In this edition of Insights, we review monthly market performance, the potential for the Federal Reserve to lower rates in September, the standout month for small-cap stocks, and historical market patterns during election years.

Market Overview

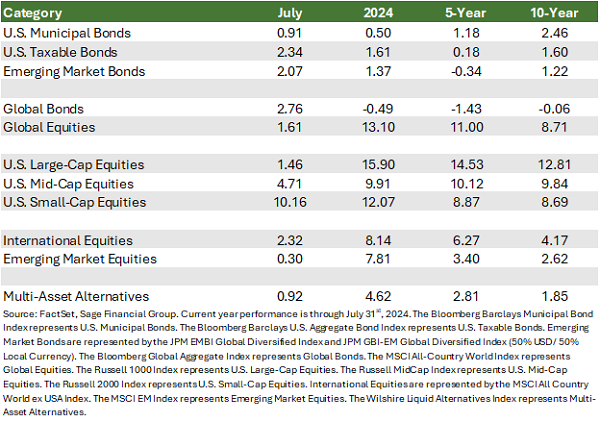

Positive labor markets and inflation data drove markets higher in July.

Earlier in the month, the U.S. jobs report revealed a modest increase in the unemployment rate alongside cooling wage pressure. A week later, the Consumer Price Index (CPI) indicated further progress toward the Fed’s 2% inflation target.

Both data points bolstered investor confidence in the economy’s resilience and the prospect of lower interest rates.

Global fixed-income returns rose 2.76% in July as rates fell across major markets amidst reduced volatility following European elections and a recovery in the Japanese bond market.

- U.S. Treasury yields declined for a second consecutive month, leading to a 2.34% rise in investment-grade fixed income, which is now positive year-to-date.

- U.S. floating-rate loans recorded their ninth consecutive month of gains, rising 0.81% in July. This positive performance has moderated recently due to increasing expectations of gradual rate cuts ahead.

- Municipal bonds returned 0.91% in July, with continued strong investor interest due to high after-tax income from a steep municipal yield curve.

- Emerging market bonds rose 2.07% as anticipation of the Fed easing interest rates encouraged a perspective that emerging market central banks might also cut rates further in the latter half of 2024.

Global equity returns posted a 1.61% return. While U.S. large-cap and emerging market stocks pushed equities higher in June, the sizable returns from U.S. small-cap stocks drove performance in July.

- U.S. large-cap equities rose in July, with the Russell 1000 Index up 1.46%. While mega-cap technology stocks underperformed, more than 75% of large-cap companies have exceeded earnings expectations. Q2 earnings are on pace to grow by nearly 10%.

- U.S. mid- and small-cap equities outperformed U.S. large-cap equities in July, gaining 4.71% and 10.16%, respectively. Small-cap stocks were a particular beneficiary of the softer-than-expected June CPI report, which pointed toward slowing inflation and raised optimism for rate cuts at the September FOMC meeting.

- International equities, represented by the most widely referenced index, climbed 2.32% last month. A 0.30% rise from emerging markets with the market’s lackluster response to the Chinese government’s decision to address its domestic economic challenges by lowering policy rates.[1]

Increased Confidence in Interest Rate Policy

A year ago, it was unclear when the period of persistently higher rates might conclude. But the Fed’s July meeting marked one year since the last rate hike in this tightening cycle.

Investors eagerly awaited the release of the June Consumer Price Index report on July 11th. Market participants wanted to gain greater insight from the data and learn if positive trends from recent months would continue.

Over the year, the underlying data has been softer than expected, as the broad measure of prices across the U.S. has been at its lowest level in more than three years, and the Fed’s preferred measure of inflation is approaching its 2% target.

Though inflation falling is a positive for the Fed’s price stability mandate, their other mandate remains worth watching. The U.S. unemployment rate rose to 4.1% last month, the highest level in twelve months.

Historically, rising unemployment levels have often signaled a slowing economy or a recession. However, we believe these concerns are not currently materializing, especially as the recent increase in unemployment comes after last year’s 50-year low.

We observe an economy coming into better balance following the COVID-19-related economic shock. Though higher interest rates are intended to slow down the economy, their effect has not adversely impacted the labor market.

