As March closed out the first quarter of 2025, markets were responding to mixed signals. U.S. corporate earnings reports remained favorable, and broad economic data held steady. Yet, the fluidity of changing U.S. trade policy introduced uncertainty at home and abroad.

In this edition of Insights, we examine three key areas that we believe are particularly relevant for investors: the potential ripple effects of evolving tariffs and trade policies, shifting investor trends (particularly the rotation away from U.S. mega-cap stocks), and the historical relationship between consumer confidence and forward-looking stock market returns.

As always, our focus remains on keeping you well-informed and managing our clients’ investment portfolios through changing markets with a diversified investment approach that spans multiple asset classes, geographies, and strategies.

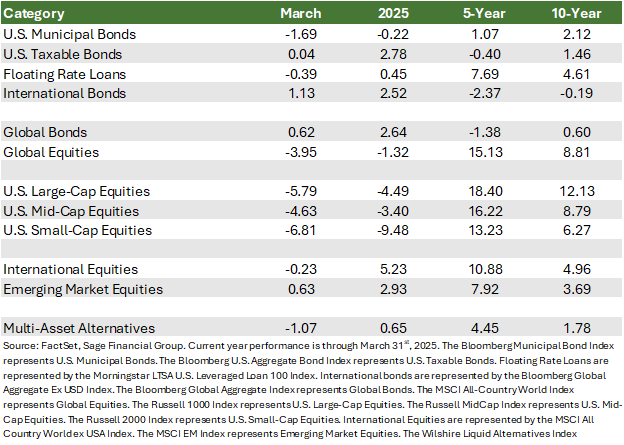

Market Performance: Portfolio Support from Abroad

Diversification proved valuable during the first three months of the year. While U.S. stocks lagged, gains in bonds, alternatives, and international equities provided meaningful balance.

Global Fixed Income returned a favorable 0.62% in March, supported by elevated income across major markets and divergent central bank policies.

- U.S. Taxable Bonds: Investment-grade fixed income returned a slightly positive 0.04%. Mixed economic data lowered long-term yields, raising bond prices alongside concerns of slowing economic growth.

- U.S. Tax-Exempt Bonds: Declined by a larger-than-usual margin in March. The 1.69% negative return was driven by speculation about potential adjustments to municipal bond tax exemption in the next tax bill. We believe this modification is unlikely and not widely supported in Congress among both parties, thus likely rendering this volatility temporary.

- Floating Rate Loans: Experienced a 39% decline, with lower economic growth forecasts contributing to the first monthly decline since October 2023. Despite this, we continue to favor these assets, which offer yields of nearly 8% in an environment where short-term rates are expected to remain elevated for longer.[1]

- International Bonds: Climbed 13% in March, with most central banks outside of the U.S. remaining on pause or cutting interest rates. A key tailwind for non-U.S. bonds has been a weakening of the U.S. dollar by nearly 4% in 2025.

Global equities declined by 3.95% overall, with a sharp divergence. For a second straight month, U.S. stocks fell and underperformed international stocks. A catalyst for this recent trend has been investors no longer chasing U.S. equities amid concerns about the negative impact caused by trade tensions.

- U.S. Large-Cap Equities: Dropped by 5.79%, with the asset class falling by 10% intra-month for the year before regaining some of the lost ground. Uncertainty caused by economic policies weighed on investor sentiment.

- U.S. Mid- and Small-Cap Equities: Fell 4.63% and 6.81%, respectively, in March. Smaller companies have faced increasing challenges in 2025 because of their sensitivity to interest rates and the economic cycle.

- International Equities: Remained more stable for investors, with international large-cap stocks declining slightly by 0.23%. A key driver of performance was Germany’s approval of a historic fiscal package aimed at restoring economic growth in Europe. Emerging market equities delivered a favorable return of 0.63%, with Indian equities providing a tailwind to performance due to improved sentiment in the country.

Tariffs Remain a Central Concern

As we noted last month, tariffs continue to dominate the daily news cycle, heightening uncertainty for investors regarding the potential impact of these new trade policies on economic growth and inflation.

Tomorrow, April 2nd, is expected to be a significant date in the development of U.S. trade policy, following an early February order to review global trade relationships.

Here is a brief summary of what has already occurred and what is expected in the coming days and months ahead:

- February: An executive order imposed a 10% tariff on all imports from China. This was in addition to the existing rate.

- March: 25% tariffs were placed on all goods from Mexico and Canada (except for Canadian energy, whose tariff remained at 10%). A separate executive order signed days later applied a 25% tariff on all steel and aluminum products.

- April (anticipated): More targeted tariffs are expected on imports from 15 countries with large trade imbalances, along with additional tariffs on goods from Canada, Mexico, and possibly the European Union. Further considerations include cars, agricultural products, semiconductors, and pharmaceuticals produced outside the United States.

