November was a busy month, marked by the U.S. election and another rate cut from the Federal Reserve. In this edition of Insights, we’ll discuss how these events influenced market dynamics, shaping expectations for trade policy, economic growth, and cryptocurrency trends. As we look toward year-end and beyond, our focus remains on effective portfolio management amidst a dynamic landscape.

Market Performance: A Strong Finish to November

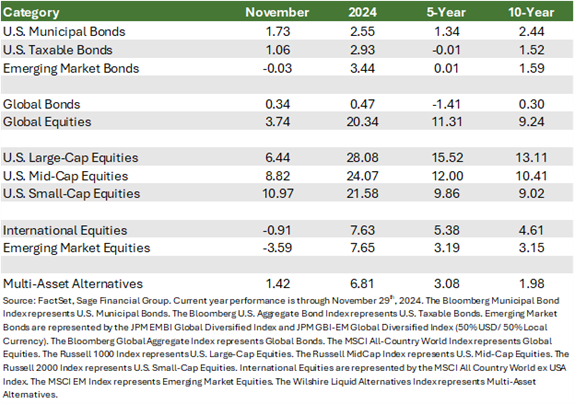

Markets delivered a mixed but largely favorable performance in November. U.S. equities rallied strongly, supported by expectations for more business-friendly policies, such as the absence of corporate tax increases and possible deregulation. At the same time, the U.S. bond market benefited as the uncertainty about the incoming administration’s fiscal agenda faded. Overseas, both equity and bond markets faced challenges, particularly from a strong U.S. dollar.

Global Fixed Income gained 0.34%, reflecting a continuation of synchronized central bank policy easing.

- U.S. Taxable Bonds: Investment-grade fixed income rose 1.06%. Despite volatile interest rates on longer-term U.S. Treasuries, rates moved lower toward the end of the month, boosting bond prices.

- U.S. Tax-Exempt Bonds: Appreciated by 1.73%, primarily due to investor demand for tax-advantaged, defensive municipal bonds.

- Emerging Markets Bonds: Declined by 0.13% under the weight of a stronger U.S. dollar and elevated geopolitical tensions.

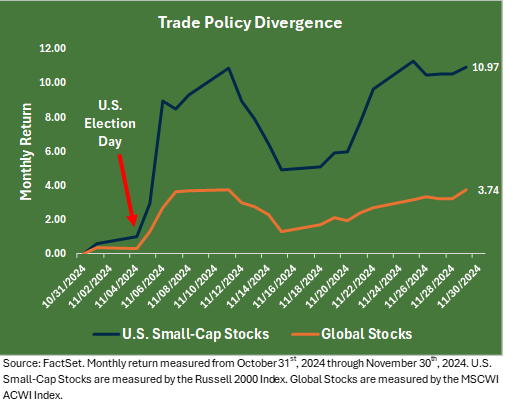

Global equities climbed 3.74%, with U.S. stocks leading the charge and offsetting negative returns from abroad. U.S. small-cap stocks posted their strongest month of the year and third-strongest monthly return since 2020.

- U.S. Large-Cap Equities: Rose 6.44% in November, with the index receiving strong support from Nvidia, the world’s largest company, as measured by market cap. It posted a strong quarterly report that further fueled investor excitement around artificial intelligence.

- U.S. Mid- and Small-Cap Equities: Mid-caps surged by 8.82%, and small-caps posted an impressive 10.97% gain. Optimism surrounding the U.S. election outcome fueled the rally, as investors anticipate that trade and tax policies could significantly boost corporate profitability, particularly for smaller, domestically focused companies.

- International Equities: Global markets faced headwinds in November, particularly in the aftermath of the U.S. election. International large-cap stocks, as measured by the most widely referenced index, fell 0.91%, while emerging market equities declined 3.59%. The strength of the U.S. dollar, coupled with concerns over potential trade policy changes, including tariffs, from the incoming U.S. administration, weighed on non-U.S. markets. These countries, particularly China, remain vulnerable to the broader range of trade measures that could be implemented.

Trade Policy and Tariffs: A Pivotal Shift in Focus

The 2024 U.S. election has reignited discussions on U.S. trade policy. Recent history reminds us of the economic implications of tariffs, such as the “Section 301 Tariffs” against China in 2018, which affected the development of technology, manufacturing, and consumer goods. These tariffs contributed to increased costs and supply chain disruptions of imported goods. At the same time, they contributed to a decline in stock prices, particularly for companies with significant exposure to China, and reduced investor sentiment.

