View a printable version

Overview

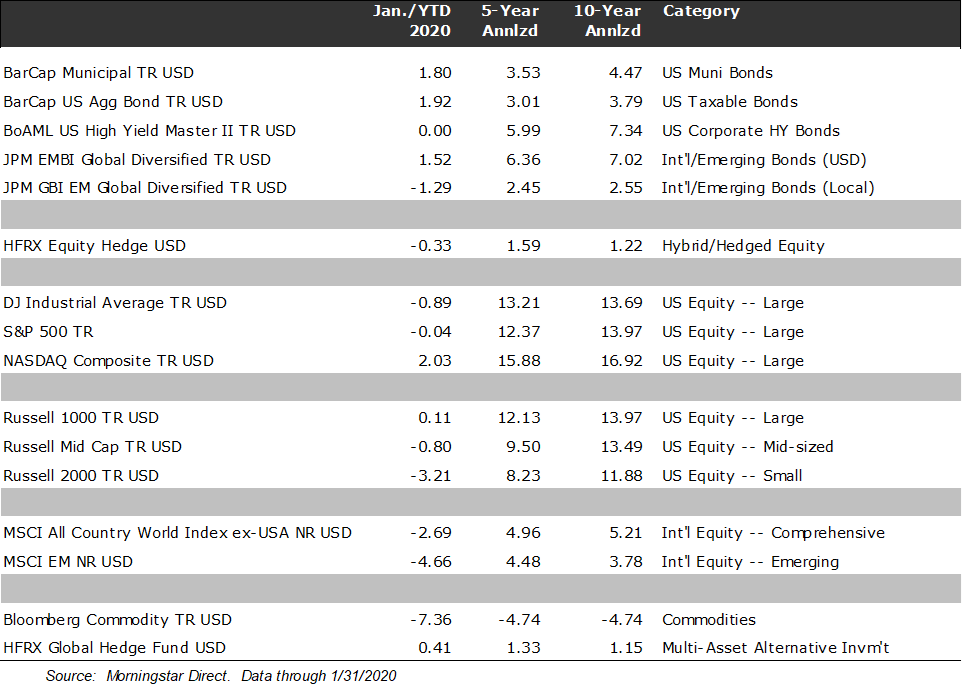

In January, most major stock indices retreated given worries about the global economic implications of the coronavirus. The monthly return for the S&P 500 was largely unchanged at -0.04%, the Russell 2000 (U.S. small-company stocks) fell 3.21%, and the MSCI ACWI ex-USA (non-U.S. stocks) lost 2.69%. In contrast, core U.S. bonds rose last month. The Barclays U.S. Aggregate Bond Index was up 1.92%.

In this issue of Insights, we primarily address current concerns about the potential economic and investment implications of the coronavirus. The United Kingdom (UK) officially left the European Union (EU) at the end of January without incident, and at its January meeting the Federal Reserve, as expected, left its benchmark policy rate unchanged (targeting a range of 1.50% to 1.75%) and affirmed its rate policy outlook as on hold for the time being. Until the coronavirus outbreak, the economic and market sentiment was largely carrying forward the positive momentum from 2019. The coronavirus, however, quickly established itself as a geopolitical risk because of the unknown effects it may have on Asian and global commerce. Global health concerns about the spread of the coronavirus are understandable. At this point, our view is that in the near term decreased global economic activity, particularly in East Asia, will be reflected in quarterly GDP figures; however, based on prior outbreaks of infectious diseases, we believe that the coronavirus by itself is unlikely to derail economic growth fueled by a smooth Brexit transition, de-escalation in global trade friction especially between the U.S. and China, and supportive global central banks, including the Fed.

Performance

Core bonds gained in January, while worries about the coronavirus weighed on stock indices (see table below).

After a strong start to the month, the S&P 500 fell back to post a negligible loss of 0.04% in January. The Russell Mid Cap Index retreated 0.80%, and the Russell 2000 Index of small companies dropped 3.21%. The MSCI ACWI Ex-USA Index, a measure of all stocks outside the U.S., lost 2.69%, and emerging market stocks were worst-hit by the coronavirus scare given its origins in China. The MSCI Emerging Market Index slid 4.66% in January.

The Bloomberg Barclays U.S. Aggregate Bond Index climbed 1.92% in January as many investors joined the flight to safety. The Barclays Municipal Bond Index was also up sharply by 1.80%. U.S. Dollar strength helped USD-denominated emerging market bonds last month, which rose 1.52%, as reflected in the JPMorgan EMBI Global Diversified Index. The local currency EM bond index, the JPMorgan GBI EM Global Diversified Index, however, fell 1.29%. A 50/50 blend of the two EM bond indices has eked out a slightly positive return of 0.11% in 2020 through January.

