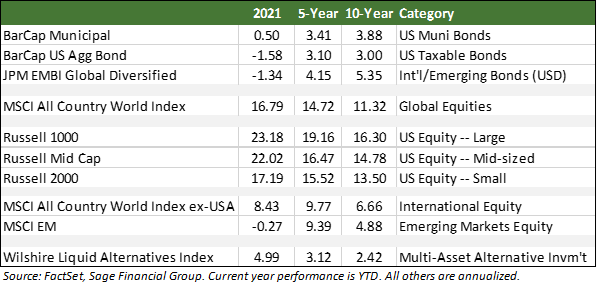

In October, stocks started the fourth quarter on a strong note, while bonds retreated modestly as market participants positioned portfolios for the final months of 2021.

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 5.10% in October, the U.S. large-cap Russell 1000 Index rose 6.94%, the U.S. small-cap Russell 2000 Index advanced by 4.25%, and the MSCI ACWI Ex-USA Index (international stocks) posted a gain of 2.39%. After a volatile September, during which equities declined, markets benefited in October from strong corporate earnings and some early signs that supply-chain issues were abating.

Core U.S. taxable bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index and Barclays Municipal Index ended the month lower by 0.03% and 0.29%, respectively, primarily due to slightly higher interest rates in anticipation of a gradual reduction of accommodative monetary policy from the Federal Reserve.

Inflation, Monetary Policy Decisions, and The Impact on Portfolios

In this edition of Insights, we discuss what we see as one of the most relevant topics affecting financial markets today, inflation, and our perspective on what it means for investors.

Inflation has been top of mind for investors throughout 2021, especially as it gained speed at the beginning of the 2nd quarter when markets solemnly celebrated one year removed from the March 2020 lows. It is an important topic because inflation impacts monetary policy decisions, corporate profits, and thus portfolio returns.

As we analyze below what higher inflation could mean for investors, we look at a variety of factors, including (1) what is causing inflation, (2) the course we expect inflationary pressures to take, (3) what it means for investors in bonds and equities, and (4) how Sage portfolios are prepared for a variety of environments.

What is causing inflation?

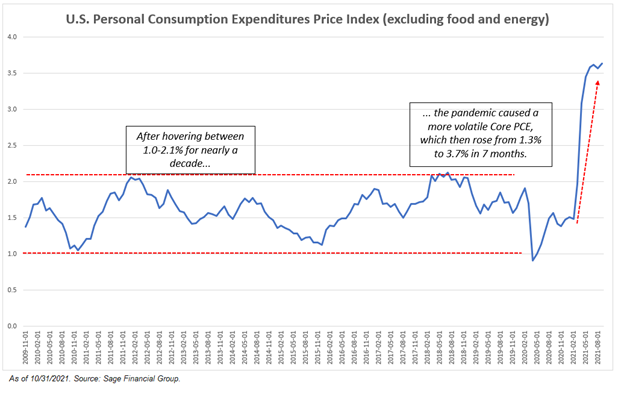

Over the past 20 years, inflation has been surprisingly stable, despite accommodative monetary policy from central bankers, and this stability has created an environment with artificially low interest rates. As shown below, the Personal Consumption Expenditure (“PCE”) Price Index, which is the Federal Reserve’s preferred measure of inflation, stayed between a band of 1.0% and 2.1% for more than a decade, before taking a large dip earlier this year and then breaking higher as demand for goods has outpaced the ability for supply to react flexibly.

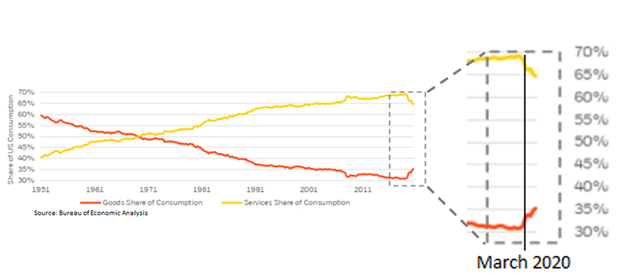

In aggregate, consumer spending has been robust in 2021, growing nearly 20% from pre-pandemic levels, but what consumers purchase has likely temporarily shifted due to the pandemic beginning in March 2020. Before March 2020, services (e.g., bars & restaurants, travel, sporting events, etc.) comprised the bulk of consumer spending. As shown below, in 1951, 40% of consumer spending was on services, and by 2020, services accounted for nearly 70% of consumer spending. However, the pandemic reversed these trends as consumers sought out goods much more than services.

