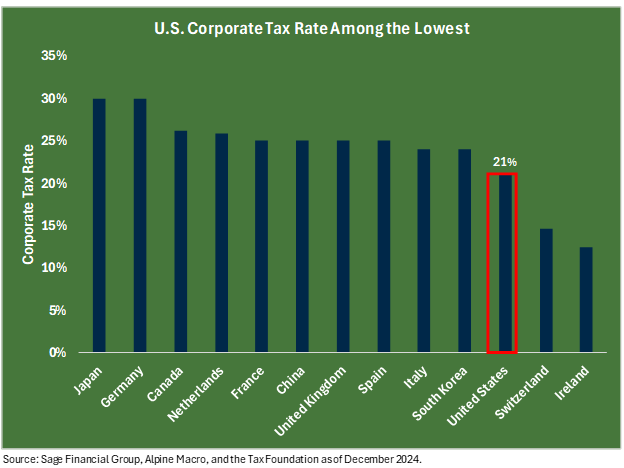

Tax Reform: The administration has proposed maintaining the corporate tax rate at 21% while offering targeted cuts to 15% for domestic manufacturing. This move positions the U.S. as one of the most tax-competitive economies globally, fostering growth in industries tied to domestic production. Additionally, making provisions from the 2017 Tax Cuts and Jobs Act permanent would provide further stability for businesses.

A further reduction in the corporate tax rate would make it among the lowest in the world, making business operations in the U.S. more attractive for investment. Further cuts would increase the attractiveness for businesses but also possibly further widen the deficit.

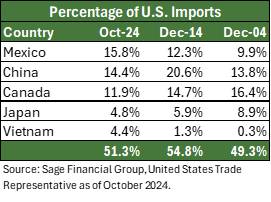

Trade Policy: Proposed tariffs on imported goods could raise near-term costs for businesses and consumers but are designed to encourage domestic production over time. While these measures may create inflationary pressures in the short run, they aim to bolster U.S.-centric industries in the long term.

Labor Markets: Stricter immigration policies, if enacted, may exacerbate labor shortages in industries that depend on lower-wage workers, driving up operational costs. At the same time, policies supporting domestic job creation could offset some of these challenges.

Investor Takeaway: Policy shifts introduce both opportunities and risks. Deregulation and tax incentives are likely to benefit mid- and small-cap companies with a domestic focus, while inflationary pressures from tariffs may favor sectors with pricing power, such as consumer staples and energy. Investors should remain vigilant about the potential for market volatility as these policies unfold.

Theme #3: Cash Balances As a Stabilizing Force

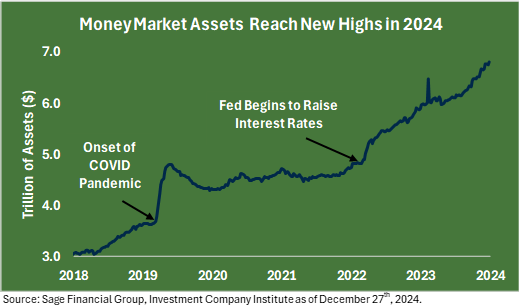

Cash has played a pivotal role in recent years, with money market assets soaring from $3.7 trillion at the end of 2019 to a record $6.8 trillion in 2024. Rate hikes in 2022 and 2023 made cash a more appealing option for yield-focused investors, offering returns unseen in over a decade.

Current Dynamics: As rates declined late in 2024, the yield on money market funds dropped from 4.75% in September to 4.11% by year-end. While still competitive, this downward trend underscores the diminishing potential of cash to serve as a reservoir of liquidity over the long term.

Potential Catalysts: In 2025, declining rates could create tactical buying opportunities as investors deploy cash into attractively valued assets during market pullbacks. Additionally, the Federal Reserve’s continued focus on maintaining economic stability may support a gradual rotation from cash to growth-oriented investments.

Investor Takeaway: While cash has served as a haven during volatile periods, its role is evolving. Investors should consider reallocating cash to high-quality securities, balancing the need for liquidity with the opportunity to capture gains in equities and fixed income.

2025 OUTLOOK BY ASSET CLASS

Fixed Income Outlook: Navigating a Changing Landscape

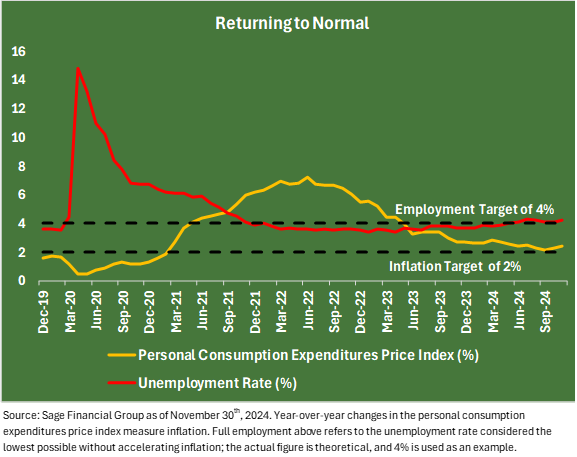

The Federal Reserve has navigated a challenging path in recent years, balancing efforts to tame inflation while preserving a strong job market. Its goal was to achieve a “soft landing” – taming inflation without triggering a recession and significant job losses. The Fed’s actions in 2024—a gradual reduction in interest rates—have set the stage for a potentially more stable fixed-income environment in 2025. However, opportunities and risks remain as market conditions evolve.