Outlook

Our view remains that the global economy will continue to grow, boosted by easier monetary policy, less political risk in Europe, and decreased trade tensions between the U.S. and China. However, we continue to think that as 2020 unfolds various geopolitical risks, some known and others surprising (like the coronavirus), have the potential to disrupt general stability to varying extents. At present, the question on everyone’s mind is to what extent the coronavirus surprise will disrupt the generally optimistic stance with which we started the year.

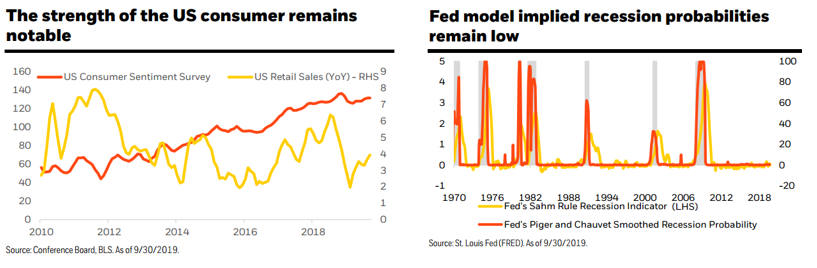

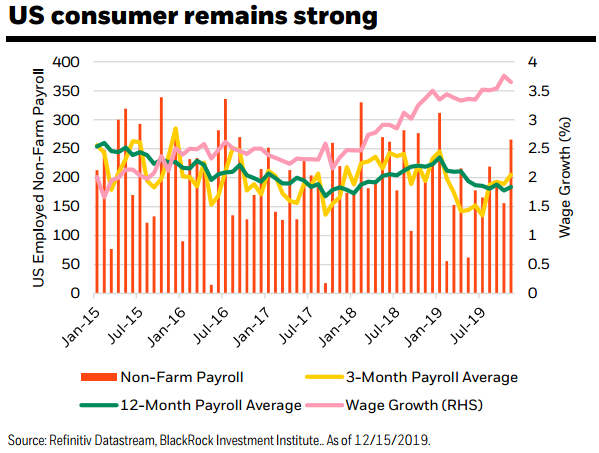

Currently, we believe that the U.S. economy remains fundamentally sound and will likely stay on positive footing. Consumer sentiment is strong, and recession risk is low (see graphics below).

The global economy entering the year was, we believe, poised to improve. Based on the history of prior infectious disease outbreaks, we still see that as likely, although we also think that there will be visible near-term economic drag.

News and fear about the coronavirus spread faster than the virus itself over the last two weeks, and acknowledgment by the Chinese government that confirmed infections are growing (although now at a slower pace than earlier in January) has created unease in global health and financial communities. The high travel season related to the recent Chinese lunar new year and the lengthy incubation period before symptoms manifest themselves have made this new outbreak difficult to contain. Global stock indices have traded down from their January highs since the outbreak became known.

Such stock market pullbacks have accompanied other health outbreaks in the past, such as swine flu (H1N1) in 2009, SARS, avian flu, and Ebola. Although there can be short-term worry (and understandably so from a health perspective), over time, the effect on stock markets tends to be more noise than substance. In the short term, though, places closer to the source, such as in Asia, might experience more volatility. The table below lists health outbreaks and identifies the 6- and 12-month percentage (%) change in the S&P 500 index from the start of the health outbreak. As you can see, only the 12-month change in the S&P 500 that overlapped with the HIV/AIDS onset in 1981 was significant, and even then it is questionable whether it was the health epidemic that triggered the equity market correction or, perhaps more impactful, other inflation and economic factors (such as Fed Chairman Paul Volcker’s raising interest rates to the nose-bleed 20% level in June 1981).

