After a long week of market volatility and an avalanche of news from every angle, we want to provide some information and perspective on a few of the most important developments. The COVID-19 pandemic has extensive economic implications, but it is, first and foremost, a healthcare and humanitarian problem. Daily life has changed as we quickly embrace restrictive social, business, and travel policies. The emotional and psychological toll of this change is significant, and it will not be long before someone we know is severely affected by the virus. It is critical during this stressful and uncharted time to be supportive of one another and respectful of the efforts to contain the virus and protect our communities. Our thoughts and prayers are with the front line of responders and all those impacted.

The main developments for the week were (1) the continued spread of COVID-19, (2) massive monetary policy action by the Federal Reserve (and other global central banks) and a fiscal policy response in the U.S. by Congress and the Trump administration, (3) containment in China, and (4) promising new treatments for the virus.

Spread of COVID-19

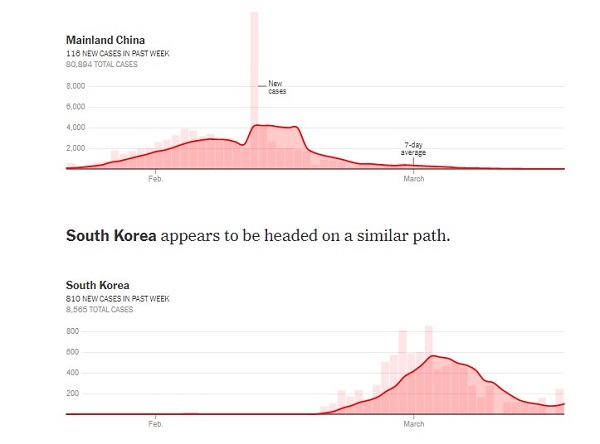

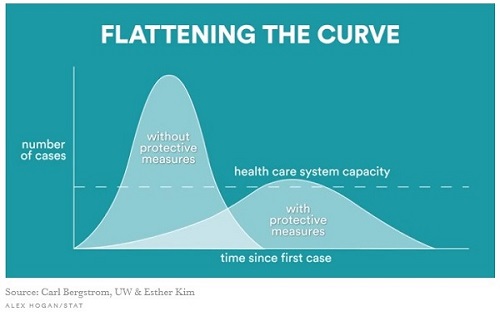

From an investment perspective, it is now a baseline assumption that there will be a deep contraction in the second quarter of 2020 as a result of the efforts necessary to contain the virus. Some state governors have ordered their citizens take extra precautions, including California, Pennsylvania, New York, Connecticut, Texas, Illinois, and others. More extensive lockdowns across the country have become the expectation, and in some ways, these mitigation measures are welcomed because it is thought that they will more speedily help to “flatten the curve.” This phrase refers to slowing down the number of new cases and thus reversing the exponential spread of infection and decreasing the stress on the hospital system. The goal is to follow a mitigation model such as those implemented by China or South Korea, where restrictive business, social, and travel policies helped to flatten the curve of new confirmed cases of COVID-19 per the below graphs.

Global equity market volatility (i.e., sharp moves up and down) is the new normal that investors should expect until the spread of the virus is contained.

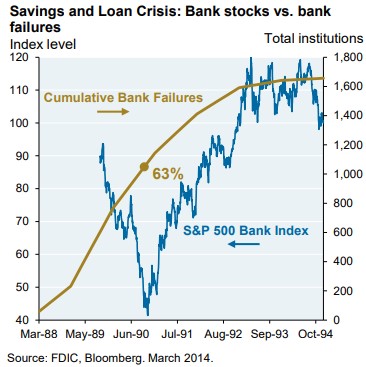

In Sage’s view, it is important to remember that equity markets and economic growth are not perfectly correlated. They do not always move in the same direction at the same time, which is to say that equity markets tend to begin to recover before the economy does because stock investors look ahead to where corporate earnings will be in the future. In a historical comparison, during the Savings and Loans crisis of 1989-1991, bank stocks bottomed and then began to recover before the number of bank failures started to decelerate (chart below). In the case of a global pandemic, it seems probable to us that a similar dynamic may exist and that equity markets may begin to recover even before the number of new COVID-19 cases begins to decelerate and mortality rates begin to decline, as the markets anticipate the impact of the government stimulus and the economy post COVID-19.

Monetary and Fiscal Stimulus

Two major institutions stand ready to assist the global economy: central banks via monetary stimulus and federal governments via fiscal stimulus. Stimulus refers to the various forms of assistance that the banking system and congressional legislation provide, chiefly by supplying money for smoother, more liquid financial market operations (monetary policy) and economy-sustaining household income relief and business support (fiscal policy).

The Federal Reserve has acted swiftly and decisively to inject liquidity into the U.S. financial system. Federal Reserve Chairman Powell has cut the Federal Funds rate to the floor of 0% – 0.25% and announced plans to buy “at least” $750 billion of securities to help with liquidity and an alphabet soup of lending facilities to help companies with short-term liquidity needs.

For its part, the U.S. government has been cooperative in drafting new emergency legislation. To date, Congress has passed two phases of bills totaling $60 billion of stimulus, which include measures such as free testing for COVID-19, funding for vaccines/treatments, and aid for struggling companies. These were a helpful start, but “Phase 3” is necessary to keep people and small businesses solvent in the coming quarter when economic activity will come to a near standstill in many parts of the country. The latest estimates for the Phase 3 legislation now under discussion are that it will be a $1.2-$2 trillion package including:

- $300 billion in loans to small businesses that would be forgiven if used to pay employees,

- $208 billion for targeted industry relief for airlines and other affected businesses,

- roughly $250 billion in payments to individuals, and

- tax benefits for businesses and individuals, including a deferral of tax deadlines that should push around $400 billion in tax payments to later in the year.

Containment in China

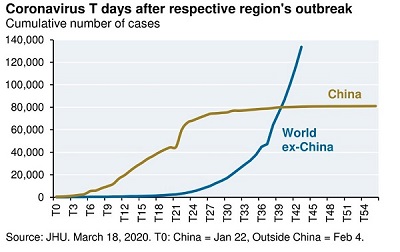

China has been able to contain its outbreak and reported zero (0) new cases the past two days. The number of confirmed cases in China and the World ex-China are shown below. China took extreme measures to restrict travel and social contact in an effort to slow the spread. Other countries such as South Korea and Japan have been successful in copying the model, while others such as Italy, unfortunately, have not.

Sage’s Efforts and Response

While working remotely in respect of Governor Wolf’s early requests, we are talking with clients as regularly as usual. Our team has embraced new technologies that are allowing us to stay connected to each other and provide a near-seamless experience for our clients. We are inspired by their resiliency, dedication, and positive attitude.

During this time, we continue to keep a watchful eye on client portfolios. We are looking for investment opportunities the market volatility creates such as rebalancing portfolios and/or tax loss harvesting.

Previous Posts

Our Perspective: An Update On the Effects of COVID-19

Insights: COVID-19 Uncertainties Rattle Investors and Fuel Psychological and Market Volatility

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.