As we head into the long weekend, we want to share our thoughts on the ongoing debt ceiling tension and put the developments into a broader perspective. We understand the potential concerns and uncertainty the situation may raise and hope we can provide some clarity and guidance.

The Current Debt Limit Situation

We began to discuss the debt ceiling situation in mid-January in the piece “Our Perspective: The Debt Ceiling Limit.” At that time, the U.S. government hit the maximum level of debt it could borrow (debt limit), and the Treasury began to employ “extraordinary measures” to avoid a default. Over the past five months, Congress and the White House have sought a resolution to protect the financial standing of the U.S. government. But are struggling to reach an agreement, and Treasury Secretary Janet Yellen recently warned that the Treasury Department might run out of cash by early June, with a default possibly occurring as soon as June 1st.

A key impasse remains the extent and composition of proposed spending reductions to support an increase in the debt limit.

- What do Republicans want? House Republicans are pushing for more military spending, deeper cuts, and/or more restrictions around domestic spending programs.

- What do Democrats want? Democrats prefer an increase in the debt limit with no strings attached and have suggested more minor cuts over a few years, including defense spending limits in any agreement.

Daily work toward a resolution continues between Democrat and Republican officials, as President Biden and House Speaker McCarthy remain publicly optimistic but show limited progress.

- In a speech from the Oval Office, President Biden shared earlier this week, “We are optimistic we may be able to make some progress because we both agree that a default is not really on the table; we’ve got to get something done here.”[1]

- Speaker McCarthy also remains optimistic that a deal can be reached by June 1st. McCarthy said, “At the end of the day, we can find common ground, make our economy stronger, and take care of this debt.”

Our Perspective

Our base case expectation is that the government will reach a deal before the Treasury runs below its $30 billion cash balance. The Treasury has estimated this could occur as early as the first week of June.

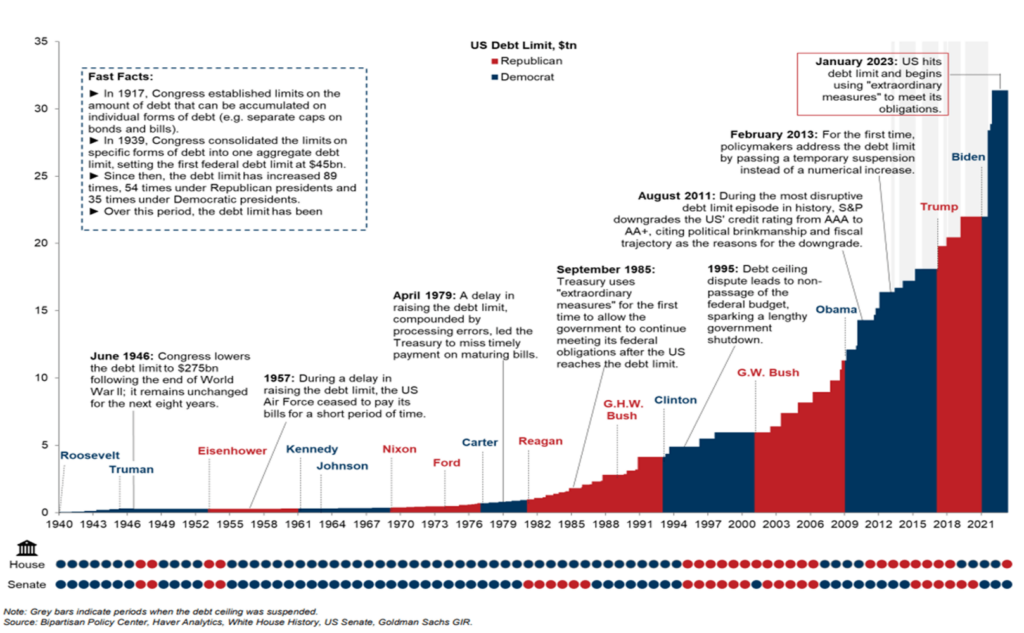

It is crucial to remember that the U.S. has never defaulted on its debt in the 106 years since 1917, when it established the debt ceiling. Instead, the government has raised the debt ceiling 89 times, including 54 instances under Republican and 35 under Democratic presidencies (see historical chart below).

We believe Congress has a growing sense of urgency as the deadline for raising the debt ceiling approaches, while both parties have strong incentives to avert a self-made crisis by missing debt payments.

In our view, the ability to reach a deal would increase certainty and boost financial markets in the near term. Equities and credit markets would likely react positively, while shorter-term Treasury yields might normalize.

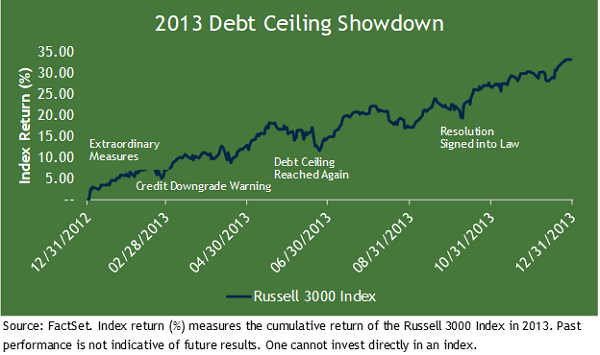

Additionally, for those seeking historical context, the 2013 debt limit contention and resulting downgrade serve as helpful reference points. Similar to what we experienced a decade ago, the market impacts of a failure to raise the debt limit could resemble a growth shock scenario, which is negative for financial markets. The adverse scenario would likely include:

- Declines in equities, increase in credit spreads and decrease in longer-term bond yields.

- However, while the Treasury potentially redirecting scheduled payments may create market pressure, the situation could be brief. Although an adverse scenario would initially cause a significant market reaction, it would also intensify the urgency for a resolution.

Our Approach and Portfolio Resilience

We have learned through history and our own experience over the past 30+ years as advisors that while geopolitical events often create a heightened sense of urgency and importance at the moment, their impact tends to wane over time. Again, the 2013 U.S. debt downgrade offers a good point of reference. While the downgrade was initially perceived as significant, its impact was short-lived, and portfolio returns exhibited consistent strength over the subsequent decade.

While it may feel unsettling now, Sage portfolios are well diversified and structured with a multi-asset and geographical approach designed to reduce the impact of volatility in any one sector or region. They are structured to weather the storms and, most importantly, focus on our clients’ time horizons and financial goals.

[1] https://www.whitehouse.gov/briefing-room/speeches-remarks/2023/05/22/remarks-by-president-biden-before-meeting-with-speaker-mccarthy-to-discuss-the-debt-ceiling/

Previous Posts

- Sage Insights: Taking Stock of Today’s Climate

- Sage Insights: March Madness in the Banking Sector

- Our Perspective: Our Perspective: An Update On The Banking Industry and Interest Rates

- Our Perspective: Current Thoughts on the Banking Industry

- Sage Insights: Strong U.S. Economic Data and the Geopolitical Climate Stall Market Momentum

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content made reference to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.