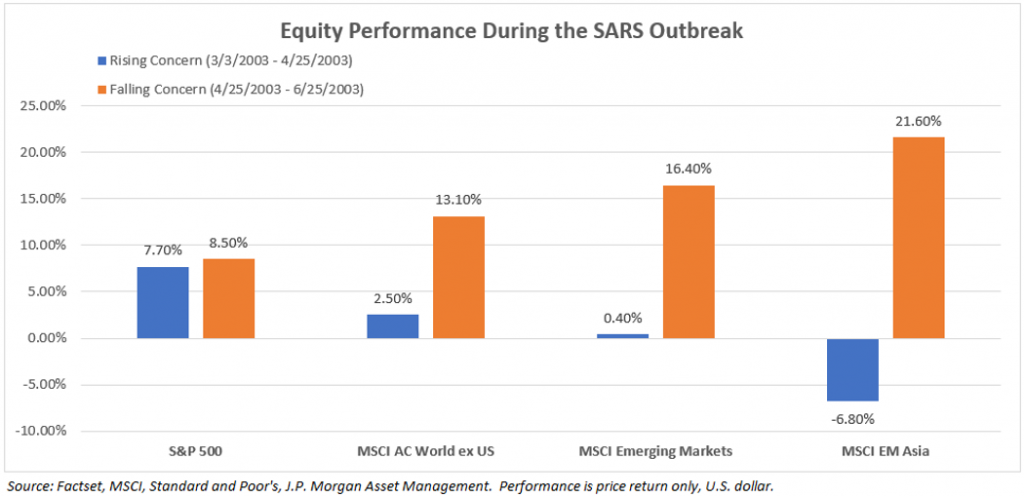

The fact that 6 and 12 months later the U.S. stock market has tended not to evidence material impairment from health emergencies does not mean that there will not be some nearer-term volatility and declines or that secondary effects from the health scare will not detract from economic growth. For instance, the graph below shows different global equity market responses to the SARS outbreak in 2003, when concern was both rising and falling. Foreign stocks in general, and EM and EM Asian equities in particular, all showed greater disparities in returns during both rising and falling concern periods than the U.S. stock market did. However, those foreign stock markets also bounced back much more sharply than the S&P 500 did when worries subsided. Although we cannot guarantee that such a pattern will repeat this time, we believe that it is likely that something similar will occur, consistent with the larger point that longer periods smooth out the near-term investment noise.

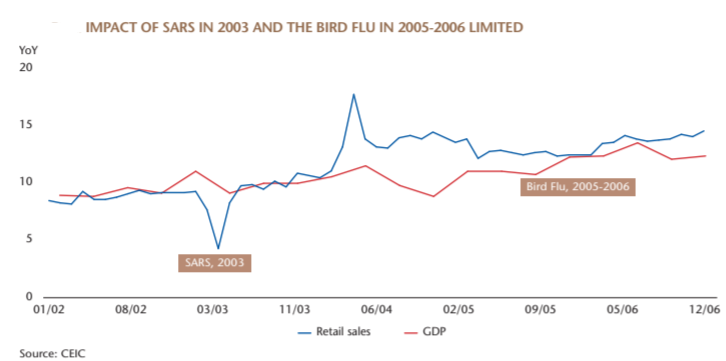

Economically, the GDP and retail sales effects in China from the SARS and avian flu incidents were limited and temporary, as you can see from the graphic below.

The regionally specialized investment firm Matthews Asia studied the 2002/03 SARS outbreak and the 2005/06 bird flu epidemic. Some of its findings are shown in the graph above. Matthews found that “while there was significant short-term economic impact, that impact faded quickly. … During SARS, nominal retail sales growth slowed from 9.2% YoY in 1Q03 to 4.3% in May but rebounded to 8.3% in June and was 9.8% in July and August. For the full year 2003, nominal retail sales were up 9.1% vs 8.8% in 2002. … GDP growth slowed from 11.1% YoY in 1Q03 to 9.1% in 2Q03 but rebounded to 10% in 3Q03. For the full year, GDP was up 10% vs 9.1% in 2002.” Based on prior health emergencies, the economic effect over the full year of 2020 may be modest if the coronavirus is contained in roughly the same timeframe as was SARS.

