The market volatility that has come to define the start of 2022 persisted through April and left many investors feeling anxious. Policymakers – and investors – were focused on rising prices and efforts to contain them coming into this year. Unfortunately, that inflation continued last month, largely driven by dual pressures playing out on a global scale. At the same time, equity markets entered correction territory, partly prompted by these supply chain issues and ongoing labor challenges.

In times of significant uncertainty and market volatility, maintaining a focus on your goals and time horizon is especially essential. In this issue of Insights, we continue to examine the implications of the conflict in Ukraine and share key details from first-quarter earnings and equity markets, along with a bit of perspective on the power of not deviating from your strategic investment plan.

Financial Markets Re-Enter Correction Territory

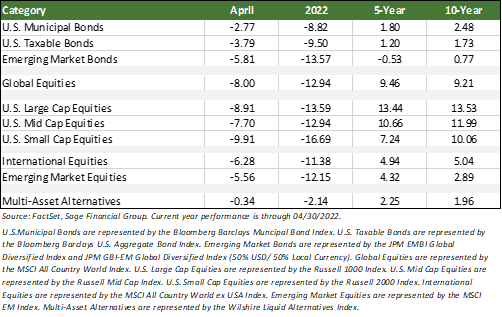

In equity markets, through April, U.S. large-cap stocks fell 12% from all-time highs reached earlier this year, re-entering correction territory (i.e., losses greater than 10%). The U.S. technology-focused Nasdaq Index moved even further into correction territory, falling 22% lower from its last all-time high set in November 2021. International stock indices have also seen declines this year, with the most widely quoted international stock index down 12% in 2022, while emerging market stocks are down 14%[1].

Despite near-universal declines this year, Sage’s investment principles and focus compel us to look at the broader context. Through that lens, we see a more optimistic outlook — the 5- and 10-year returns of Global Equities through April 2022 have been 9.46% and 9.21% annualized.

On the bond front, rising interest rates were the primary drivers of negative performance. Through April, the 9.5% decline in the Bloomberg Barclay’s U.S. Aggregate Index was the worst start in over 40 years for bonds.

As we noted last month, Sage actively planned for this historically challenging start in the bond market. There are several strategies our investment teams and advisers can utilize to counteract this trend. We continue to look toward nontraditional bond funds and alternatives to provide diversification during these times of interest rate volatility.

1. Conflict in Ukraine Shows No Sign of Slowing

We understand the unease around markets and the state of the world these days. We feel it, too. A global event of this longevity and scale demands continued focus as we analyze the implications and construct diversified investment portfolios to withstand challenging environments.

From a humanitarian standpoint, we share the anguish and anxiety this conflict is creating for so many of our clients. We continue to hope for a swift end to this global conflict. However, April saw Russia escalating its aggression by cutting off energy to Poland and preparing to invade Moldova. Despite these developments, our current perspective is that the ongoing conflict should have a modest negative impact on global economic growth while contributing to lingering inflation. We expect that the effects will be felt most acutely in Europe, which is more dependent on Russia as a primary provider of energy, but also that ripple effects could be felt throughout the world.

Lingering, elevated inflation will likely lead to more aggressive central banks. Over the coming months, we expect the Federal Reserve to continue to raise interest rates in increments of 0.25 to 0.50 percentage points bps per meeting. This is a development we have anticipated. We continuously monitor portfolios and integrate investments that may protect against a variety of outcomes, including continued elevated inflation. These strategies include nontraditional bonds, floating-rate loans, infrastructure, and others.

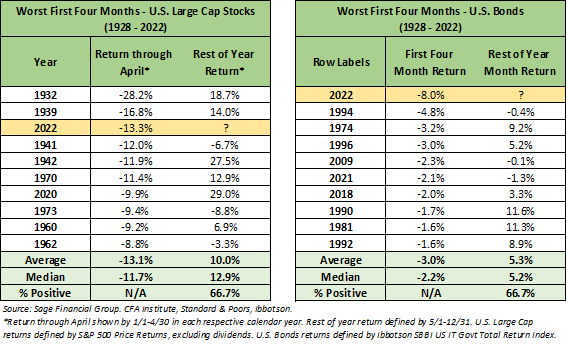

As we’ve shared in the past, it’s difficult to foresee the outcome of this war and its ultimate impact over the coming months. That uncertainty is hard to sit with, especially as the conflict and its media coverage continue into its third month. That said, we know that double-digit intra-year losses have happened in the past. As shown in the tables below, the sell-off in U.S. equities was the third-worst in the four months to start the year since 1928, and the start for bonds was the worst over that time period (see table below).

Here again, however, a little historical perspective offers some vital context. Following these tough drawdowns, markets, on average, have provided positive returns two-thirds of the time over the rest of the year, both for stocks and bonds. Furthermore, these types of drawdowns can be short-lived. From the perspective of an investor aligned with their strategic investment plan, these events historically prove to be speedbumps, as longer-term returns are driven by population growth, moderate inflation, and innovation.

