As we await the official election results, we want to share our perspective on how potential outcomes are impacting financial markets now, and in the future.

Presidential Election

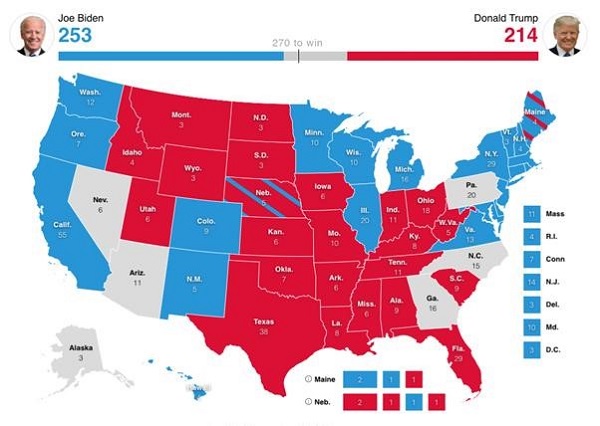

While control of the House and Senate has become more apparent, the presidential election’s outcome remains uncertain, and votes continue to be counted in Nevada, Pennsylvania, Georgia, Arizona, and North Carolina. As the election map below indicates, former Vice President Biden currently has more paths to victory than President Trump:

Vice President Biden is currently expected to win in Arizona, although the votes are still being counted. Victory in any of the other remaining undecided states (shown in grey above) would carry him across the 270-vote threshold. President Trump, on the other hand, would need to win every undecided state to secure a second term.

Election Day and the counting of ballots has continued in a methodical fashion, although slowly in some states. However, some risks remain, such as the chance of widespread protests in the coming days in response to the official outcome. The President has filed or intends to file lawsuits in Michigan, Pennsylvania, Georgia, and Nevada to halt vote counting, and he has signaled his intent to legally challenge official vote tallies in these states and seek a recount in Wisconsin.[1]

As we have noted before, markets tend to respond negatively to uncertainty; investors should be aware that a protracted legal battle could lead to market volatility in the near-term, but it would be unlikely to have long-term effects.

Congressional Elections

A number of Congressional races have yet to be officially decided, with at least one race heading for a runoff election. However, it seems likely that, regardless of whether President Trump or former Vice President Biden wins the presidency, we will have a divided government through 2022 with Republicans retaining control of the Senate and Democrats holding a majority in the House.

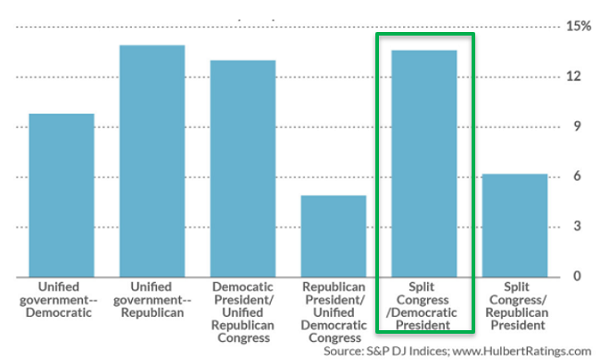

Historically, financial markets take a positive view of a divided government, as it signals a more moderate path forward for the country. From a policy perspective, a divided government means that corporate tax reform, a renewable infrastructure plan, or a stricter regulatory environment — all potential sources of significant uncertainty for the markets — are less likely in the near-term.

We witnessed this dynamic this week around the potential upcoming stimulus package. On Wednesday, Senate Leader McConnell confirmed to reporters that fiscal stimulus would be the “top priority” this year, and McConnell is said to support aid for state and local governments in the next fiscal stimulus.[2] While a GOP-controlled Senate is unlikely to pass a large stimulus package (i.e., anything greater than $3 trillion), the renewed commitment to a fiscal stimulus will likely be viewed positively by financial markets.

Market Update

Although the larger conversation about the election has occasionally been volatile, the market-response has been positive since the election. Growth stocks, as well as bonds, have been aided by a decline in interest rates, which is a function of the decreased probability that a $3 trillion-plus stimulus bill will be passed.

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), has risen 7.4%, while the MSCI ACWI Ex-USA (international stocks) has ticked up by 7.5%. The U.S. Large Cap Russell 1000, which has been strong over the past month, continued to rise this week by 7.5%, while the U.S. small cap Russell 2000 has climbed 6.9%. Finally, core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index have risen 0.5%.

Some of this week’s positive performance can be attributed to the distraction the elections are providing from the COVID pandemic. Focus will likely return to concerns around COVID in the coming weeks, and there is still a fair amount of uncertainty around the trajectory of the U.S. economy in the months ahead.

Investor Implications

As we stated above, a split Congress (Democratic-controlled House, GOP Senate) is one of the most positive outcomes from a financial market perspective. A GOP Senate probably means that Trump’s tax reform and de-regulation policies stay intact even if Biden wins the Presidency. Further, if Vice President Biden wins the election, market participants expect normalized foreign policy, particularly with China, which decreases uncertainty and is likely to boost corporate profits. On the other hand, if President Trump wins the outstanding states or in a court battle, we would expect status quo, pro-business policies from the past 4 years to continue. We would also expect an adversarial stance regarding trade towards China and some European allies.” As shown below, a split Congress and Democratic President has historically translated to an approximate 13% annualized returns in large cap stocks.

As we move into the end of 2020, markets are likely to continue to grapple with the COVID-19 pandemic. Sage expects vaccine data to be released in the upcoming weeks, with the potential for one or more candidates to apply for an Emergency Use Authorization by mid-December. From a stimulus perspective, both Republicans and Democrats look motivated to get something passed this year during the “lame duck” period now that the political calculus of an election has passed, although the dust may need to settle first.

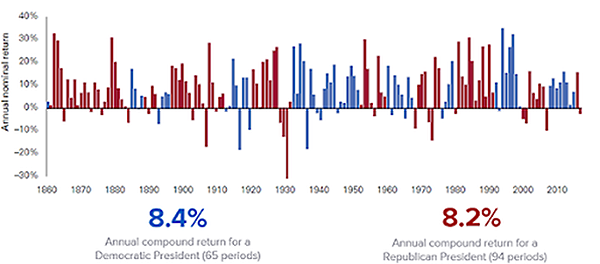

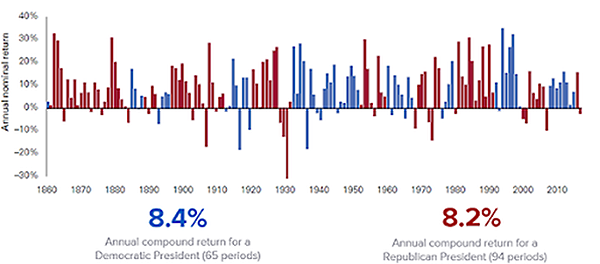

Elections can cause short-term market turmoil because uncertainty is part of the process. Our focus is on longer-term market performance, which is driven by economic growth, productivity, and innovation. Historically, control of the White House has little bearing on overall market performance:

In the near-term, there may be potential volatility, but we encourage investors to remain focused and committed to their investment strategy, which is constructed based on their financial goals, time horizon and risk/return investor profile. We will continue to monitor market data closely and advise you of any developments that could impact your investments.

If you have any questions about this week’s commentary, please do not hesitate to get in touch with us.

[1] USA Today, Election challenges live updates: Trump pursuing lawsuits in Nevada and Pennsylvania; Georgia, Michigan judges toss suits.

[2] Washington Post, McConnell says stimulus bill is top priority when Senate returns.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.