The unemployment rate metric captures the percentage of those who cannot find employment among those seeking employment. We do not observe companies widely laying off employees. Instead, individuals are coming off the sidelines to seek employment.

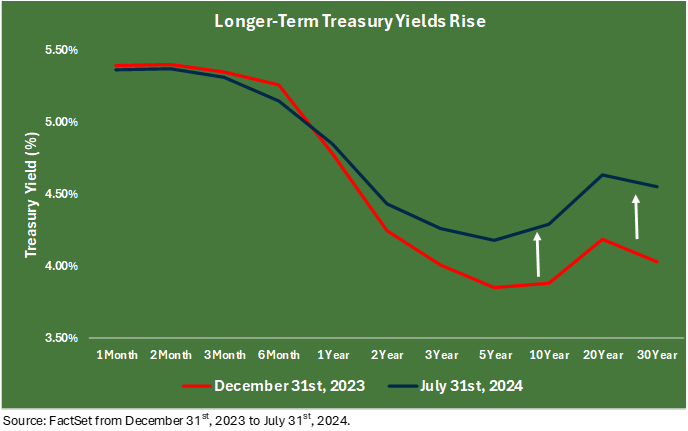

The outlook for the economy remains positive within financial markets, as measured by the U.S. Treasury yield curve. The front end of the curve captures the Fed’s current policy stance of higher rates, while longer-term yields capture the market’s expectation of growth and inflation.

The curve steepened through the first seven months of the year, with the front end remaining unchanged while longer maturities moved higher. This has been caused by the resilience of the U.S. consumer and positive future economic growth.

We anticipate lower rates as our base case. Given the declining rate of inflation (i.e., disinflation) throughout the U.S. economy, we believe the Fed will finally reduce rates in September in response to slowing inflation and to avoid keeping rates restrictively high for too long.

From an investment perspective, lower rates typically benefit asset prices, especially fixed-income and cyclical assets like small-cap stocks and real estate, and Sage has been preparing portfolios for this potential change.

In portfolios that hold bonds, Sage has added to high-quality fixed income over the past year, as cash will likely underperform in a lower-yield environment. Still, our approach to fixed income remains focused on providing portfolio diversification and income generation to prepare for a range of outcomes pertaining to the speed and path of future interest rate policy.

In equity portfolios, we anticipate continued gains from U.S. stocks and maintaining diversified exposure in addition to large-cap technology companies while aiming to capitalize on potential shifts favoring smaller companies. Internationally, we believe companies will benefit from a weaker U.S. dollar as the Fed begins to lower interest rates and garner increased investor interest, given attractive lower valuations, which may provide improved return potential.

Small-Cap Stocks Awaken

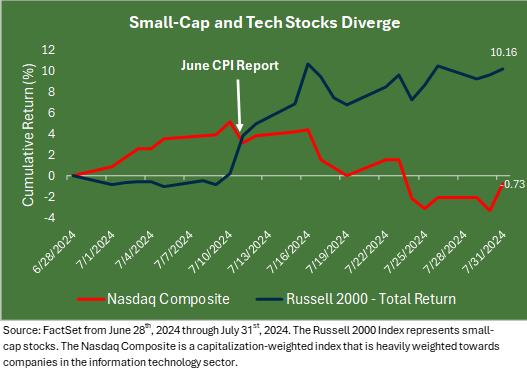

Small-cap stocks rocketed higher in July. Long seen as an underdog within the U.S. market, the asset class gained more than 10% last month, marking the most robust one-month return of 2024 and the largest gap of monthly outperformance relative to large-cap stocks in over a decade.

Smaller companies derive a greater percentage of their revenue from the U.S. than larger multinational firms with global exposure.

Meanwhile, large technology companies, previously viewed as a haven, underperformed as economic growth and inflation data exceeded expectations. The potential for a more favorable regulatory environment around a possible November shift in the congressional landscape also contributed to the reversal of this trend.

