Market Update

COVID-19 statistics, consumer spending, and improving trends in employment data drove positive equity gains for most indices since our last update. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), gained 1.6% over the past two weeks, while the MSCI ACWI Ex-USA (international stocks) gained 1.1%. U.S. large cap stocks finished up 1.4% during the same period. The U.S. small cap Russell 2000 fell 1.2%. Core U.S. bonds, as represented by the Bloomberg Barclays Aggregate U.S. Bond Index, declined by 0.6% since our last update due to slightly higher interest rates.

Unemployment Data

Although initial jobless claims unexpectedly rose to 1.1 million this past week, continuing unemployment claims have steadily declined and are now down 10 million from May’s peak. Continuing claims measures how many jobs were added to the U.S. economy on a net basis. This steady decline of continuing jobless claims aligns with the gain of 9.7 million jobs in the same period, which brought the unemployment rate down from 14.7% in April to 10.2% in July.[1] Of course, the unemployment rate remains historically high, and there is still a long and likely bumpy road ahead before we return to normal employment. From an investor’s perspective, while we are cautiously optimistic about the current trend, initial jobless claims bear watching in the coming weeks.

COVID-19 Developments

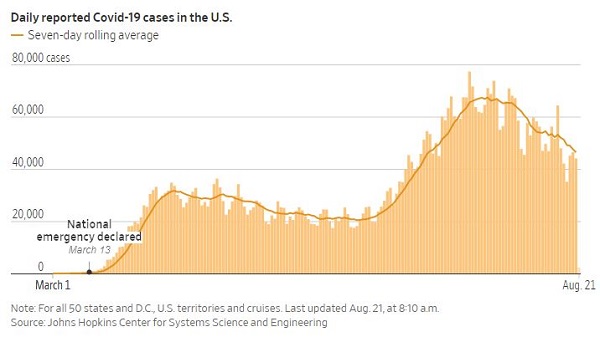

Monday’s 35,112 new COVID-19 cases in the U.S. were the fewest since June 24th, and the 7-day average declined throughout the week (chart below). For the moment, it appears new infection rates have begun to slow.[2] Although the improving trends in COVID-19 statistics are encouraging, there are still several risks that will likely persist until we can distribute a viable vaccine, some of which include lower consumer confidence leading to lower consumer spending, a rise in COVID cases in the fall when social distancing becomes more difficult, and a delay in approval or distribution of the vaccine itself.

During a news briefing on Tuesday, the World Health Organization (WHO) warned that young people are “increasingly driving the spread” of coronavirus.[3] The WHO’s warning comes as colleges and universities are resuming classes — some in a traditional classroom setting — and many states are planning to reopen public schools. As cooler temperatures force people indoors, where social distancing is more challenging, another uptick in new COVID cases is possible.

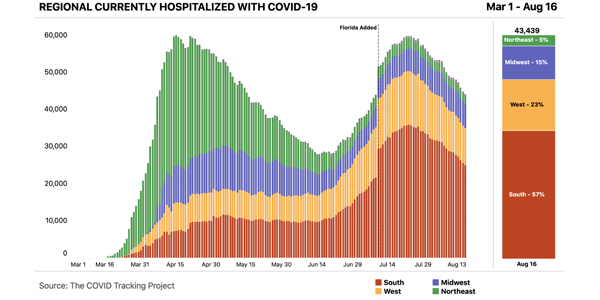

While we will be watching new infection rates closely as we head into the fall, the data trends at the moment are somewhat encouraging. In the U.S., the areas that were hot spots in July (e.g., the South) have seen a meaningful downturn in COVID hospitalizations in the last month, while the Northeast has kept the virus at bay, as the chart below indicates.

Some European countries, such as the U.K. and France, have seen modest increases in cases, which is something we will continue to watch. However, the increases have not been exponential, and the countries have not re-imposed harsh shutdown orders.

From an investor’s perspective, we view the fact that state and local governments have not had to resort to the stay-at-home orders that negatively impacted the broader economy this spring as a positive sign. However, an increase in cases in the fall may lead to incremental closings of the economy and dent consumer confidence.

Fiscal Stimulus

In recent weeks, negotiations between Democrats and the White House on a potential fifth fiscal stimulus have been slow. On Tuesday, Speaker Pelosi told reporters she would be willing to “cut our bill in half” in order to reach an agreement with Republicans, which would bring the total proposed amount down to $1.5 trillion.[4] The Trump Administration has suggested there “may be a bipartisan path to a pared-down bill” worth around $500 billion.[5]

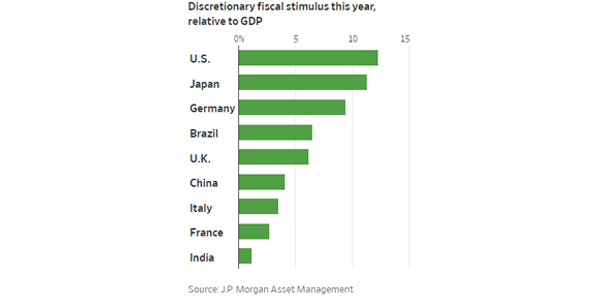

Some Senate Republicans think that a fifth fiscal stimulus may not be necessary, partly because economic data point to recovery and stocks are at all-time highs; in addition, as the graph below shows, the U.S. fiscal response as a percentage of GDP has outpaced every other country to date — even without a fifth stimulus bill.

Nevertheless, a fifth fiscal stimulus would help reduce market and economic risks, especially those related to enhanced unemployment benefits and fiscal support for state and local governments. Consumer spending accounts for roughly 70% of U.S. GDP and has played a significant role in the economic recovery.[6] If a fiscal stimulus does not materialize, consumer spending could plateau or decline, and the recovery could stall or take steps backward. In addition, mortgage delinquencies spiked by nearly 4 percentage points from Q1 to Q2 2020, and the extra funds could help many families feel more comfortable financially in the coming months.[7]

Investors also should note that financial markets have at least somewhat anticipated that a fiscal deal would be reached. If the two parties cannot reach an agreement or the scope of the fiscal stimulus fails to meet expectations, it could disappoint investors and lead to volatility in the near-term.

As we have done throughout this crisis, we advise you to stay focused on the time horizon associated with your goals and avoid reacting to near-term volatility and noise.

[1] Bureau of Labor Statistics, Employment Situation Summary.

[2] Wall Street Journal, New U.S. Coronavirus Cases Slip to Lowest Since Late June.

[3] Washington Post, WHO warns young people are emerging as main spreaders of the coronavirus.

[4] Politico, Pelosi celebrates walkback of Postal Service changes: ‘They felt the heat.’

[5] Bloomberg, Trump Team Sees Path to Pared-Down $500 Billion Stimulus Deal.

[6] The White House, An In-Depth Look at COVID-19’s Early Effects on Consumer Spending and GDP.

[7] Mortgage Bankers Association, Mortgage Delinquencies Spike in the Second Quarter of 2020.

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.