June was a positive month for global stocks and bonds, driven by a favorable inflation trend and critical actions from global central banks.

In this edition of Insights, we review monthly market performance, discuss the recent divergence of global central bank policy, monitor the slowing yet growing U.S. economy, and observe attractive yield opportunities across the fixed-income market.

As always, we aim to offer insight into our thinking and how we seek to help our clients achieve their investment and financial goals.

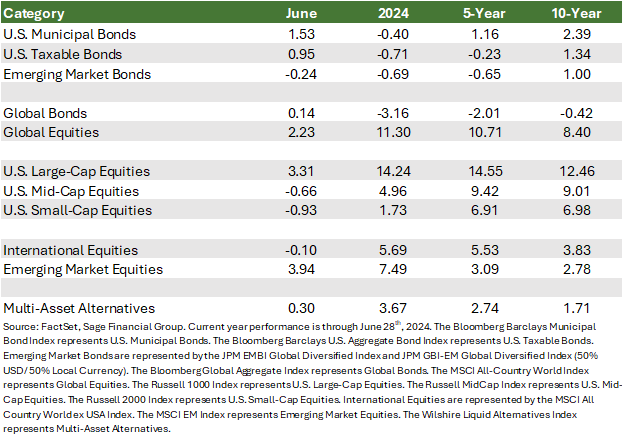

Market Overview

Some economic data in June pointed toward slowing economic growth, but stocks and bonds appeared to have found their sweet spot as inflation approached target levels. Enthusiasm for artificial intelligence and resilient corporate earnings added further optimism at month’s end.

After a six-week break, the Federal Open Market Committee (FOMC) held policy rates steady at the June meeting. The Committee continued to emphasize its members’ desire to have sustained confidence in the trend of lower inflation. Markets digested the news with minimal concern, accepting that delaying a first rate cut until September would not negatively impact expectations for the year’s second half.

Global fixed-income returns were more modest in June, as investors experienced a slight appreciation of 0.14%. Despite many major economies beginning to lower policy rates, geopolitical uncertainty and upcoming European national elections prevented broader gains.

- U.S. Treasury yields declined throughout the month, providing a tailwind for investment-grade fixed income. The asset class rose by 0.95% in June as U.S. inflation continued to trend lower in several macroeconomic reports.

- U.S. floating-rate loans provided another positive month, recording a gain of 0.32%. The asset class is supported by slowing but stable economic growth, in which corporate borrowers are not experiencing significant enough hindrances to profitability.

- Municipal bonds rose 1.53% in June, edging out their taxable peers. The strength of the municipal market was supported by elevated supply, met by investor demand for tax-exempt income at increased yield levels.

- Emerging market bonds modestly declined 0.24% in June as emerging market central banks slowed the pace of policy easing to balance, stimulating their economies against potentially weakening their currencies relative to the continued strength of the U.S. dollar.

Global equity returns ended the second quarter positively, providing investors with an 11.30% gain through the year’s first half. While corporate earnings have been favorable for two consecutive quarters, investors’ resilience and fortitude to look through the noise of geopolitics and fluctuating interest rates around the globe bolstered the gain.

- U.S. large-cap equities performed strongly in June. The Russell 1000 Index gained 3.31%, driven predominately by the continued success of mega-cap technology stocks.

- U.S. mid- and small-cap equities underwhelmed investors in June, retreating 0.66% and 0.93%, respectively, and trailed U.S. large-cap equities. Smaller companies are more sensitive to economic conditions, and even moderate signs of an economic slowdown can increase investor concerns about prospects for these businesses. Larger technology companies, in contrast, are viewed as less sensitive to modest fluctuations in the economy.

- International equities, represented by the most widely referenced index, declined 0.10% last month, while emerging markets were the top-performing asset class returning 3.94%.[1] Surprise election results in Mexico and India initially increased volatility, which eased by month-end. Tech companies like TSMC and Samsung Electronics drove markets higher amid A.I. enthusiasm, although upcoming elections in France and the U.K. added a layer of fresh uncertainty.

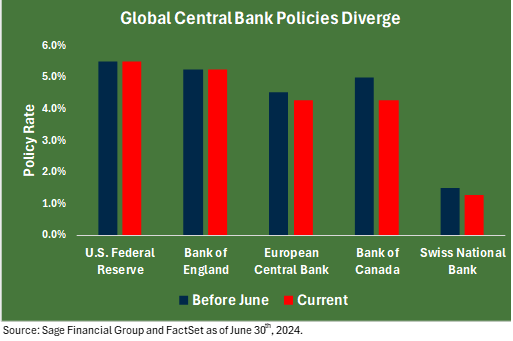

Central Banks Take Different Courses

For the past two years, most major central banks have followed a unified approach to implementing monetary policy to slow economic growth. However, as higher interest rates increased bond volatility and resulted in underwhelming investment performance from an asset class expected to provide stability, central banks have begun to diverge from this unified approach.

Investors in the U.S. entered the year expecting to be the first G7 member to lower rates, just as the Federal Reserve was the first to raise rates in March 2022. Those expectations have been tempered through June, with the first-rate cut now expected in September.

