January was a difficult month for financial markets, caused primarily by expectations of tighter monetary policy by the Federal Reserve and a soft start to corporate earnings season. The Russia-Ukraine tensions provided an additional source of uncertainty for markets. While we observed some recent downside in equity markets, we remain encouraged by the strong economic backdrop. As a result, we continue to think that most companies should have a positive environment for continued revenue and earnings growth in 2022.

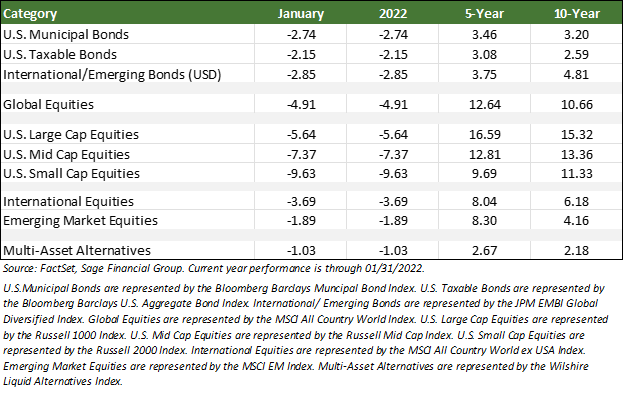

The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), declined by 4.91% in January. The U.S. large cap equities fell 5.64%, the U.S. small cap by 9.63%, and international stocks posted a loss of 3.69%. In addition, core U.S. taxable and tax-exempt bonds ended the month lower by 2.15% and 2.74%, respectively, as higher interest rates negatively impacted bond prices.

In this edition of Insights, we discuss what we see as the most relevant developments and themes driving financial markets, including (1) the Federal Reserve detailing its plan to tighten monetary policy, (2) the fact that corporate earnings remain upbeat on average, and (3) the boiling tensions between Russia and Ukraine.

Federal Reserve Details its Plan for Tightening

The Federal Reserve has been evolving its policy in the early part of 2022. Fed Chairman Powell signaled that the Fed would soon raise interest rates in an environment that is testing its dual mandate with both elevated inflation and a tighter labor market.

U.S. consumers continue to experience higher prices, as seen via 4.9% year-over-year growth in the Core Personal Consumption Expenditures Price Index (“Core PCE”) through December. Core PCE is the Fed’s preferred inflation index. Its goal for price stability is for the Core PCE to average 2% growth over time. Depending on labor market conditions, an inflationary reading of 4.9% is expected to lead to a more aggressive rising rate policy from the Fed.

The labor market has also tightened faster than expected. Towards the end of last year, the Federal Reserve expected the unemployment rate to end 2022 at 4.3%. But, more quickly than expected, the unemployment rate has already dropped to 4.0%, which suggests a tight labor market.

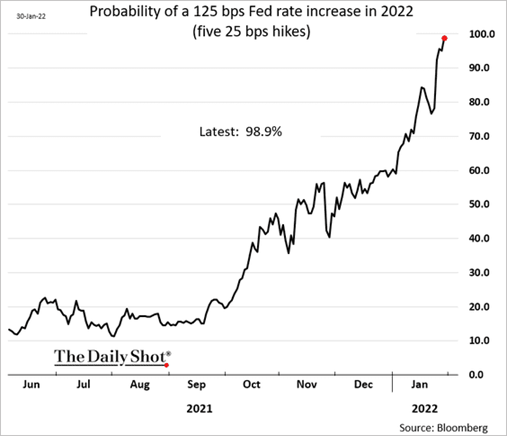

These two pieces together, current high prices and low unemployment, increase the likelihood that the Fed will raise rates to cool the economy. Interest rate markets currently expect four to five increases of 0.25% by the Federal Reserve in 2022, a significant increase from the number of hikes expected a couple of months ago (see chart below). This shift to a restrictive monetary policy will end two years of extraordinarily accommodative measures by the Federal Reserve and other global central banks and decreases investors’ comfort with risk (i.e., bonds became relatively more attractive than stocks).

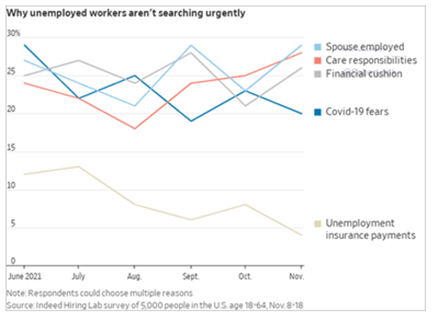

We see two key catalysts for markets moving forward, including the path of inflation and workforce participation. That is, workers may begin to return to work in higher numbers as COVID concerns wane, according to a recent Indeed Hiring Lab survey (see chart below). Over 75% of unemployed respondents reported they are not re-entering the workforce due to temporary developments, including care responsibilities, financial cushion, COVID fears, and unemployment payments. More people returning to work or a slowdown in price increases could be a positive for stocks, as either would translate to a less aggressive Federal Reserve.

In our view, more rate hikes would translate to higher short-term rates and may weigh on stock prices, because higher rates make bonds relatively more attractive compared to stocks. However, if inflationary pressures wane and more people return to the workforce, the Fed could move forward more slowly than expected, which would positively affect financial markets. We believe the current market expectation of 5+ Federal Reserve rate hikes in 2022 may have swung too far, as economic growth and inflation are likely to slow later in the year. Instead, we believe the Fed will take data-dependent actions since economic data is evolving rapidly regarding inflation.

Corporate Earnings Have Been Upbeat on Average

On average, corporate earnings have been encouraging after a rocky start to the quarterly reports by banks. In Our Perspective communication in January, we noted that banks started off quarterly earnings on a bad foot but that it was still too soon to extrapolate the state of corporate America from the reports of a few companies.

