Market Returns

Global equity markets made a strong start this week, continuing a broad-based rally on Monday and Tuesday. The primary drivers were the ongoing reopenings across the country as well as positive movement among economic indicators, including global PMIs, housing data, and retail sales

Despite the positive data, markets declined following reports of increased COVID-19 cases in key states (e.g., Florida, Arizona, California, Texas). The MSCI All Country World Index (ACWI), which represents global equities (i.e., both U.S. and international stocks), closed the week down 1.8%. The S&P 500 Index finished the week down 2.9%, and the Russell 2000 index, representing U.S. small companies, ended the week with a return of -2.4%. Core U.S. bonds in the Bloomberg Barclays U.S. Aggregate Bond Index held steady, finishing the week up slightly by 0.2%.

This week’s market performance was a reminder that volatility in these uncertain times is to be expected.

Global Economic Developments

This week brought the month to a close, and readings from Eurozone Purchasing Managers Index (PMIs) were solid. The composite PMI increased to 47.5 in June — comfortably above both the consensus forecast of 42.4 and May’s 31.9 reading. (A reading at or above 50 indicates growth or expansion; anything below suggests contraction.)

Manufacturing PMI ended the month at 46.9, just above market expectations of 44.5 and solidly above May’s reading of 39.4. Meanwhile, services PMI jumped from 30.5 in May to 47.3 in June, outpacing the market forecast of 41.[1] Markit Economics attributes the rise in PMI readings to relaxed lockdown restrictions in the Eurozone, noting “a continued strong improvement in business expectations for the year ahead.” [2] We are seeing similar PMI recoveries in the U.K. and Japan as well:

While not included on this chart, U.S. PMI readings for June also exceeded expectations. The composite PMI of 49.6 was ahead of the expected reading of 48 and represents a leap of nearly 10 points from May’s 39.8 reading. In addition to exceeding expectations, the significant month-to-month PMI rebound suggests a relatively healthy and durable global economy, especially given the current circumstance. Higher prices for global equities and “risky” bonds are likely as long as this trend continues.

COVID Hotspots

The biggest development this week continued to be the path of COVID cases and hospitalizations in particular regions of the U.S.

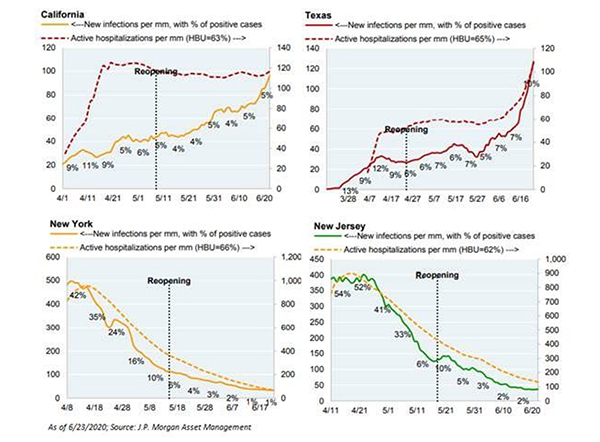

Texas, California, Florida, and Arizona are experiencing spikes in statistics (transmissions and hospitalizations). While wholesale lockdowns/reclosures are not being announced, politicians are taking action. Florida and Texas both paused their reopening processes, and Texas took the further step of closing bars again on Friday, while New York, New Jersey, and Connecticut announced Wednesday that they will require travelers from these three hotspot states and six others to self-quarantine for 14 days upon arrival in order to preserve their health gains.[3] (The four charts below illustrate the different experiences that key states have had with new Covid-19 infections over various periods.)

It is important to note that none of these states has imposed stringent lockdowns at this time, and most areas appear to have ample hospital capacity to handle the surge in cases. If conditions worsen in particular areas, states and cities are likely to shut down parts of the economy incrementally and/or require the wearing of masks, but they are unlikely to go back to the more radical “shelter-in-place” type measures that were so economically damaging. More people will remain home, which will hurt some businesses and economic growth until some of these new daily case trends and hospitalizations decline, but these outbreaks also will put more pressure on Congress to enact another large stimulus bill to help states/municipalities, consumers, and businesses alike.

The spikes in new coronavirus cases have made investors nervous, and these setbacks may contribute to create near-term market volatility. However, amid these mixed reopening experiences, some positive elements have been overlooked. Despite predictions to the contrary, states that experienced a sustained first wave of infections have yet to see a significant second wave. The current surge in Texas can be seen as the extension of its first wave rather than a second wave, and places like New York, with heavy first waves, are seeing continued improvements. As we have noted in prior communications, Sage does not expect the economic recovery and regional re-openings to happen in a straight line. It will likely be gradual and uneven. While there can be starts and stops to various reopening efforts (as measured by mobility data, employment gains, and other economic developments), investors should be prepared for volatility, and continue to keep the big picture top of mind.

Investor Implications

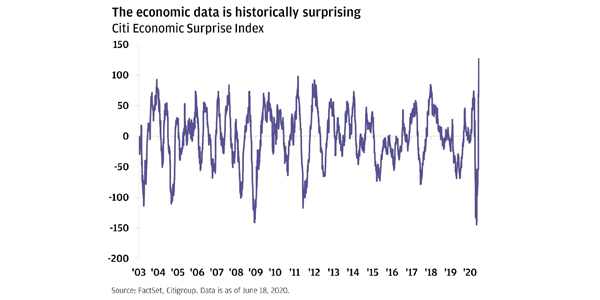

In this connection, it is important for investors to remember that headlines don’t necessarily tell the whole story. In fact, often they are designed to focus on negative aspects of a more complicated reality. For instance, the increasing Covid-19 case numbers in May masked what turned out to be a surprisingly positive employment report for the month. One way to see that economic developments may be more robust than some news reports might suggest is to look at Citigroup’s Economic Surprise Index, which measures economic data against market economists’ forecasts. As you can see, the economy has a habit of defying predictions:

Periods of equity market volatility will likely continue until COVID-19 is fully under control. As we’ve noted in recent weeks, the rise of hospitalizations and deaths in key hotspot areas remains a short-term risk, as governors will be forced to consider slowing or halting reopening plans for their states.

Nevertheless, it is important not to focus on any particular data point. The government’s monetary and fiscal policy response has been encouraging. Previous stimulus packages provided support for large corporations, small businesses, and consumers. We expect state and local governments to receive stimulus help in the coming months, along with some type of extension for the expanded unemployment benefits established in the CARES Act.

We see a high probability that the scientific community will identify additional effective treatments and/or vaccines over the next 6-12 months. Multiple vaccine trials are currently underway and entering phase 3 later this summer. Meanwhile, Gilead Sciences is developing an inhalable version of the anti-viral drug remdesivir. The goal of an inhalable version of the anti-viral is that by administering the drug via nebulizer rather than intravenously (which requires a hospital setting), patients could get the same treatment at home, theoretically reducing the burden on the hospital system.

The latest economic data and reports of developments from the scientific and medical communities are encouraging, and we believe the medium- to long-term outlook for financial markets is positive. We will continue to monitor and analyze new information as it becomes available and incorporate it into our thinking. As always, we encourage you to reach out if there is anything you would like to discuss.