However, central banks outside the U.S. and the U.K. began acting in June. The European Central Bank (ECB), Bank of Canada (BOC), and Swiss National Bank (SNB) all reduced their respective policy rates by 0.25%.

Following their decisions to lower rates, each of these central banks discussed holding rates steady for several months as policymakers decided the inflation outlook had improved. Restrictive monetary policy dampened demand and anchored expectations, ultimately bringing inflation down to target levels.

This story has been a slower process in the U.S., which continues to experience positive economic growth and job creation despite restrictive monetary policy. As a result, members of the FOMC have not gained sustained confidence in inflation returning to target levels.

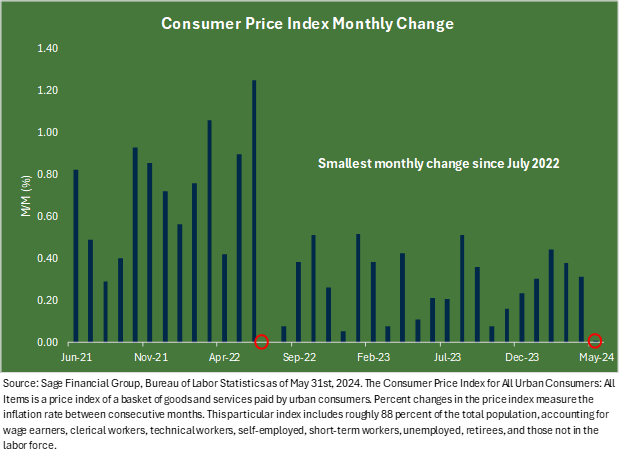

Yet, inflation data has helped Fed officials gain more confidence that slowing inflation is gaining momentum. While the change of 0.0% month-over-month was the smallest margin since July 2022, the sticky services segment of the index deflated during the month.

Fed Chair Powell has cited “super core” inflation as a metric Fed officials closely follow. The measure, which includes shelter data, declined for the first time since August 2021. Even though the Fed kept rates on hold at the June FOMC meeting and projects only one rate cut for the rest of 2024, the path of lower inflation ahead remains on track.

While the Federal Reserve remains patient, the rest of the world is not. Most emerging central banks have been lowering interest rates for over a year, which has benefitted investors in this sector through higher starting income yields and price appreciation.

We believe exposure to high-quality investment-grade bonds in Europe should benefit portfolio performance. Although surprise election results in France and upcoming national elections in the United Kingdom may generate volatility, international policymakers remain on a path to cut rates ahead of the Fed.

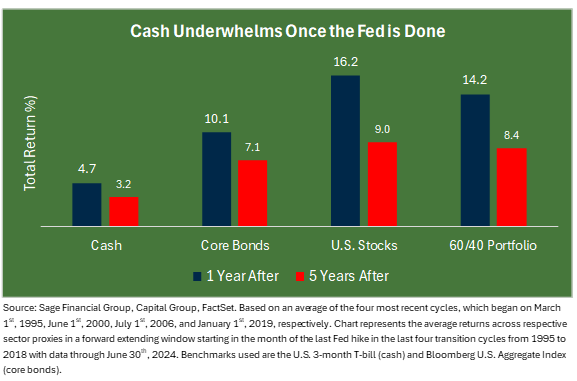

Even so, U.S. bonds are the ballast and most significant component of fixed-income portfolios. In our portfolios that hold bonds, we believe the allocations we have added to core bonds between the last rate hike and the first rate cut in the U.S. will prove their merit. As the Fed begins to reduce rates, we expect high-quality core bonds to provide continued income and attractive price appreciation alongside assets like floating-rate loans, emerging market debt, and global bonds while also enhancing portfolio stability.

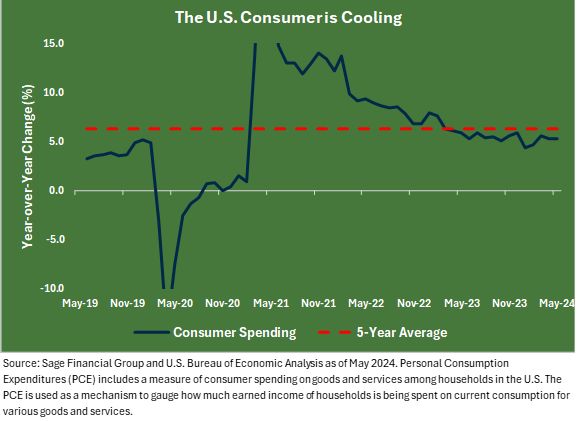

Growing but Slowing

Incoming monthly data suggests that persistent inflation, even if easing, is beginning to challenge the U.S. consumer. Retail sales were weaker than anticipated in June, raising concerns about cracks in an otherwise resilient economy.

However, it is helpful to remember that consumer spending is cooling from a higher starting point. Current spending remains more than 5% above a year ago, and continued positive real income levels will likely support consumer activity in the coming months.