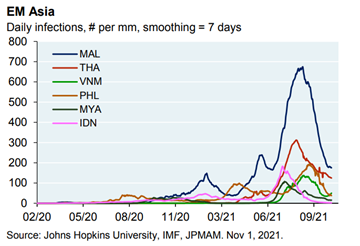

This massive shift towards goods caused issues in the supply chain exacerbated by COVID outbreaks in Southeast Asia. China, Vietnam, Malaysia, and many of their neighboring countries are important hubs for manufacturing clothing, furniture, and housing appliances, as well as critical inputs for the semiconductors required for automobiles and electronics. For example, over half of Nike’s shoes are made in Vietnam, where factories were out of service for much of August and September. The combined pressure from increased demand and COVID-related shutdowns pushed inflation higher. However, we expect that inflationary pressures will wane in 2022 through a natural diminishing of demand for goods and an improving COVID situation in Asia.

As shown below, the COVID situation in Asia has significantly improved recently, following lockdowns over the summer. Many factories were shut down during the most recent wave of COVID cases in Asia, but many began the process of reopening in October. For example, Nike announced that all of its factories are back online at full capacity as of October, which is an example of supply-chain pressures easing modestly. Additionally, both GM and Ford recently announced in their quarterly earnings calls that the semiconductor environment is seeing sequential improvement.

As shown below, the key factors contributing to higher inflation readings today are expected to be a drag on inflation by mid-2022. That is, we would expect that the 3.7% inflation (via Core PCE) that we are experiencing today should trend below 3% by mid-2022.

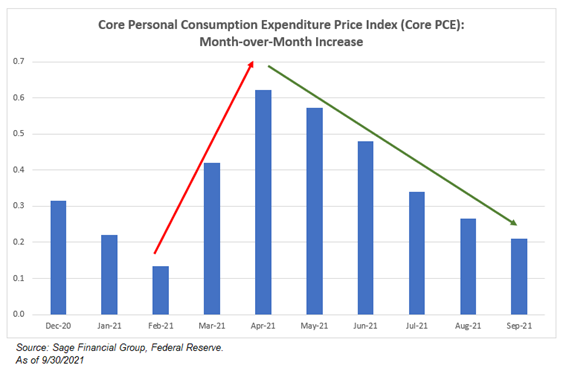

A data point that we think is indicative of broad inflation is Core PCE on a month-over-month basis. Core PCE had above target year-over-year inflation readings, but also the lowest month-over-month reading since February, when inflationary pressures were at their peak (see chart below). We expect this trend to continue, although there will certainly be some pockets of inflation in specific industries where supply-demand dynamics may take longer to adapt, such as restaurants, construction, and real estate.

What does this environment mean for investors?

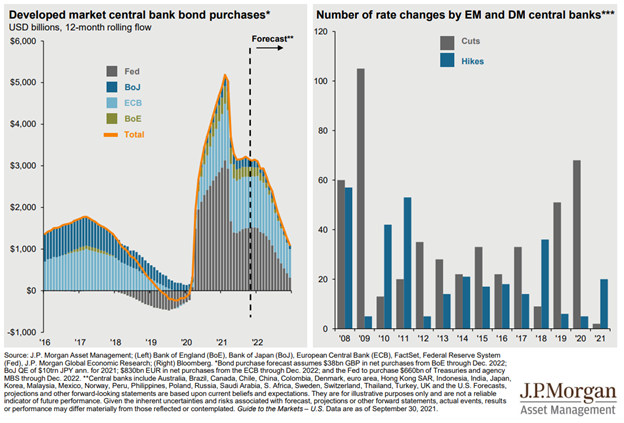

Inflation matters primarily because persistent price increases can cause instability in financial markets through the erosion of economic growth and corporate profits. Thus, central banks are keenly focused on controlling prices through bond purchases (one of its available tools), which can impact short-term interest rates. This week, in response to inflation and improvements in employment, the Federal Reserve announced that it would begin slowing the bond purchasing program that saw the central bank add $120 billion of bonds to its balance sheet per month. By slowing its bond purchasing program (“tapering), the Fed hopes to decrease demand for goods and position itself to begin raising rates in the second half of 2022.

From a bond perspective, we would expect that this tapering program will lead to modestly higher interest rates across the treasury yield curve. Higher interest rates negatively impact fixed-rate bonds via duration, particularly investment-grade bonds. Around the globe, central banks have gotten incrementally more “hawkish,” which we expect to translate to modestly higher rates. As shown below, bond purchases have been reduced by major central banks, and other central banks have started to raise rates for the first time since 2019 (e.g., Brazil, Mexico, and Singapore).

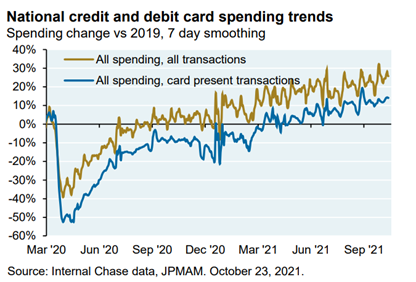

The impact tapering has on equities will likely depend on how persistent the current inflationary pressures remain. Our current base case is that higher inflation should decrease in 2022 and continue to provide equities with the solid backdrop they currently enjoy. As of November 2nd, approximately two-thirds of major U.S. companies have reported Q3 earnings, and corporate profits have been very strong overall. Corporate earnings have grown 37% on a year-over-year basis, with 85% of companies exceeding their earnings expectations as companies have been able to mitigate the effects of inflation through pricing power, supply-chain management, and controlling operational costs. Moreover, as shown below, consumer spending in 2021 compared to 2019 remains very robust heading into the holiday season.

