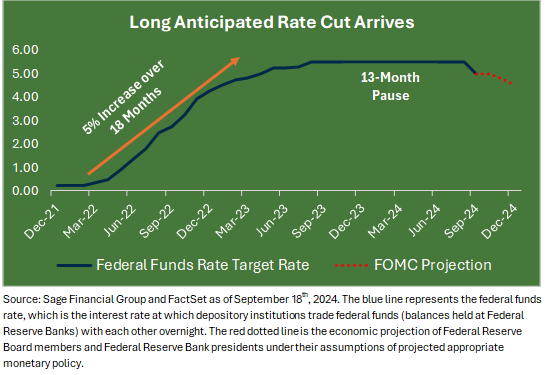

September was a much-awaited month for investors as the Federal Open Market Committee (FOMC) made its highly anticipated decision to cut interest rates for the first time in over four years. The move, which followed unprecedented rate hikes in 2022 and 2023 designed to curb inflation, marks a key shift in U.S. monetary policy.

As investors, you are likely wondering how this decision will impact your portfolio and the broader investment landscape. In this edition of Insights, we break down the key market developments, explain their significance, and highlight our strategy to help you navigate these evolving conditions.

As always, we remain committed to offering insights that help you achieve your financial goals.

Market Overview

After a brief post-Labor Day decline, September ultimately delivered strong equity returns. The month started with some unease as labor market data showed weaker job creation, and worries abounded about the labor market’s health. However, the Fed’s decision to cut interest rates by 0.50% on September 18th alleviated fears, and equity markets ended the month on a high note. The Fed’s action was seen as a clear signal of its commitment to supporting economic growth amidst easing inflation.

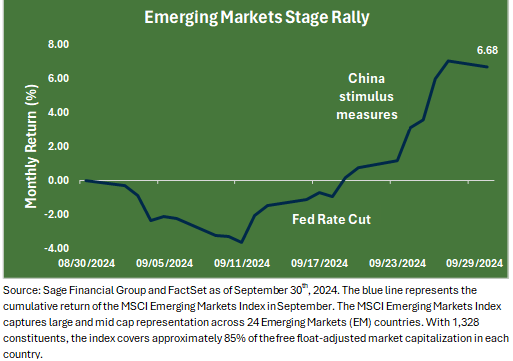

In global markets, lower rates boosted both equities and bonds. The U.S. dollar weakened following the Fed’s decision, which benefited international markets. China’s domestic stimulus measures added fuel to an emerging market rally.

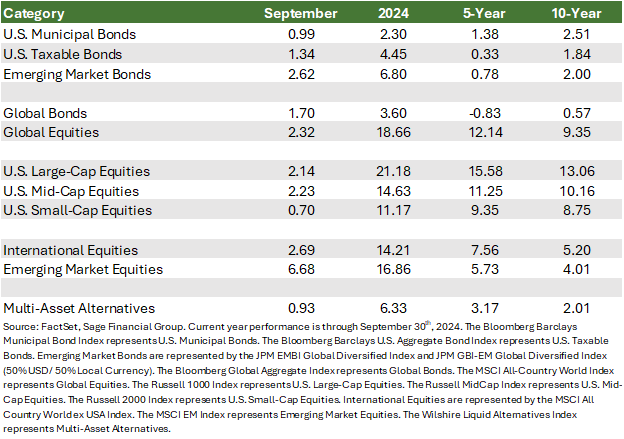

Market Performance in September

Global fixed-income returns rose 1.70% in September, driven by synchronized rate cuts from major central banks worldwide, with Japan as a notable exception.

- U.S. Taxable Bonds: Yields continued to fall, boosting investment-grade fixed income by 1.34%.

- U.S. Tax-Exempt Bonds returned 0.99% in September. Despite lower yields, this asset class continues to attract buyers.

- Emerging Market Bonds: A notable performer in September, with gains of 2.62%, bolstered by the weaker U.S. dollar following the outsized 0.50% rate cut in the U.S.

Global equities rose 2.32%, with international developed market equities modestly underperforming their U.S. counterparts. Emerging market equities rallied in September on the announcement of policy support measures from the Chinese government.

- U.S. Large-Cap Equities: The asset class continued to build on strong 2024 performance, delivering a 2.14% return in September. The concentration of returns among the top stocks in the index was a major contributor, with all “Magnificent 7” stocks except Apple posting gains for the month.

- U.S. Mid- and Small-Cap Equities: These stocks had mixed but positive results in September. Mid-caps rose by 2.23%, while small caps gained a smaller 0.70%. Although the Fed’s rate cut initially boosted smaller companies, signaling the potential for an economic soft landing, small-cap returns were less pronounced than in prior months.

- International Equities: As measured by the most widely referenced index, these stocks outperformed U.S. equities with a solid 2.69% gain in September. Emerging market stocks led the way, rising 6.68%. At the end of the month, China’s central bank and regulators announced new stimulus measures, spurring the best week for Chinese equities since 2008.

What Drove the Markets in September?

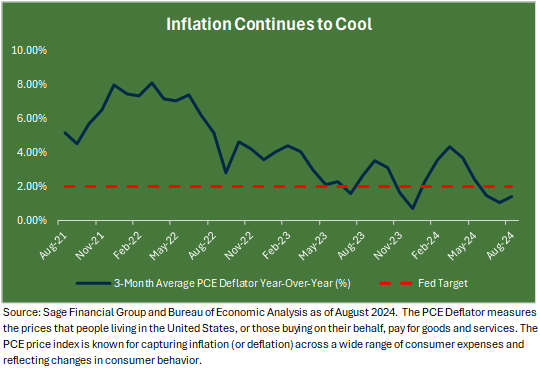

The primary driver of September’s market movement was the Federal Reserve’s decision to cut interest rates by 0.50%. This followed unprecedented rate hikes in 2022 and 2023, during which time the Fed raised policy rates by 5.00% to control the pace of inflation in the U.S.

