August started on shaky ground but ended on a high note. The month began with an unexpectedly weak jobs report, currency volatility in Japan, and disappointing tech earnings, triggering a sharp global selloff. However, as the initial shocks subsided and more data came in suggesting a continued decline in inflation and an increased likelihood of interest rate cuts, many investors recognized an overreaction, and both stocks and bonds regained momentum. By the end of August, the broader markets had recovered their footing, delivering overall positive returns.

In this edition of Insights, we review August’s market performance and explore the key developments we believe will shape the financial landscape in the near future, particularly sustained U.S. economic growth and the now nearly certain expectation of interest rate cuts by the U.S. Federal Reserve (the Fed). We also help contextualize the month’s rocky start by looking at the frequency of global market corrections and reviewing our core strategies for mitigating risk and capturing return.

As always, we aim to provide insights that support your investment and financial goals.

Market Overview

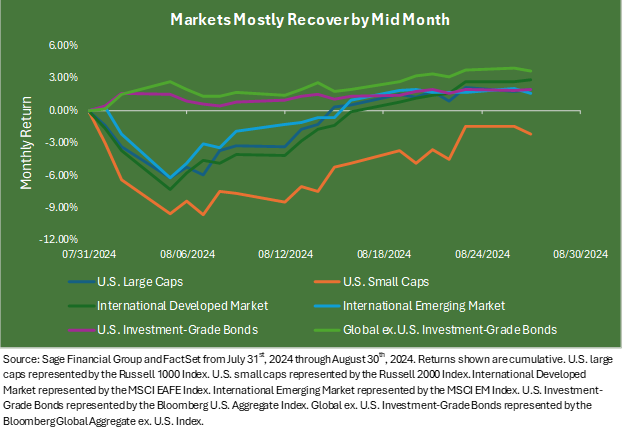

August began with a sharp equity selloff that raised concerns about the challenges ahead. However, the fears were short-lived, and by the middle of the month, most equity classes had recovered and were able to deliver positive returns.

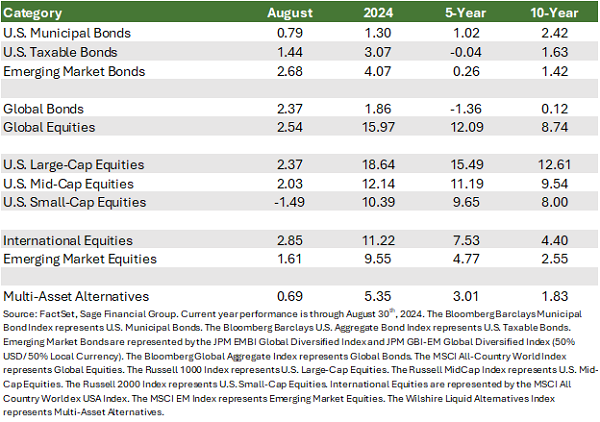

Global fixed-income returns rose 2.37% in August as rates continued to fall, driven by a growing number of global central banks easing monetary policy.

- U.S. Treasury yields moved lower for the third consecutive month, contributing to a 1.44% rise in investment-grade fixed income, now up 3.07% year-to-date.

- U.S. floating-rate loans, which adjust with interest rates, posted their tenth consecutive month of gains, with a 0.48% increase, demonstrating resilience within credit markets.

- Municipal bonds returned 0.79% in August, benefiting from positive capital inflows during each week of the month.

- Emerging market bonds gained 2.68%, driven by the near-certain expectation of Fed rate cuts in September and a weakening U.S. dollar.

Global equities rose 2.54%, with international equities modestly outperforming their U.S. counterparts, bolstered by a weaker U.S. dollar.

- U.S. large-cap equities continued their strong performance, posting a 2.37% return in August. While mega-cap technology companies remained dominant in a market-cap-weighted index, the average stock performed more in line with the broader large-cap index during the month.