President-elect Trump’s tariff rhetoric has been omnipresent since his election. Depending on negotiations, it remains to be seen if the incoming administration’s trade policy will be gradual or more aggressive than similar measures taken during President-elect Trump’s first term.

From a market perspective, U.S. small-cap stocks could benefit from policies that prioritize domestic production and competitiveness. These stocks have already shown positive momentum, with a double-digit rally in November. At Sage, we recognized this opportunity early in 2023, positioning portfolios, where applicable, to capture the growth potential of small-caps by increasing clients’ allocation to a more attractively valued asset class that we believed had strong return potential.

We continue to believe that small-cap stocks offer investment portfolios differentiated, complementary exposure alongside large-cap stocks. However, we also recognize that the potential long-term impact of tariffs on the global economy and trade relations requires a balanced view. While gradual tariffs may support domestic industries, more aggressive measures could elevate inflation, potentially impacting the broader economy.

A higher inflationary environment would create headwinds for long-term bonds, an area in which we have proactively minimized exposure in portfolios. Conversely, we recommend that clients who allocate to U.S. equities maintain an overweight toward U.S. companies with pricing power to pass through higher costs.

Economic Growth: Resilient but Balanced Optimism

Despite recession predictions, the U.S. economy remains robust, buoyed by a strong labor market and rising real incomes.

Consumer health continues to support growth, and the absence of corporate tax increases provides additional stability. That said, trade policies and their potential inflationary effects warrant close monitoring. Gradual adjustments could mirror the measured growth of the 2018-2019 period, but more broad-based tariffs have the potential to elevate inflation further above the 2% target and harm consumers.

For now, we believe the economic backdrop continues to support asset classes such as equities, infrastructure, and quality higher-yielding credit. We maintain a balanced approach across geographies and asset classes, seeking to ensure that portfolios are prepared for a range of economic scenarios.

Bitcoin: Speculative Surge Amid Optimism

Bitcoin neared a record $100,000 in November, driven by several factors:

- ETF Adoption: Increased accessibility to a wider investor base.

- Potential Rate Cuts: Lower interest rates could stimulate risk appetite.

- Favorable Regulatory Environment: Reduced regulatory uncertainty driven by a more crypto currency-friendly administration.

President-elect Trump’s campaign rhetoric often expressed pro-crypto sentiments and a desire to position the U.S. as a global leader in digital assets, which added to investor enthusiasm. This excitement from retail investors, double-levered ETFs, and a publicly-traded company[1] issuing equity to buy Bitcoin has pushed speculation of the asset higher.

While these developments are noteworthy, given the early stage of crypto’s evolution and high risk, we maintain a cautious stance on the suitability of Bitcoin and other crypto assets for most clients. The asset class’s high volatility—highlighted by its 75% drawdown in 2022—underscores its speculative nature. These assets are subject to less regulation and less investor protection relative to equities, options, and other markets.

Implications for Investment Portfolios

As we close the year, fiscal and trade policies will continue shaping market trends and their impact on economic growth. Here are the asset classes that we believe are most attractive, subject to potential unexpected domestic and world events that could impact performance in a positive or negative direction:

- Equities: U.S. small- and mid-cap stocks remain attractive, particularly in sectors aligned with domestic trade and deregulation.

- Fixed Income: Higher current yields than in recent history offer compelling opportunities for investors to generate attractive income, with shorter-duration strategies and corporate bonds and loans as key considerations.

- Alternatives: Deregulation and more rate certainty should support alternative asset classes like real estate and private equity. In terms of the recent performance of cryptocurrency, while Bitcoin’s recent spike higher is captivating, we advise caution, given its speculative nature and limited regulatory safeguards.

Closing Thoughts

In our view, the economic outlook remains reservedly positive as the incoming administration’s policies, especially those related to trade and immigration, come into greater focus. While near-term economic projections suggest continued strength, unexpected developments could shift market sentiment.

We encourage you to remain disciplined and adhere to your specific investment plan.

As always, we are here to guide you through these dynamics, keeping your financial goals at the forefront.

Footnotes

[1] https://www.bloomberg.com/news/articles/2024-11-25/microstrategy-purchases-another-5-4-billion-in-bitcoin

Previous Posts

-

-

- Our Perspective: On the 2024 U.S. Elections

- Sage Insights: Market Resilience Amidst Volatility

- Sage Insights: Market Movements and Perspective — Analyzing the Past Month and The Road Ahead

- Sage Insights: Observations at Halftime

-

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’s written disclosure statement discussing our advisory services and fees is available for review upon request.