The new year started on a generally positive note for the markets, supported by low interest rates, positive vaccine developments, and impressive corporate earnings.

In January, the MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), declined by 0.5%. The U.S. large-cap Russell 1000 Index fell 0.8% in January, although the small-cap Russell 2000 Index increased by 5.0%, and the MSCI ACWI Ex-USA Index (international stocks) ticked up by about 0.2%. Core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index ended the month down by 0.7%, primarily due to slightly higher interest rates.

In this edition of Insights, we provide an update on COVID-19 developments, corporate earnings, and the buzz of activity around popular Reddit stocks (e.g., GameStop, BlackBerry, etc.).

COVID-19 Developments

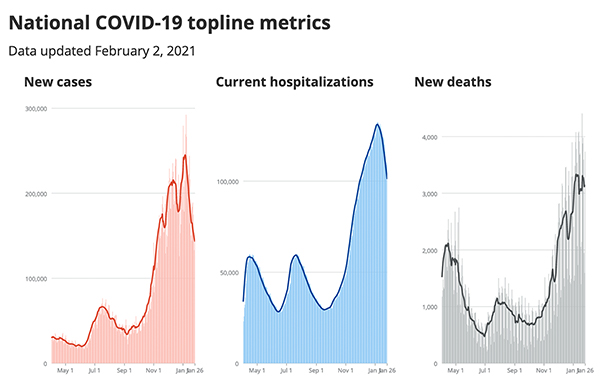

New daily case numbers of COVID continue to decline across the country, falling from over 291,000 in early January to 113,512 on January 31st. Hospitalizations also declined significantly throughout January, falling from an all-time high of 132,474 on January 6th to 95,013 on January 31st — a reduction of almost 30%.[1] As the below chart demonstrates, new cases and hospitalizations are both off their highs, although, sadly, new COVID-related deaths remain elevated.

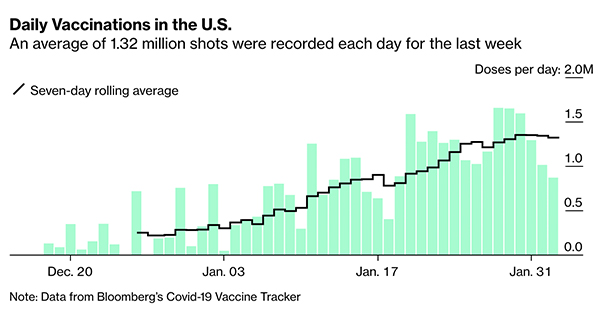

In our view, these downward trends are partly attributable to the increasing number of Americans who have already been exposed to the virus either through having COVID or receiving the vaccine. As of January 31st, more than 33 million doses of vaccines had been administered, accounting for roughly 10% of the total U.S. population.[2] More importantly, the pace of vaccine distribution is trending upwards; as this graph indicates, the U.S. is currently vaccinating 1.35 million people per day:

Risks do still remain. New COVID variants have been identified in the U.K., South Africa, and Brazil, and early research suggests these variants spread more quickly than the original form of the virus.

So far, these variants have only appeared in limited numbers in the United States, and the existing vaccines are believed to protect against them.[3] If these variants are indeed more contagious, we could see an increase in new cases and hospitalizations, which could, in turn, lead to stricter social-distancing and isolation mandates. While we believe a return to full lockdown is unlikely, investors should remain aware of that possibility and other unexpected events. The best protection for investors, in our view, is vigilant, broad diversification in investment portfolios, and mental and emotional preparation for volatility.

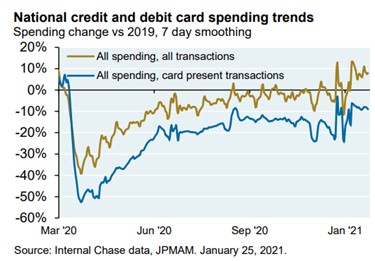

Economically, spending data from January indicates that consumers are becoming more comfortable resuming pre-pandemic leisure activities, such as dining out. We expect to see consumer spending increase as long as COVID trends remain positive. As shown below, recent Chase Bank data shows that “all spending” has recently exceeded pre-pandemic levels. Consumer spending accounts for 60–70% of our economy, and both individuals and companies could feel a financial boost from this trend.

While the path forward most likely will not be linear, there have been signs that we are continuing a gradual return to reopening; for example, New York will allow indoor dining at 25% capacity starting on Valentine’s Day and weddings of up to 150 people beginning in March.[4] We expect re-openings to continue as much of the country’s colder parts begin to enjoy warmer weather, and we believe that an uptick in consumer activity and the resumption of closer to normal operations in key sectors will propel the economy forward.