- U.S. mid- and small-cap equities exhibited mixed performance in August, as the former rose 2.03% and the latter declined by 1.49%. Smaller companies remain a primary beneficiary of potential future interest rate cuts, yet investor enthusiasm remains tempered pending clarity on monetary policy, particularly in light of the upcoming U.S. elections.

- International equities, represented by the most widely referenced index, outperformed with a 2.85% gain, making them the top-performing asset class in August. The primary driver came from developed markets in Western Europe, particularly the U.K., where the Bank of England announced its first rate cut. Emerging market stocks also saw gains in August, with a 1.61% increase driven by the currency strength of South American and Southeast Asian countries amidst a weaker U.S. dollar.

What Drove the Markets in August?

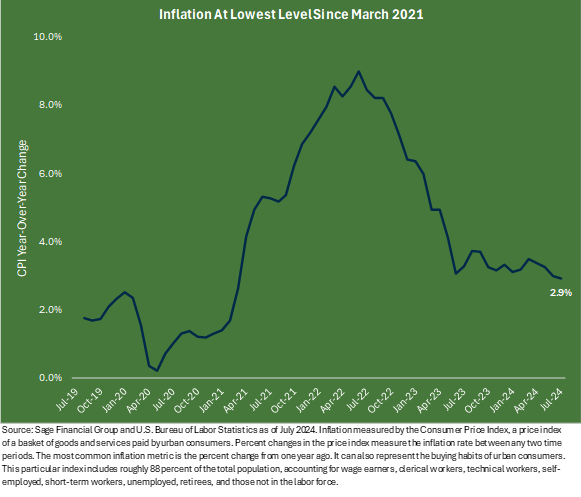

Investors kept a close watch on economic indicators throughout August. Two key points helped ease the anxiety created by the early selloff and boost both stocks and bonds: the continued decline in inflation and strong statements from U.S. Federal Reserve Chairman Jerome Powell about the likelihood of interest rate cuts. We expect both factors will continue to have a positive influence for at least the coming month.

While the unemployment rate edged up slightly last month, inflation continued its downward trend, with the 2.9% year-over-year growth rate reaching its lowest point since March 2021. This sustained easing positively impacts U.S. consumer spending, which is a crucial pillar of overall economic health, given that it accounts for over two-thirds of the U.S. economy.

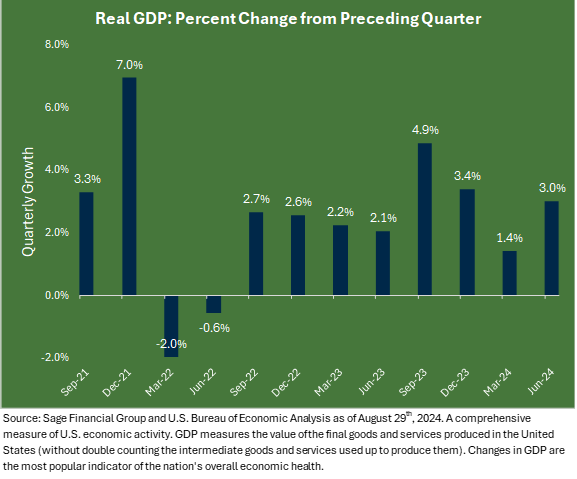

Real GDP is a key measure of economic health since it measures an economy’s output. The most recent reading and revision showed growth of 3.0% in the previous quarter, exceeding expectations of 2.1%.