Economic Context and Fed Policy

The labor market has shown remarkable resilience during this tightening cycle. While the unemployment rate increased modestly from 3.7% to 4.2% from late 2023 to November 2024, companies largely responded by reducing job vacancies rather than conducting widespread layoffs, achieving what Fed Governor Christopher Waller called a “sweet spot” for the labor market.

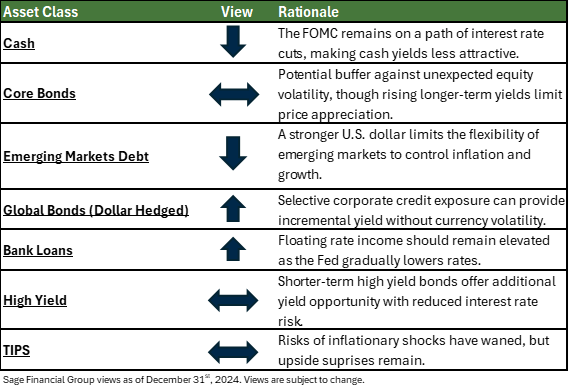

Fixed Income Opportunities for 2025

In line with our overall perspective on diversification, we value balance within the fixed-income portion of a portfolio and like to pair core-investment grade bonds with selective credit exposure and an allocation to bonds issued globally, where appropriate.

Cash and Core Bonds

- Despite the appeal of higher yields, we continue to recommend holding cash only when immediate liquidity is needed. While the Fed appears to be shifting toward a slower, more gradual path of future rate cuts, the bar for additional rate hikes remains high. In our view, cash lacks the potential for price appreciation that often accompanies falling interest rates.

- We maintain a neutral stance on core investment-grade intermediate-term bonds. These bonds offer the opportunity to lock in elevated income opportunities over extended maturities. That said, we believe bond prices will likely remain stable, reducing potential price appreciation in the near term.

Non-U.S. Bonds

- The strong U.S. dollar continues to weigh on the attractiveness of global debt. However, selective exposure to European corporate credit may provide opportunities to enhance portfolio returns.

- Emerging market central banks are likely to face limitations in lowering rates, as doing so could weaken their currencies. This dynamic, combined with depreciating currencies and rising inflation, is expected to push yields higher, resulting in lower bond prices.

Opportunistic Credit

- We believe the high single-digit income generated by bank loans offers a buffer against potential economic weakness and rising default rates. Their floating-rate structure offers an income stream that is less sensitive to rising rates, making them an attractive option in a diversified portfolio.

- High-yield bonds delivered strong performance in 2024, supported by economic resilience that kept spreads tight. However, longer-term high-yield bonds offer minimal compensation for the additional credit risk they carry. In contrast, short-term high-yield bonds provide attractive income opportunities while minimizing exposure to interest rate volatility.

TIPS (Treasury Inflation-Protected Securities)

- For conservative portfolios with substantial fixed-income exposure, we continue to view TIPS as a prudent allocation.

- With current 5-year inflation expectations at 2.3%, TIPS offer valuable protection against unexpected inflationary pressures, enhancing their value as a defensive investment.

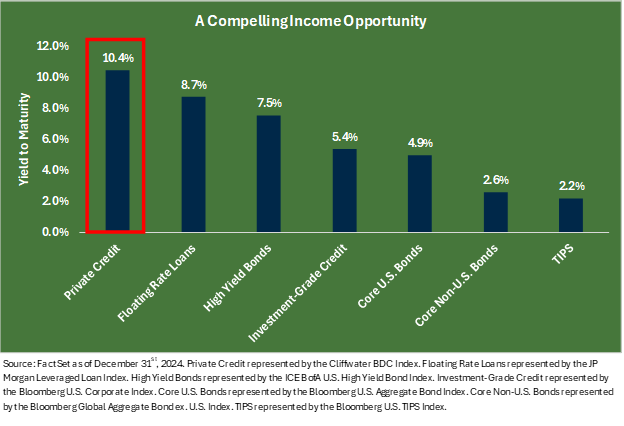

Private Credit

- Over the past five years, private credit has emerged as one of the most compelling asset classes, growing to nearly $2 trillion in assets.[5]

- Private credit lenders fill a crucial gap by providing financing that traditional banks have scaled back. These loans, typically issued at floating rates, have rewarded investors with higher income as interest rates have risen since March 2022.