Corporate Earnings

Earnings reports so far have been encouraging as roughly 82% of companies that reported earnings have exceeded analyst expectations — well above the average rate of 61% of companies exceeding analyst expectations.[5]

Large-cap companies have fared particularly well this earnings season. For example, Wall Street analysts expected Apple to exceed $100 billion in quarterly revenue for the first time in Q4 2020 and report earnings close to $103.3 billion. Apple’s $111.4 billion reported revenue far exceeded their expectations.[6] Similarly, Alphabet (Google’s parent company) and Amazon also both outpaced revenue and earnings predictions. [7] And despite a mixed earnings report for Q4 2020, Pfizer has raised its earnings guidance to $15 billion for 2021.[8]

Mastercard, which also reported solid earnings, has noted an acceleration in spending trends in January.[9] We believe that the increased spending is partly due to the stimulus checks sent out in December and January and the continued reopening in California and Texas, where there was an uptick in restaurant spending in January.

While we find these trends encouraging, we remain cautiously optimistic. It is still relatively early in earnings season: many companies have yet to provide full-year earnings guidance for 2021, and COVID-19 presents several lingering risks as we move through the year.

GameStop, BlackBerry, AMC, and other Reddit Stocks

Investor exuberance — best exemplified by the dramatic price movements in GameStop, AMC, and Nokia — garnered a significant amount of attention in January. In our view, these stocks experienced “short squeezes” fueled by social media, primarily Reddit and its “Wall Street Bets” forum. A short squeeze is a scenario in which investors who had bet that a stock’s price was going to fall are suddenly forced to buy it at a much higher price because its value is soaring. In the case of GME, the stock became popular on Reddit’s Wall Street Bets forum, which caused the stock price to rise quickly. Because GME had greater than 100% short interest, primarily by hedge funds, the short-sellers had to buy shares of the company (at the increased value) to close their positions. GME has experienced a dizzying price swing this year, as the stock price increased from $17.69/share on January 4th to $325/share on January 25th and then decreased to just $67 on February 4th.

Amid the volatility, Robinhood, the most popular retail trading firm, decided to slow users from buying GME, BB, AMC shares. Although we do not have complete information at this time, it appears Robinhood needed to slow trading to decrease the collateral it was required to post to prevent insolvency. Because many users on the platform use options and margin, Robinhood has to post significant collateral with custodians. The combination of Robinhood’s curtailment of how quickly retail investors could buy shares, along with decreased short interest, let the air out of the bubble. Over the past few days, many of these stocks saw declines of 70% or more.

And while we did see some broader market volatility due to concerns about this exuberance, it was isolated to small pockets of the equity market and is unlikely to have lasting implications.[10]

Closing Thoughts

The COVID-19 pandemic and its associated economic and social restrictions remain the most pressing concern for investors, especially as we continue to learn more about the virus’s variants. Based on the available evidence, it appears that the recovery and re-openings are moving in a positive direction.

To date, company earnings have been positive, and we remain cautiously optimistic that corporations will experience a healthy bounce in profits this year. Our perspective and advice have not changed: while investors should prepare for short-term market volatility, we believe they will be best served by compartmentalizing short and long-term needs and sticking with their personalized investment strategy that is aligned with their financial objectives, time horizon, and appetite for risk.

Related Posts

Insights: The Markets, Fiscal Stimulus, and the November Elections

Sage Recognized by Barrons’ and The Financial Times

[1] Eater, Indoor Dining Will Return to NYC Starting on Valentine’s Day.

[2] Refinitiv, This Week In Earnings.

[3] CNBC, Apple reports blowout quarter, booking more than $100 billion in revenue for the first time.

[4] Investor’s Business Daily, Google Stock Pops As Earnings Crush Views Amid Advertising Rebound.

[5] Barron’s, Pfizer Just Reported Earnings. Here’s the One Number to Notice.

[6] MarketWatch, Mastercard sees U.S. spending trends improve in January as earnings ‘set the stage’ for 2021 rebound.

[7] Bloomberg, GameStop Short Nightmare Shows Few Signs of Becoming a Contagion.

[8] CDC, Variants of the Virus.

[9] Bloomberg, Covid-19 Vaccine Tracker.

[10] The COVID Tracking Project, National Data: Current Hospitalizations.

Disclosure

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.