With the results of the U.S. presidential election announced and the congressional elections coming into more precise focus, we wanted to share our perspective on what these outcomes could mean for markets and your investment portfolio.

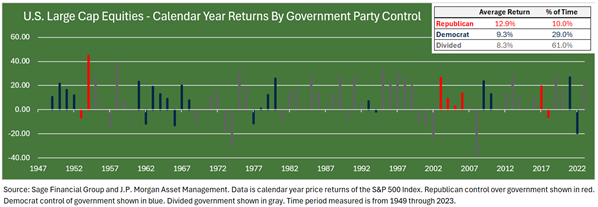

Upfront, it is important to state that historically, equity markets have delivered positive returns on average, regardless of the party or individual in control, and investment portfolios with broad-based exposure to U.S. large-cap equity markets have performed well under every government combination (see chart below). Thus, we advise investors not to focus on political composition when making investment decisions.

While election results may create temporary volatility and generate headlines and uncertainty ahead of potential policy shifts, they are not the primary force behind sustainable market returns. Instead, we encourage you to focus on the key drivers of market performance: economic fundamentals and company earnings.

What Happened?

As of early this morning, Donald Trump has been elected as the 47th President of the United States. The Associated Press reported that he surpassed the 270 Electoral College votes needed. Additionally, the Republican party has won a majority in the Senate after picking up seats in the states of West Virginia, Montana, and Ohio, with several races still to be called. At this time, control of the House of Representatives remains too close to call between the parties, with several congressional districts still tallying votes.

For investors, the policy areas we’re particularly focused on include potential adjustments to tax codes, trade agreements, immigration policies, and regulation. While tax cuts and deregulation could stimulate growth, other policies, such as tariffs and immigration restrictions, might counterbalance these effects. Importantly, not all campaign promises become policy, and markets will adjust as policies are clarified in the coming months.

Market Reaction

Today, U.S. large-cap stocks rose 2.5%, and U.S. small-cap stocks surged 5.8%, with an uptick in Treasury yields across the curve, reflecting an initial positive response to potential growth-focused policies like easing of M&A regulation and corporate tax cuts. Markets in Asia and Europe showed mixed reactions, largely in response to concerns over trade and currency impacts.

We expect volatility to persist in the short term as markets adjust to the new political landscape. However, this type of post-election fluctuation tends to be temporary, and we recommend that clients focus on their holistic investment strategy and financial goals.

Economic Policy Outlook

President-elect Trump’s campaign focused on tax cuts, immigration reform, and trade adjustments. While a unified government may increase the likelihood of certain policy enactments, the impact on the economy and markets will depend on the final congressional composition.

In particular:

- Corporate Taxes: Trump has indicated a desire to maintain the corporate tax rate at 21% with possible cuts to 15% for domestic manufacturing and make several of the provisions in the 2017 Tax Cuts and Jobs Act (TCJA) permanent. This could benefit U.S.-focused small to mid-sized companies by increasing after-tax earnings.

- Trade and Tariffs: Proposed tariffs on imports may impact company profit margins and/or raise consumer costs in the near term while encouraging domestic production over time. Higher tariffs on imported goods may create inflationary pressures that could lead to volatile interest rates.

- Immigration: Stricter immigration policies, if enacted, may result in higher labor costs, in particular impacting those industries reliant on lower-wage labor.

- Regulation: Policies favoring traditional energy sources and infrastructure improvements could provide opportunities for investment, largely through private funding rather than direct government spending.

- More favorable M&A environment: Less regulation of mergers & acquisitions and capital requirements may lead to an uptick in transactions, benefiting cyclical asset classes like U.S. large and small cap stocks, private equity, and real estate.

Our Perspective

We encourage our clients to avoid making immediate changes based on political developments. While markets may see significant movement in the coming days, these short-term adjustments rarely impact long-term performance. Historically, equity markets have performed well regardless of which party is in office, and we see staying invested as the most prudent approach.

Our strategy remains centered on long-term fundamentals rather than short-term political shifts. It is our view that a disciplined, diversified, and sensible approach provides the best opportunity to achieve your long-term objectives. As the market and policies evolve, we will continue to periodically adjust our mix of investments as appropriate with the objective of structuring a portfolio positioned to reach our clients’ return goals.