- We believe the asset class is positioned for another strong year in 2025, even as rates move lower. Loan demand in the private market is closely tied to mergers & acquisitions (M&A) activity, which we expect to remain robust.

- The forecasted two rate cuts in 2025 could reduce borrowers’ cost of capital, boosting M&A activity. Additionally, signals from the incoming administration pointing to a lighter regulatory approach may bolster CEO confidence, further supporting dealmaking and private credit demand.

Fixed Income Perspective

- While interest rates are expected to decline in 2025, most fixed-income sub-asset classes continue to offer more attractive yields than in recent years.

- We see particular value in private credit and floating-rate loans, which have higher yields that can enhance portfolio income. Their “senior secured” status offers repayment priority over equity or unsecured bond investors, providing a measure of downside protection even in challenging environments.

- These assets combine attractive income potential with low correlation to traditional fixed income, making them an effective complement to high-quality investment-grade bonds.

Equity Outlook: Bull Markets Don’t Die of Old Age

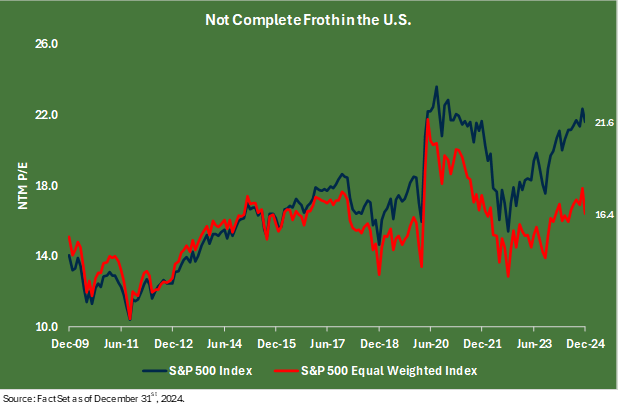

Equity markets have demonstrated remarkable resilience, with U.S. large-cap stocks leading the way in recent years. As we enter 2025, the key question for investors is whether this momentum can be sustained amid elevated valuations and shifting economic dynamics. Our outlook emphasizes the importance of diversification and a disciplined, long-term approach to navigating equity markets.

As the top ten stocks in the S&P 500 have grown to comprise approximately 40% of the index, investors are paying a significant premium for future return potential. The current forward price-to-earnings ratio of the S&P 500 Index is 21.9, representing a 31% premium, the highest level since 2009.

Many cite high valuations as a headwind, which is only partially true. There are 490 other stocks in the U.S. large-cap universe, with a P/E of 16.7x, which aligns with the 15-year average. We believe the average stock offers investors continued return potential and trades at a more reasonable valuation.

U.S. Large Cap

- We remain cautiously optimistic about U.S. large-cap stocks while acknowledging their market leadership over the last 15 years.

- U.S. technology companies with robust balance sheets are at the forefront of innovation. Earnings growth remains positive, with large companies poised to produce free cash flow and positive operating income.

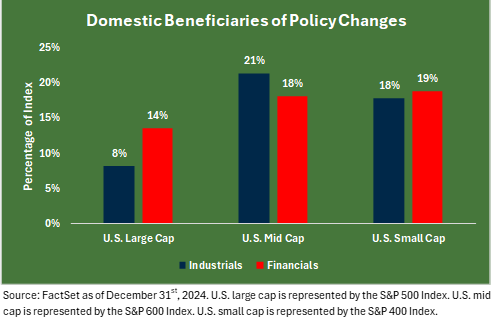

U.S. Mid and Small Cap

- We expect U.S. mid- and small-cap stocks to benefit from domestic trade policies intended to protect and promote domestic manufacturing.

- By reducing reliance on imports, these policies can create a more favorable environment for smaller companies operating within the U.S. economy, boosting their competitiveness and driving economic growth.

- Similarly, we expect these stocks to benefit from lowered regulation. Reduced regulatory burdens can lower compliance costs for smaller companies, freeing up resources for investment and growth. Deregulation can also increase competition, stimulate innovation, and create new opportunities for smaller companies to succeed.

- Key sectors that could benefit from a change in domestic policy include industrials and financials. These sectors comprise a smaller percentage of the U.S. large-cap index than the mid- and small-cap indices. A positive influence on these sectors could have a more pronounced impact on the returns of these indices.

International

- Looking beyond the U.S., we continue to believe international equities can be additive to portfolio returns despite a prolonged period of underperformance.

- We observe key features of international stocks, including less concentration and diversification away from sectors and risk factors specific to the U.S.