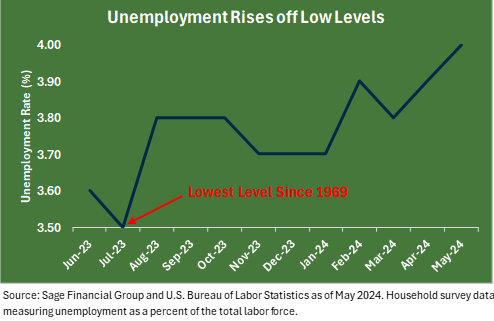

The U.S. unemployment level has marginally increased as the labor market returns toward pre-pandemic normalization. Importantly, this modest rise reached 50-year lows in July 2023.

Given the low starting point, this incredibly tight labor market represents a limited risk of an adverse effect on consumption in the U.S.

Nonetheless, we believe the growing U.S. economy is beginning to slow down, which could further increase the likelihood of interest rate cuts in the coming months. Historically, rising unemployment and jobless claims have often served as impetus for rate cuts, neither of which we have today.

But there have been other times when the Fed has initiated rate cuts in a climate more analogous to the one we are in today. In 1995, for example, the Fed initiated rate cuts in a move to stimulate the economy. Notably, those cuts were followed by strong performance from stocks and bonds in each of the subsequent three years.

We also believe a cooling U.S. economy increases the importance of diversifying across asset classes, geographies, and investment styles within an investment portfolio to balance some heightened uncertainty. Positive movement in consumer spending, which typically accounts for nearly 70% of the U.S. economy, underscores the importance of equities in the portfolio as a driver of further growth. At the same time, bonds should play an increased role in income generation and stability as economic conditions begin to slow more meaningfully.

Yield Opportunities Besides Cash

Another theme we have seen throughout the first half of 2024 is the temptation to increase reliance on cash. Indeed, cash remains a useful liquidity tool in an investment plan, but it lacks the potential for price appreciation when interest rates decline. On the other hand, bonds should benefit as inflation and interest rates trend downward, with additional upside possible if rates decrease faster.

We encourage investors to capitalize on potential gains and mitigate the risk of cash underperforming in a falling-rate environment.

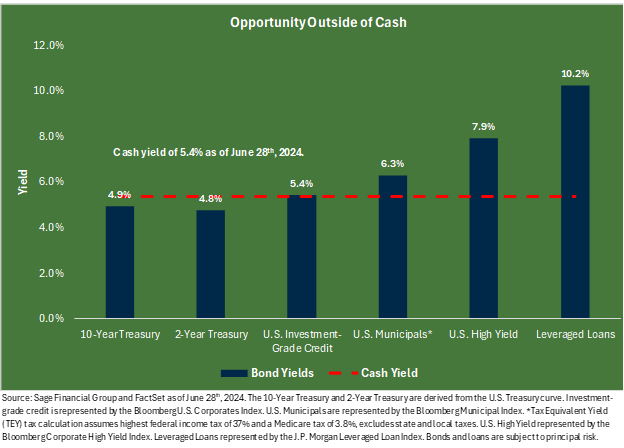

In our opinion, several fixed-income sectors offer better income opportunities in the U.S. for investors looking to compound portfolio growth over time. For investors seeking high-quality exposure, investment-grade credit offers similar income levels to cash alongside the benefit of price appreciation if yields begin to decline.

On an after-tax basis, U.S. municipal bonds, due to favorable tax treatment, have an improved income opportunity. At the end of June, municipal bonds offered yield levels that exceeded cash by 0.8%.

Those with the ability to withstand a higher risk tolerance can allocate to high-yield bonds and leveraged loans. Each offers improved income potential in the current environment. Sage maintains a constructive outlook on floating-rate bank loans to generate a higher total return with less interest rate risk.

We understand the prolonged appeal of cash. As short-term interest rates remain higher for longer than anticipated, earning 5% with no apparent risk has benefits. However, we recognize that larger cash allocations become subject to lower future returns, reduced spending power, and likely reinvestment risk as rates move lower.

Closing Thoughts

As we conclude the first half of the year and look toward the future, we remain relatively upbeat for the rest of this year and into 2025, with the caveat that we are prepared for a wide range of scenarios.

Global central banks are beginning to ease monetary policy as the much-discussed but long-elusive 2% inflation goal is moving into sight. Meanwhile, the U.S. economy continues to expand, albeit at a slower pace, and despite the allure of returns on cash in portfolios today, we are finding more compelling opportunities elsewhere.

We recognize there is no shortage of potential challenges ahead. From our experience, preparing and planning for various markets is a proven, time-tested strategy for hedging against uncertainty. Our customized portfolio strategies are designed to help our clients achieve their financial and investment goals, notwithstanding inevitably challenging periods.

Footnotes

[1] International stocks are represented by the MSCI All Country World ex USA Index.

Previous Posts

-

-

- Sage Insights: Observations as Data Cools and Markets Rise

- Sage Insights: Market Observations as the Fed Remains on Pause

- Sage Insights: Market Observations at the End of the First Quarter

- Sage Insights: U.S. Stocks Reach All-Time Highs Despite a Reset of Rate Expectations

- Sage 2024 Investment Outlook

-

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.