It took Fed officials thirteen additional months to gain sustained confidence around the path of inflation, and rates hovered between 5.25% and 5.50% from July 2023 through September 2024. However, the September 18th decision to cut rates was nearly unanimous.

Fed Chairman Jerome Powell made it clear during his post-meeting press conference that the decision to lower rates was designed to sustain growth in the face of falling inflation.

The Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) index, has remained below the Fed’s target for three consecutive months, signaling that inflationary pressures are easing.

With inflation concerns moving to the background, the focus has shifted to the health of the labor market. The Fed expects that lower rates will support economic growth while ensuring stable employment levels.

This rate cut widely supported equity and bond markets, and additional rate cuts are anticipated in November and December. Markets like certainty, which the beginning of rate cuts provides.

The base case outlook for the U.S. economy continues to suggest a “soft landing”—growth without a significant rise in unemployment. To prepare for a wide variety of outcomes, including potential labor market weakness and re-acceleration of inflation, we maintain a diversified and balanced positioning across portfolios.

Central Bank Support is a Global Phenomenon

While much of the attention in September was on the U.S., central banks around the world have also been cutting rates. The U.K., Canada, Europe, and several South American countries have also lowered rates, helping boost fixed-income and equity markets globally.

In particular, emerging market fixed-income and equity assets rallied in September on the back of two key catalysts. First, the weakening U.S. dollar provided relief for countries with U.S. dollar-denominated debt, as well as for exporters. Second, China announced a series of stimulus measures, including rate cuts and stock buyback allowances, to stabilize its economy.

As the world’s second-largest economy and more than 25% of the emerging market index, China plays a critical role in global markets. The decision to lock down the economy a few years ago and the constantly evolving regulatory policy have provided meaningful headwinds to investors.

China’s policymakers have hinted that additional policy changes may occur towards the end of the year. The outcome of the U.S. Presidential election will likely play a more significant role in China’s decision about the timing of future economic and market stimulus.

We believe a strong Chinese economy benefits global markets, both directly and indirectly. For investors with exposure to China, this economic stimulus creates opportunities for capital growth. Indirectly, a healthy Chinese economy is a positive signal for companies outside of China that rely on Chinese consumers and businesses.

Implications of Falling Rates on Cash Yields

As recently as July, the yield on cash exceeded 5.25%, offering a compelling income option for investors looking for short-term stability. We recognize the appeal but are also aware of the reinvestment risk this created.

If the Fed continues to lower rates as fast as the market expects, cash yields could fall below 3.00% over the next year. In contrast, buying a portfolio of bonds with an average of five years until maturity mitigates this reinvestment risk in a falling rate environment. Our research has found that bond returns are correlated with current yield to maturity over five-year periods.

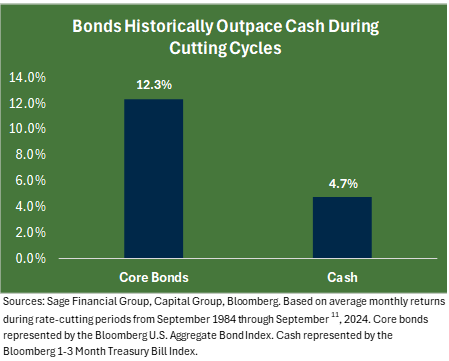

An analysis over the last forty years shows that core bonds deliver their strongest returns when the Fed is cutting rates. Specifically, core bonds have outperformed cash on average by more than 7.5% during periods of falling rates.

While it can be tempting to hold onto cash, we believe that high-quality bonds offer a better long-term opportunity. Bonds not only provide income but also have the potential for price appreciation as rates decline. In our view, it is not too late to make this shift and capture these opportunities.

Sage’s Investment Perspective

We believe equities remain an essential component of a well-balanced investment portfolio. While large-cap U.S. stocks have been the dominant performer over the past decade, we continue to see opportunities in smaller companies and international markets as areas with attractive valuations that may benefit from lower rates and stronger earnings growth.

Lower central bank policy rates are also likely to benefit alternative assets such as commercial real estate and private equity. We expect more certainty in interest rates to provide a positive backdrop for M&A activity.

High-quality, intermediate-term bonds may also offer attractive opportunities, especially as yields continue to decline globally. We believe combining these bonds with floating-rate loans provides a balanced approach, generating income while mitigating the risks associated with falling rates.

Lastly, our confidence in a diversified portfolio remains steadfast. We believe that by combining equities, fixed income, and alternative investments, investors can balance risk and return prudently and effectively navigate changing market conditions.

Closing Thoughts

September was a month of positive returns for financial markets, primarily driven by the Federal Reserve’s decision to cut interest rates. This move not only boosted equities and bonds but also had a ripple effect across global markets. Emerging economies benefited from a weaker U.S. dollar and domestic stimulus measures in China.

While economic conditions continue to evolve, we remain confident in our approach. By staying diversified and proactive, we aim to help our clients navigate these changes and achieve their financial objectives.

Previous Posts

Learn More About Sage

Disclosures

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks, or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events that will occur. These projections, market outlooks, or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, product, or any non-investment-related content referred to directly or indirectly in this newsletter will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer reflect current opinions or positions. All indexes are unmanaged, and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in managing an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Sage Financial Group’sGroup’st written disclosure statement discussing our advisory services and fees is available for review upon request.