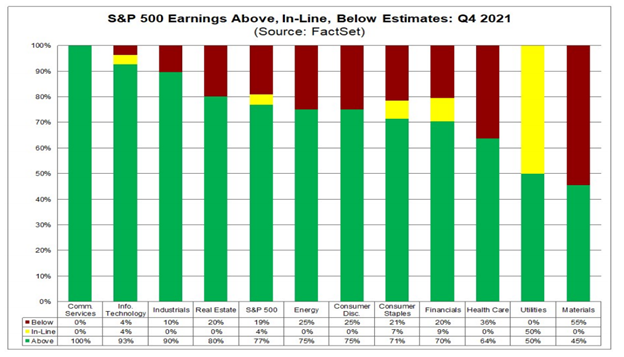

Through the end of January, 33% of companies in the S&P 500 have reported earnings, with 77% and 75% beating earnings and revenue estimates, respectively. Moreover, U.S. companies are on track to grow earnings 24% year-over-year, which in our view shows a healthy corporate backdrop (source: FactSet). As shown below, communication services and technology companies have been standout sectors. Both comprise a significant portion of U.S. large-cap stocks, and if the trend holds, they should provide some support for indices broadly.

While J.P. Morgan, Goldman, and some others noted issues associated with the cost of labor, and there have been some high-profile misses like Facebook, not every business has had the same experience. For example, companies such as Apple, Google parent Alphabet, Tesla, American Express, and Microsoft delivered robust earnings results.

In our view, while banks started corporate earnings season off in a challenging fashion, technology companies turned the trend around. Companies like Apple and Tesla noted supply issues, but their management teams communicated that these issues are improving and likely to end this year. Nevertheless, sentiment remains depressed, and stocks tend to climb a “wall of worry,” which may be a positive in the coming months, as some of these concerns may not prove to matter over time. If companies are able to continue to grow their revenue and earnings in 2022, as they have in recent quarters, we believe that equity funds in portfolios should continue to benefit.

Russia-Ukraine Tensions Heat Up

Tensions surrounding Russia-Ukraine relations have been boiling in recent weeks, as Russia amassed 100,000 troops at its border with Ukraine. We do not think these tensions have been a large driver of market performance recently, but they provide an extra level of uncertainty.

As of this writing, diplomatic conversations continue to occur between the two sides, and a “hot” war remains much less likely than either a diplomatic solution or economic sanctions. Interestingly, Ukraine’s foreign minister recently pointed out that 100,000 Russian troops are “insufficient” to invade Ukraine[1] (i.e., he thinks we will know if an invasion is about to happen, as the number of troops will increase and military infrastructure, including hospitals, will emerge).

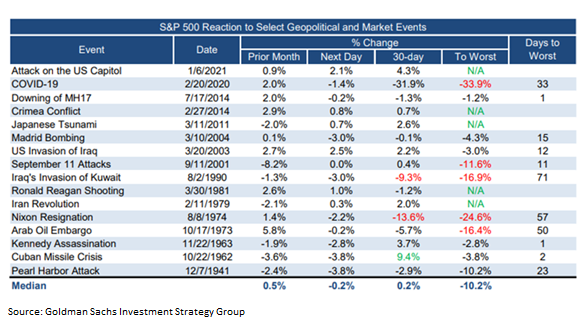

While geopolitical tensions like Russia/Ukraine can be scary, markets tend to take geopolitical issues in stride over time. While we cannot say with certainty what will happen concerning U.S.-Russia relations, we can use history as a guide to show that equity markets tend to overcome challenging geopolitical environments.

Historical context illustrates that geopolitical tensions can lead to short-term pullbacks in equities, but investors tend to look through these events. As a result, markets may see an average decline of up to 10%, but that drawdown is typically short-lived. For example, the 2014 Crimean conflict led to a 2% peak-to-trough for equities before recovering within 30 days.

Sage constructs portfolios for various scenarios, both in the U.S. and abroad. We take a long-term view and diversify with the expectation of elevated geopolitical risk from time to time. Market fluctuations due to geopolitical events provide good examples of why geographic diversification is important, as specific events may impact companies in various countries much differently. While the current tensions could lead to some market fluctuations in the near term, we expect U.S. markets to be less impacted than Russian markets as uncertainty grows around an escalation of conflict.

Closing Thoughts

The market volatility we saw in January was primarily a result of uncertainty in response to the Federal Reserve policy, a soft start to corporate earnings season, and Russia-Ukraine geopolitical concerns. We will continue to closely watch the Federal Reserve’s actions regarding its dual mandate of full employment and price stability. Fed Chairman Powell appears focused on curtailing inflationary pressures by speeding the bond purchasing program and is likely to begin raising rates steadily in 2022. Sage constructs diversified multi-asset class portfolios for a range of scenarios, including further equity volatility and higher interest rates. We will make changes to your portfolio as we see appropriate.

While we have seen some sharp fluctuations in stocks over recent weeks related to the developments discussed in this piece, we still believe that the U.S. economy should continue to grow throughout 2022. Moreover, both U.S. consumers and businesses remain extremely well-capitalized, which is likely to boost economic activity over the next 12 months. To be clear, risks remain to our outlook as inflation remains elevated, and the COVID pandemic continues. Still, we advise our clients to stick to their financial plans and avoid making emotional decisions when markets go through periods of negative performance.

[1] CNN: Ukrainian Foreign Minister says current Russian troop numbers insufficient for full invasion

Previous Posts

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Insights: Market Volatility in November, Omicron, and Tapering

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.