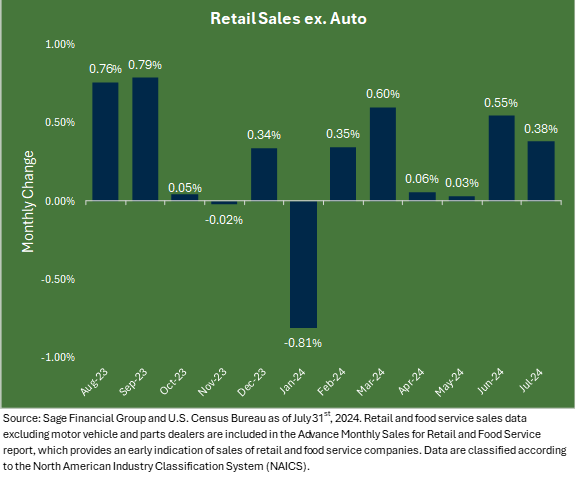

Stripping out automobiles, retail sales rose 0.4% last month. Retail sales provide a good picture of consumer spending behavior on goods. This suggests the consumer is off to a good start for the quarter.

In August, spending on big-ticket items like automobiles and travel was notably strong, though there was some softness in sectors such as home appliances. Moving forward, we will be closely monitoring these monthly retail sales figures. If they continue to be stronger than expected, this will signal that consumers are focused more on the growing health of their household finances than on any risks potentially posed by rising unemployment or stubbornly high inflation.

Our base case remains that the U.S. consumer is in a good financial position overall. Given falling inflation and consistently positive consumer spending, rising real wages (wage growth that exceeds inflation) should keep the economy on a path of growth over the coming quarters and investor appetite for equities strong. With the FOMC poised to lower rates, easing financial conditions in a healthy economy reduces the likelihood of a policy error from the Federal Reserve.

A productive economy is a more robust economy. A healthy U.S. consumer sector can create a positive feedback loop that benefits businesses, the economy, and the stock market. From an investment perspective, we maintain exposure to beneficiaries, including cyclical assets such as small-cap stocks and real estate.

In response to the markets’ heightened sensitivity to incoming inflation and employment data, we have increased the allocation to bonds in portfolios that own them over this past year.

Powell Signals More Predictability for Monetary Policy

The other factor that drove August’s positive market performance was the strong message Fed Chair Powell sent when Fed officials convened in Jackson Hole, Wyoming, for an annual symposium.

Powell got straight to the point, “the time has come for policy to adjust.” His clarity and directness stoked anticipation of lower interest rates in the near future, and it now seems nearly inevitable that the Federal Open Market Committee (FOMC) will announce a rate cut at its upcoming meeting on September 17-18.

Powell’s statement also underscored the likelihood of a more predictable interest rate policy from now on. The Fed has been on pause for over a year, with expectations for rate cuts being continuously pushed later into 2024. Powell’s speech removed some of this persistent guessing around a timeline. In general, markets like predictability and both equities and bonds reacted positively to Powell’s speech, with international stocks performing particularly well given a weaker U.S. dollar.

Our take on this speech follows the time-tested phrase, “Do not fight the Fed.” Powell and the Committee will likely act on this guidance if they plan to lower rates. Now, we expect the attention of monetary policymakers to shift toward the labor market.

With price pressures moving lower and supply/demand imbalances continuing to improve, the July unemployment rate rose to 4.3% despite the addition of 114,000 new jobs in the economy. If the unemployment rate continues to increase and job creation slows, this could result in half-percentage point rate cuts at future meetings in September and Q4.

Sage has anticipated a period of lower rates dating back to early 2023. We do not believe in market timing or recommend changing once the Fed has officially lowered interest rates. From a historical return perspective, looking back on the last six Fed rate-cutting cycles, we observe that investing in bonds one month before a rate cut outperforms investing one month after by nearly 2.9% over the next twelve months.

Corrections Happen and Create Unease

Sudden equity market retreats and recoveries, such as the one we experienced at the beginning of August, can be unnerving. Still, we believe they serve as a less than gentle reminder of the merit of portfolio diversification.

The sharp selloff to begin the month created rumbles and concerns for a challenging period ahead. A narrow U.S. tech-led market heightened sensitivity to the July jobs report, and currency volatility in Japan sent equities tumbling. At the same time, fixed-income returns provided a steady hand in portfolios.