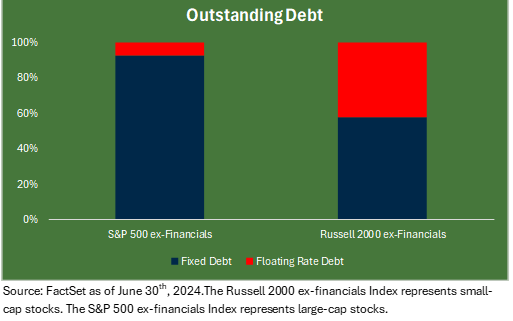

Another meaningful headwind for small-cap stocks has been their sensitivity to higher interest rates. In aggregate, smaller companies carry a more significant portion of floating-rate debt on their balance sheets than larger companies. The anticipation of lower rates directly translates to reduced interest expense and a boost in expected earnings.

When you exclude the financial sector within large and small-cap indices, there is a material difference in company debt management. Larger companies carry less than 10% of their outstanding debt as floating rate, which helps these companies manage interest expense during periods of rising rates. Conversely, small-cap companies have more than 40% of their outstanding debt as floating rate.

The June CPI report indicating further signs of disinflation pulled forward market expectations for a September rate cut by the Federal Open Market Committee (FOMC). Lower future interest rates would provide much-needed balance sheet relief for smaller, more debt-laden companies.

While sharp reversals in performance are not uncommon, sustained outperformance from small-cap stocks has been rare in the past decade. Equity markets remain fast-changing, and focusing on companies of one size or within a singular geography can lead investors to miss potential opportunities.

Our strategy emphasizes diversification across companies of different sizes in the U.S. and overseas. We seek to create portfolios that are prepared for various economic and market outcomes, able to participate in market upside, and protected during market downturns.

Election Year Volatility

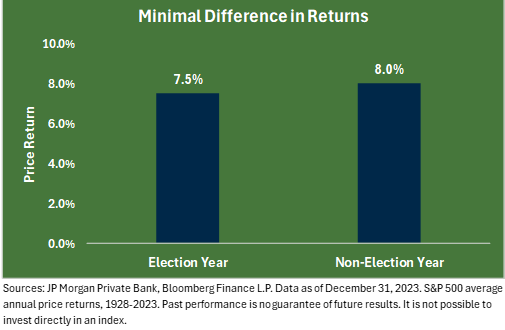

Every four years, voters head to the polls to elect a new U.S. President or reaffirm an incumbent. Election years often evoke strong emotions that can skew our understanding of the potential any one candidate has to move markets and influence investor behavior. However, historical data shows minimal difference in the annual return of the S&P 500 during election years compared to non-election years.

Politicians have some influence on markets, but we observe a more meaningful impact on investment returns from economic growth, corporate health, and inflation.

At the same time, the real winners in elections are those who do not seek to time financial markets. Looking back to the 1992 election, money market funds see, on average, $195 billion of inflows during election years. In the year following a Presidential election, equity funds see $202 billion of inflows. As said differently, investors are cautious about elections and move into cash before reversing course.

Fixed-income investments are also no more or less impacted in Presidential election years. The Fed has increased and lowered the Fed Funds Rate in election years dating back to 1956.

We advise avoiding making short-term decisions based on electoral outcome and emotion, as that may conflict with your financial goals and time horizon. We believe that sticking to a disciplined investment plan can help your portfolio achieve its stated objective.

Closing Thoughts

Although the economic landscape constantly evolves, recent data suggesting U.S. consumer resiliency and labor market health encourage us. These data reaffirm our belief that the economy is on track to realize the Fed’s goal of lowering inflationary pressures without risking recession by overly reducing economic growth.

In addition, easing inflation and the prospect of rate cuts ahead have boosted small-cap performance, a noteworthy development that we are participating in across client portfolios, underscoring the merits of an investment strategy focused on diversification between different asset classes and geographic regions.

While election-year uncertainty may bring volatility, we emphasize the importance of maintaining a disciplined investment plan and staying committed to your strategic plan, which is aligned with your goals and time horizon. We believe that a balanced approach is essential for navigating the complexities of the current market environment.

Footnotes

[1] International stocks are represented by the MSCI All Country World ex USA Index.

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.