2. A Complex Earnings and Equity Outlook

By the end of April, 55% of large U.S. companies reported their first-quarter earnings. High-profile misses like Amazon and Netflix may have dominated the headlines, but Sage’s deeper analysis paints a more nuanced picture. The reality is that 80% and 72% of companies beat their earnings and revenue expectations, respectively. In aggregate, companies have registered 10% growth in Q1 2022 over Q1 2021. Our investment team sees these results as indicative of a positive corporate environment.

Yet it’s undeniable that these results are out of step with the current tenor of the market. Why the disconnect? The answer, again, lies in continued labor and supply chain issues.

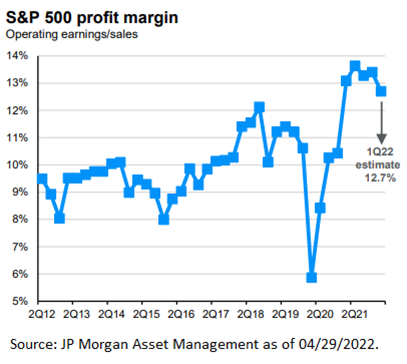

Inflationary pressures weighed on profit margins in the first quarter of 2022. For example, although many consumer-focused companies have benefited from increasing prices, some management teams now acknowledge eroding pricing tolerance from consumers. That is, ongoing pressures on input costs such as labor, materials, etc., could dent margins in the future. Current estimates are for Q1 2022 profit margins to total 12.7% of sales — the first meaningful dip since the COVID-19 pandemic began.

China’s “zero tolerance” policies toward COVID-19 cases have further hurt margins, and in turn, put additional pressure on supply chains. The limited output of goods from China has affected companies such as Apple, Tesla, Nike, etc., which have major factories in China. For example, Apple reported fantastic earnings near the end of April, but the stock dropped due to lower-than-expected guidance on the number of iPhones that can be produced this year in China. Concerns that supply may not be able to keep up with demand have investors thinking twice about companies that rely heavily on China.

Looking forward, we continue to believe that stock markets will be driven by the path of inflation and economic growth. We expect inflation to remain elevated for some time, but technology-driven price comparison and aging demographics should remain an anchor on longer-term inflation. Accordingly, we plan for a wide range of outcomes and have maintained less traditional strategies in portfolios to protect against higher inflation.

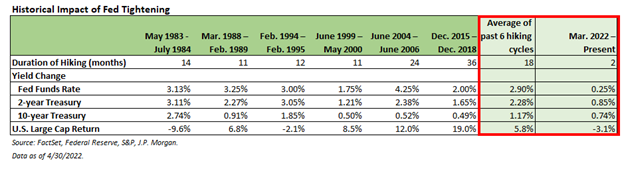

When it comes to GDP, economic growth has slowed, but we believe that growth will remain positive in 2022. While the economy showed a negative “real” GDP reading in Q1, this contraction resulted from high inflation and the harmful effects of the Omicron variant. Further, while the Fed is raising rates, our deeper perspective shows that stocks can perform well during rate-hiking cycles. Over the past six rate hike cycles, markets averaged positive returns (see chart below). Interestingly, we have essentially experienced much of the 10-year Treasury Yield rise in just two months. While a wide range of possible outcomes remains with respect to interest rates, this suggests that rates may be close to topping out, which would be supportive of bonds.

3. Research Shows That ‘Time in the Market Beats Timing the Market’

During times of increased volatility, we like to emphasize the focus of our investment philosophy on strategic goals. As we all experience what we expect to be continued volatility, here are two things to keep in mind:

- Focus on financial goals tends to reward investors.

- U.S. and international returns tend to rotate.

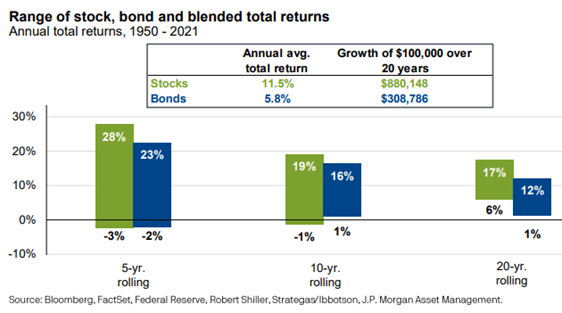

Supported by investment research studies from companies such as Dalbar[2], we think the Wall Street adage, “Time in the market beats timing the market” is correct. Sage seeks to build portfolios for a variety of environments and risk profiles. We adjust portfolios tactically depending on the environment, understanding that economies grow over time primarily due to population growth and innovation. Looking back more than 70 years, over 5-, 10-, and 20-year rolling periods, stock and bond returns tend to follow a relatively tight range.