Demand for goods and services remains remarkable and is a product of pent-up consumer behavior and excess savings over the last 18 months. Consumers drive nearly 70% of the U.S. economy, and we expect consumer spending to remain a strong engine for growth. Overall, despite higher inflation readings, company profits and equity investments have held up well, and we expect this trend to continue.

How is Sage prepared for changes in inflation?

While we believe that the Federal Reserve can make incremental moves to quell inflation concerns, we acknowledge that there are a wide variety of possible outcomes, and we believe it is important to be prepared for a variety of market environments. In general, we use flexible bond strategies, preferred securities, and other strategies to position around a potential volatile interest rate environment as some of these less traditional bond strategies offer flexibility within portfolios when high-quality fixed-rate bonds may be challenged.

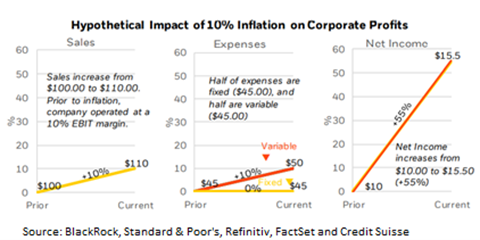

Equities may continue to do well as companies can command higher pricing power to maintain profit margins. Inflation contributes to a growth in company revenues as well as an addition to costs, and those companies with pricing power and operating leverage may be able to grow profits further. . As shown below, a hypothetical company that sees 10% growth in revenues from inflation, with half of their expenses fixed and half variable and a 10% profit margin, could see its profits increase by 55%. While this is a hypothetical corporation, this shows how an increase in revenues can flow through meaningfully to the bottom line, even when variable costs rise at the same proportion as revenues, and emphasizes how important pricing power can be.

To summarize, we acknowledge and are positioned for a wide variety of outcomes. We use bonds other than simple fixed-rate bonds to minimize interest rate risk within portfolios and continue to think that equities provide an inflation hedge through pricing power and operating leverage.

Closing Thoughts

While inflation has been a concern in 2021, the primary causes have been short-term in nature, notably issues within the supply chain that were exacerbated by COVID. However, month-over-month inflationary indicators and company progress (e.g., GM/Ford noting improving semiconductor situation, Nike’s factories in Vietnam reopening, etc.), are early signs that these supply-chain pressures are easing around the globe.

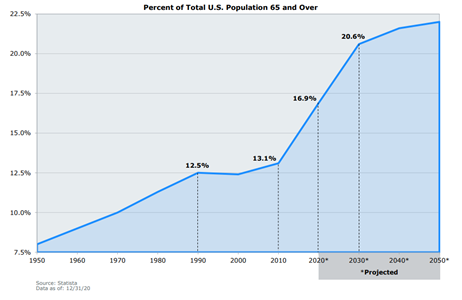

Additionally, we believe that structural forces at play will limit inflation from turning into a scenario like the one in the 1970s. These forces include technology, globalization, and others, most notably demographics, which are incredibly powerful and do not get enough attention in conversations about inflation. For example, the majority of baby boomers are approaching retirement or have recently retired. This large generational group has exceedingly grown as a percentage of the total U.S. population. Over the coming decade, forecasts project that 1 in 5 persons in the U.S. will be above 65.

This demographic trend should likely keep inflation from rapidly growing for two unique reasons: 1) Retirees are more sensitive to price increases and will likely not tolerate any further increase in prices; and 2) Investors within this age range seek stable and consistent yield to help meet their financial goals. Thus, persistent demand for investment in fixed income (e.g., U.S. Treasury Bonds) should structurally provide a limit on interest rates.

Both U.S. consumers and businesses remain extremely well-capitalized, which is likely to boost economic activity over the next 12 months. To be clear, risks remain in terms of inflation, the possibility of COVID variants, and the ongoing uncertainty about the debt ceiling, but we advise our clients to stick to their financial plans and avoid emotional decisions when markets experience volatility.

If you have any questions about this month’s commentary, please do not hesitate to get in touch with Sage at 484-342-4400 or thecohns@sagefinancial.com.

Previous Posts

Insights: Market Commentary for September 2021 and A Look Ahead (October 5th, 2021)

Insights: What Drove the Markets in August 2021 (September 8th, 2021)

Insights: Financial Markets in July 2021 (August 6th, 2021)

Revisiting 2021 Themes and Second Half Outlook (July 6th, 2021)

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please view our Accolades or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.