While these moves aim to rebalance global trade, markets remain unsure whether this response represents a negotiation tactic or a longer-term shift. The effect on profits and consumer behavior will depend largely on the size, scope, and duration of these policies.

From a risk standpoint, higher import costs could weigh on U.S. corporate earnings if companies are unable to pass through costs to consumers. However, the resulting higher prices could cause a slowdown in consumer and business spending, which could lead to a softer labor market and weaker earnings.

If global growth slows meaningfully, high-quality fixed income can offer a stabilizer within appropriate portfolios. In addition, if inflation risk re-emerges, asset classes like infrastructure, real estate, and floating-rate loans can help hedge against the risk of sustained price pressures.

Investor Trends Shifting Abroad

For much of the past two years, a handful of mega-cap U.S. technology companies known as the “Magnificent 7” led market gains. But in 2025, that leadership is being tested.

So far this year, several of these companies have underperformed, with challenges including:

- Lower sentiment around artificial intelligence (AI),

- Higher interest rates, which reduce the value of future profits, and

- A shift in investor sentiment.

For example, some hedge funds are trimming exposure to companies like Amazon, Alphabet, Nvidia, and Tesla to protect against waning enthusiasm for AI. This has contributed to a more than 15% decline in the Magnificent 7 year-to-date and reduced overall U.S. large-cap returns by almost 4% in the first quarter.

In fact, an equal-weight index of U.S. large-cap stocks only declined 1.6% in Q1, outperforming the market-cap-weighted Russell 1000’s nearly 5% decline.

In our view, less enthusiasm for a small group of U.S. stocks creates opportunities for previously out-of-favor pockets of the market, including international stocks, which have been overlooked for much of the past decade. Europe is benefiting from new fiscal stimulus, while China has signaled pro-growth intentions alongside artificial intelligence breakthroughs.

Taken together, we expect earnings growth outside the U.S. to strengthen and global diversification to remain a compelling opportunity.

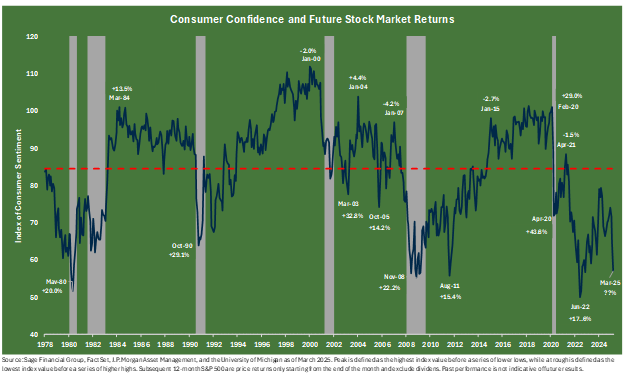

Consumer Confidence and the Stock Market

In March, the Michigan Consumer Sentiment Index reached its lowest level in nearly three years, largely due to concerns about trade policy and economic uncertainty.

Historically, periods of negative consumer sentiment have served as an attractive starting point for future equity returns. Since 1980:

- When consumer confidence is low, the average subsequent 12-month return of the S&P 500 after reaching a trough in sentiment has been 24.4%.

- During periods of peak confidence, the average 12-month return drops to just 5.3%.

While we do not know precisely when the low point will occur, the current reading is well below average. If past cycles are a guide, today’s weaker consumer confidence could set the stage for stronger economic activity and asset prices ahead.

Closing Thoughts

We diligently monitor financial markets, maintaining a balanced outlook that acknowledges risks while remaining prepared for a wide variety of outcomes. This approach enables us to make informed decisions and align with prudent investment strategies in the face of fluctuating conditions.

In the short term, markets will likely remain reactive to headlines, data releases, and policy announcements. But over time, returns are driven by fundamentals: population growth, innovation, and productivity.

Considering this, we encourage you to keep the recent volatility in perspective. Volatility tied to headlines may be unsettling, but a balanced, disciplined approach—anchored in broad diversification across asset classes and geographies—has guided investors through countless cycles. That remains our strategy today.

As always, we are here to help you navigate these markets with confidence.

Footnotes

[1] Yield to Maturity of the Morningstar LSTA US Leveraged Loan 100 Index.

Previous Posts

- Sage Insights: Market Observations for February

- Sage Insights: Navigating Markets in the New Year

- Sage 2024 Performance Review and 2025 Investment Outlook: Positioning for Opportunity in a Changing Landscape

- Sage Insights: Navigating Markets After the Election

- Our Perspective: On the 2024 U.S. Elections

-

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’s written disclosure statement discussing our advisory services and fees is available for review upon request.