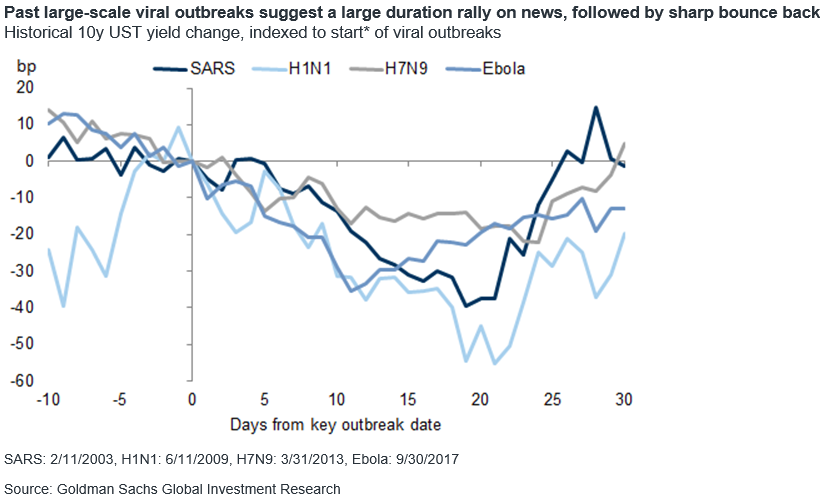

More encouragement regarding the outbreak comes from the investment side via an examination of U.S. Treasury yields during prior incidents. U.S. government bond yields fall when demand is high, often in flight-to-quality situations prompted by investor unease. The 10-year Treasury closed 2019 at 1.92%, but it began to fall sharply in the second half of January when the coronavirus scare spread, closing January at 1.51%. Put differently, bond yields declined/prices rose as stock prices fell. In previous such situations, bond yields fell (and prices gained) for a few weeks after the initial outbreak, but then bond yields rose again, sharply recovering lost ground.

What happened in the past in conjunction with health scares is not guaranteed to happen this time with the coronavirus; however, we believe that the consistency in bond yield behavior across prior health crises is instructive and encouraging.

Other geopolitical factors have had a benign effect on the global economy and financial markets this year so far. First, the UK’s exit from the EU at the end of January occurred smoothly. It is important to realize, though, that Brexit is a process, not an event. This means that the UK and EU now enter into an 11-month status-quo transition process of negotiations to iron out their divorced status post-withdrawal, especially around trade. This transition stage is perhaps analogous to a married couple that legally separates prior to finalizing a legal divorce. So, Brexit is in many ways at a new beginning, not at an end.

Second, the U.S. presidential primary season has started in earnest now that the Iowa caucuses have occurred. History suggests that the person or represented party who has occupied the White House has had little effect on stock market performance. Still, like prior global health emergencies, there have been pockets of short-term worry and volatility as investors speculate about more dire effects of potential policy implementation. We encourage clients to take an active interest in civil government, but we also advise against superimposing desired or frustrated election results with expected stock market performance.

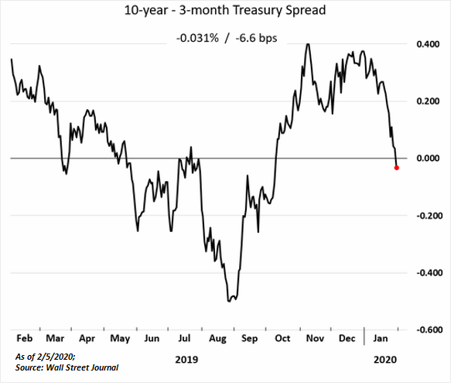

Third, the yield curve, as measured by the U.S. 10-year minus 3-month Treasury, has again inverted slightly because of increased demand for safe-haven, long-term U.S. government bonds in light of concerns about the coronavirus. As of the end of January, for instance, the 10-year Treasury Note yielded 1.51%, or 0.04 percentage points less than the 3-month Treasury Bill. At present, we do not believe that this re-inversion is by itself cause for alarm. Instead, we view it as a function of the well-documented decline in yields, discussed above, that typically occurs when a global health emergency is declared, only this time the spread between the different maturity bonds was narrower than it has been in the past.

Further, although yield curve inversions are frequently cited as predictors of economic recession, we do not anticipate an imminent recession in the U.S., and we observe generally solid economic data in recent reports. A case in point is not only the strong position of the U.S. consumer (mentioned above), but also gains in wage growth, which are represented in the nearby chart by the generally upward trajectory of the pink line at the top.

Fourth, in the first days of February, China has apparently begun to consider incremental fiscal and monetary options to help offset the economic and market effects of the coronavirus. With the Phase One trade deal now inked between the U.S. and China, officials in Beijing remain focused on how to secure economic stability for the country. Although no new stimulus measures have been officially announced at the time of writing, we view reports of China’s willingness to ease financial conditions and promote business and retail spending as positive. Further Chinese stimulus is something that we have cited in the past as a potential tailwind for global growth in the coming years.

Conclusion

The U.S. economy remains solid, despite understandable worries about the potential implications of the coronavirus. In Sage’s view, the global economy remains on track to continue to grow, albeit with some potential short-term bumps. The U.S. yield curve has again inverted, as measured by the 10-year minus 3-month Treasury yield spread, but we view this as a market movement consistent with what has transpired in bond yields during prior global health emergencies. Judging from similar events, moreover, there may be moderate and temporary economic and stock market effects, particularly in Asia, stemming from the coronavirus outbreak; however, in the longer-term (i.e., over a full 12-months or more) these disruptions typically correct, and in retrospect, they can be viewed as near-term noise. The past may not repeat itself this time with the coronavirus, but we believe that it will likely rhyme.

Recent Posts From Sage Financial Group

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please visit Accolades page or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.