By the middle of the month, most equity asset classes recovered from the market’s initial pullback. For example, international developed market stocks were down more than 7.3% through the first three days of the month and ended up nearly 2.9%.

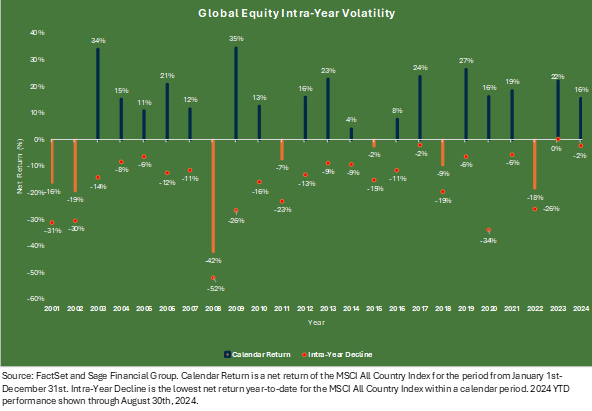

Looking back at intra-year volatility in global equity markets from 2001 to 2024, we can see that volatility is nearly constant. Global equities often experience significant intra-year declines, even in years when the overall return is positive. For example, despite an intra-year decline of 9%, the 2013 calendar year return was 23%.

Temporary market declines are a normal part of long-term equity investing, which is why we encourage you to focus on the bigger picture and stick to your investment plan. Your portfolio is designed to help you realize your financial goals while weathering periodic recoveries and retreats.

Sage’s Investment Perspectives

As we anticipate a decline in cash yields over the coming months, particularly with the Fed beginning its easing cycle, investors are likely to see reduced income from cash portfolios. In this environment, we believe high-quality intermediate-term bonds stand out as a prudent option. These bonds offer the potential for higher yields for a more extended period, along with the possibility of price appreciation. By considering longer-term bonds now instead of cash, investors could benefit from the current higher yields, which might not be available in the future if interest rates fall.

We believe bonds will maintain their strong recent performance, particularly if the Federal Reserve begins cutting rates as expected later this month. Bonds also offer stability during periods of economic volatility, such as further softening of the labor market or household spending.

At the same time, we remain cautiously optimistic about the prospect for equities within portfolios. Corporate earnings growth is broadening beyond mega-cap companies, and international stocks are projected to experience higher earnings growth over the next year. As we have noted previously, this year, we expect corporate earnings to drive market returns and contribute to more favorable investment performance.

Additionally, we believe private market assets like real estate and private equity stand to benefit from lower rates. Smaller companies, which tend to be more cyclical, could see an uptick in merger and acquisition activity, while international companies—currently challenged by a strong U.S. dollar—may experience some relief.

Ultimately, we remain convinced that a diversified portfolio provides our clients with the highest probability of meeting or exceeding their financial goals.

Closing Thoughts

While August began on less than stable footing, the U.S. economy continues to demonstrate resilience, driven by robust consumer spending and greater clarity on the trajectory of U.S. monetary policy. Recent economic data points exceeded expectations, and the Fed’s explicit embrace of the need for rate cuts makes it increasingly likely that we will achieve a soft landing.

While market volatility is inevitable, our investment strategy emphasizes diversification and a long-term perspective. We believe a balanced portfolio that incorporates equities, fixed income, and alternative investments can help mitigate risks and capture potential returns.

As the economic landscape evolves, we remain committed to adapting our investment approach to seize opportunities and navigate challenges effectively.

Previous Posts

-

-

- Sage Insights: Market Movements and Perspective — Analyzing the Past Month and The Road Ahead

- Sage Insights: Observations at Halftime

- Sage Insights: Observations as Data Cools and Markets Rise

- Sage Insights: Market Observations as the Fed Remains on Pause

- Sage Insights: Market Observations at the End of the First Quarter

- Sage 2024 Investment Outlook

-

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’sGroup’st written disclosure statement discussing our advisory services and fees is available for review upon request.