- We think the less tech-concentrated and more attractive valuations across international markets continue to make sense in portfolios to mitigate against a broader pullback in U.S. markets, specifically among mega-cap companies.

Europe

- Our view in Europe is less constructive toward companies without a global footprint. We expect companies with a multi-national presence to fare better in 2025. Several countries, including Germany and France, remain in challenging fiscal situations.

- Europe’s two largest economies will likely experience a more significant slowdown in the year ahead as they seek to improve their budget deficits. At the same time, we believe European companies deriving revenue from Asia and the United States provide compelling opportunities within industries such as health care and insurance.

- At the same time, the European Central Bank (ECB) has more wind at its back to cut rates more quickly than the U.S. in 2025. Inflation is currently at or below the 2% target during a period of slowing growth. We expect the ECB to lower the cost of capital in 2025 to stimulate domestic activity.

Japan

- In the late 1980s, Japan was seen as the greatest economic threat to the U.S. A real estate bubble and subsequent burst sent the country on a three-decade downturn. Until recently, the country’s economy felt stuck in quicksand as policymakers sought to reflate growth.

- Now, Japan appears to be a more attractive place to invest. Companies are implementing more shareholder-friendly policies with greater returns on capital. However, risks remain as inflation finally emerges, and the country is expected to raise rates in 2025 to slow down growth.

China

- An area we are keeping a close eye on is China. After a roaring performance period in the 2000s and 2010s, Chinese equities have been in a four-year malaise. Domestic challenges, including a highly indebted real estate market, have weighed on consumer behavior.

- As the world’s second-largest economy, one might expect a larger weighting within global equity markets. However, the opposite holds, with Chinese equities totaling just 3% of the MSCI All-Country World Index. Sage’s best thinking is to include about half of this exposure.

- We believe a rebound in this underperforming market is contingent on government intervention. We expect a slow, measured recovery for Chinese stocks rather than a sharp rebound.

LATAM

- In South America, Brazil’s economy is expected to slow as the country continues to hike rates to cool an overheated economy and reduce budget imbalances.

- Mexico remains in the eye of the U.S. government’s trade policy initiatives. Implementing tariffs on key auto exports should adversely impact America’s largest trading partner.

India

- Ascent within global markets is on a positive path. As measured by population, the world’s largest country provides an alternative within emerging markets as China remains in a period of direct geopolitical tensions with the U.S.

- Manufacturing continues to shift away from China in the presence of looming tariffs, positioning India’s large labor force to benefit from foreign demand for goods.

- As an energy importer, India also benefits from lower global oil prices.

Equity Perspective

- Overall, we believe a balanced approach to equity exposure will be key to portfolio construction in 2025. Equity markets remain a vital engine of long-term portfolio growth.

- We maintain cautious optimism for U.S. equities, particularly in mid- and small-cap stocks that stand to benefit from pro-domestic policy shifts and regulatory changes.

- International equities, though less dominant in recent years, remain important for diversification. Emerging markets, especially India, present intriguing opportunities as they capitalize on global trade realignments.

- To prepare for various outcomes, a balanced approach, emphasizing sector and geographic diversification, can help investors navigate potential volatility while capturing growth opportunities.

CONCLUDING THOUGHTS

As we reflect on 2024 and look ahead to 2025, one constant remains: change is the only certainty in markets. This past year demonstrated the resilience of diversified portfolios, with balanced strategies continuing to deliver strong performance despite global uncertainties. As we prepare for the opportunities and challenges that lie ahead, staying true to long-term investment principles will be key to navigating evolving economic and market dynamics.

At Sage, we are committed to positioning portfolios to grow and preserve wealth over time. By focusing on disciplined diversification, proactive portfolio adjustments, and thoughtful risk management, we aim to enhance returns while safeguarding against potential volatility. Our outlook for 2025 underscores the importance of maintaining a balanced perspective—leveraging innovation-driven growth opportunities while staying anchored in strategies that prioritize resilience and stability.

Ultimately, successful investing is about staying consistent with one’s goals, time horizon, and risk tolerance. Whether navigating market cycles, responding to shifts in policy, or capitalizing on emerging trends, our focus remains on helping our clients achieve their financial goals. We appreciate the trust you place in us and look forward to continuing our partnership in the year ahead.

[1] The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances.

[2] The MSCI All-Country World Index represents 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries.

[3] Measured by the Russell 1000 Index.

[4] Core IT spending includes infrastructure hardware, software, public cloud services and IT/business services (devices and telecommunications services excluded).

[5] Preqin as of August 2024.

Previous Posts

- Sage Insights: Navigating Markets After the Election

- Our Perspective: The Recent Market Rally

- Sage Insights: A Month of Optimism

- Sage Recognized By Leading Financial Journals

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’s written disclosure statement discussing our advisory services and fees is available for review upon request.