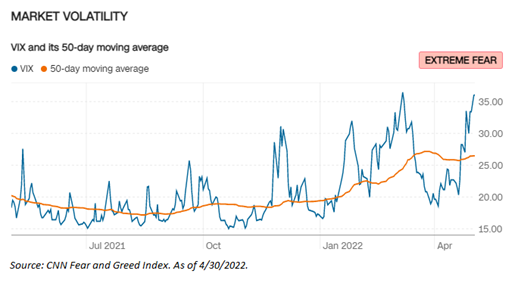

Our advice is to focus on your strategic goals. Due to the combination of factors involving Russia, inflation, the Fed, the European Central Bank, and China’s COVID-19 policies, investor positioning is as fearful as we have seen in a long time. In fact, measures of fear such as market volatility indicate “Extreme Fear” in stock markets right now. While we certainly do not claim to have a crystal ball, it’s reasonable to believe that compounding layers of uncertainty in the market right now are creating an “oversold” environment that is overly pessimistic in the near term. Some clarity on the Fed, Russia, or China developments could help provide some support and/or reduce the daily fluctuations in markets. We are actively monitoring developments on these fronts and will share any relevant updates as they occur.

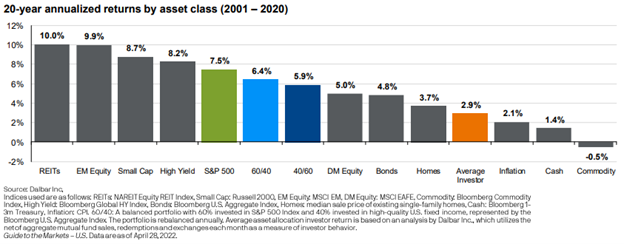

When investors are fearful, some may try to time the market. However, studies have found that timing the market tends to lead to poor results. According to quantitative analysis firm Dalbar, the average individual investor returned 2.9% between 2001-2020. This return barely beat average inflation over that time period and lagged all asset classes except commodities or holding cash. In our view, this lagging return reflects emotional investor decisions, which manifest via selling and buying at the exact wrong time (i.e., selling low and buying high). Sage’s investment philosophy is built on a more disciplined approach while maintaining a long-term historical perspective.

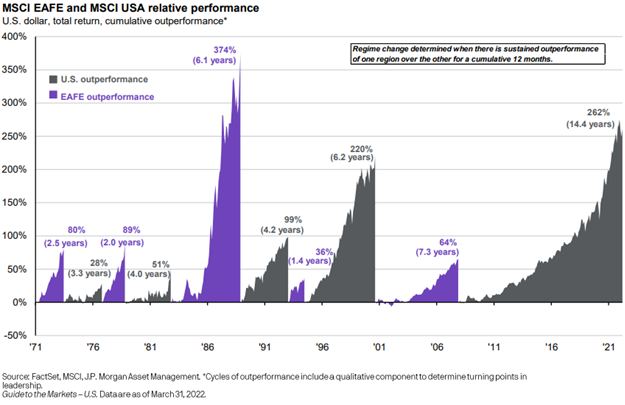

Although it feels like a lifetime ago, we wrote in our 2022 Investment and Market Outlook, “We continue to encourage investing in a geographically diversified allocation for many reasons, including participating in the benefits of growth both in the U.S. and abroad.” As shown below, growth in the U.S. and developed international markets (defined by MSCI EAFE) has rotated over time. The current period of U.S. outperformance has been the longest in duration, but developed international market equities outperformed the U.S. by a more significant margin in the 1980s. Accordingly, we advise clients to remain diversified and keep a longer-term view of the benefits of diversification through the fluctuations in individual markets.

Closing Thoughts

Fluctuations in the market have come to define recent months, and we caution that the volatility may continue in the near term. Throughout 2021, we expected inflationary pressures to wane, but the emergence of two additional COVID-19 variants, continued Chinese lockdowns, and Russia’s invasion of Ukraine have all worked together to push prices higher and force the hand of central banks. Markets continue to digest evolving monetary policy from the Fed and European Central Bank focused on fighting this inflation through slowing demand for goods and services.

Despite the fluctuations and the uncertainty, the most important advice we have for you is this: Try to keep the market volatility in perspective. Unless something has changed in your financial life, these bumps are neither unexpected nor unprepared for. Your portfolio is well-diversified and structured with a multi-asset class approach with the objective of reducing volatility over time. The investment strategy we designed for you continues to be most appropriate because it aligns with your investor profile (risk tolerance, time horizon, and return objectives) and financial goals.

If you have any questions about the topics covered in this month’s commentary or wish to discuss any aspect of your goals and your future, please do not hesitate to contact your Sage advisor or us directly.

[1] U.S. Large Cap stocks are represented by Russell 1000 Index, Global Equities by MSCI All Country World Index, International Equities by the MSCI All Country World Ex-USA Index, Emerging Market Stocks by the MSCI Emerging Markets Index, and U.S. Investment Grade Bonds by the Bloomberg Barclay’s U.S. Aggregate Index.

[2] Forbes: Busting The Myth Of Market Timing.

Previous Posts

Sage Insights: Interest Rate Hikes, Inflation, War, and Our Investment Perspective

Sage 2022 Annual Letter: A Year in Review

Sage 2022 Investment and Market Outlook

Sage Recognized for Commitment to Clients

Learn More About Sage

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks ,or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2022 Sage Financial Group. Reproduction without permission is not permitted.