The financial markets performed well in February, supported by continued fiscal stimulus, positive developments around COVID-19, and solid corporate earnings. The MSCI ACWI Index, which represents global equities (i.e., both U.S. and international stocks), advanced by 2.3%, the U.S. large-cap Russell 1000 Index rose 2.9%, the U.S. small-cap Russell 2000 Index increased by 6.2%, and the MSCI ACWI Ex-USA Index (international stocks) ticked up approximately 2.0%. Core U.S. bonds represented by the Bloomberg Barclays Aggregate U.S. Bond Index ended the month down by 1.4%, primarily due to modestly higher interest rates.

In this issue of Insights, we provide an update on the heightened focus on fiscal stimulus and rising interest rates, COVID-19 developments, and some final words on corporate earnings.

Fiscal Stimulus and Higher Interest Rates

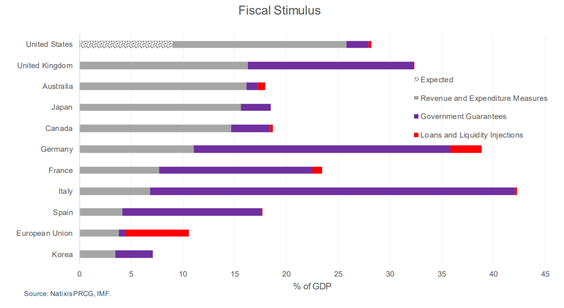

Fiscal stimulus negotiations remain ongoing in Washington, with attention to a “Rescue Package” estimated at approximately $1.5-2.0 trillion. Currently, the deal is expected to be passed through the reconciliation process, which only requires a simple majority (50%) for approval in both the House and Senate. The proposed package’s components include $1,400 direct payments to individuals beneath a certain income threshold, enhanced unemployment benefits of an additional $400 per week, more funds for vaccine distribution, and aid for state/local governments. After the package’s likely passage, we expect Congress to turn its attention to a “Recovery Bill” focused on infrastructure. As shown in the chart below, the U.S. fiscal response will exceed 25% of GDP with this new package.

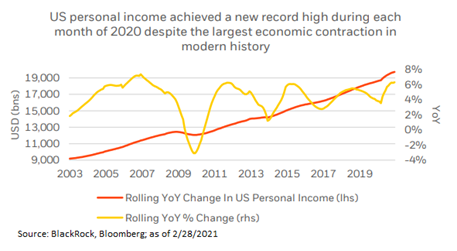

So far, fiscal stimulus has provided some support for U.S. consumers during a period of higher-than-average unemployment. As shown below, U.S. personal income continued to increase throughout 2020 despite a rise in unemployment. The divergence between employment and income was heightened by the direct payments to consumers, which also helped drive corporate earnings higher.

The financial markets recognize consumer spending as a primary driver of the economy and thus equity returns. From this perspective, the fact that fiscal stimulus has contributed to a healthy level of consumer spending is a good thing. It has helped boost corporate profits, reduce future foreclosures and evictions, and avoid further damage to the economy through layoffs. However, one side effect to the healthy level of spending has been an increased focus on government bond yields and the possibility of inflation. Large spending packages such as those we have seen in response to the pandemic trigger the question of whether more stimulus will lead to higher inflation.

In our view, inflation is a risk to markets but not a factor that we expect to materialize in a way that will adversely affect them in the near term. Expectations for higher growth and inflation have led to modestly higher interest rates, but on an absolute basis, interest rates remain at historically low levels. As shown in the chart below, the U.S. 10-year Treasury yield has risen in 2021, reaching a one-year high of 1.46% at the end of February. However, compared to just a few years ago, rates remain extremely low and are unlikely to be a threat to ongoing economic growth in the near term.

If the rate of inflation continues to rise, some asset prices, such as bonds, could be negatively affected. But the impact to equities will be somewhat offset by increased pricing power and the revenue growth being experienced by most corporations. In addition, we think there are structural boundaries in place that will contain broader inflation, including technology, manufacturing capacity, and higher than average unemployment. So while inflation could move higher than our expectations, our base case is that such a move would be transitory in nature. Overall, while February’s swift rise in rates has caused some gyrations in financial markets, it does not change our view that, over time, rates will rise in a gradual manner along with the recovery in our economic growth.

COVID-19 Developments

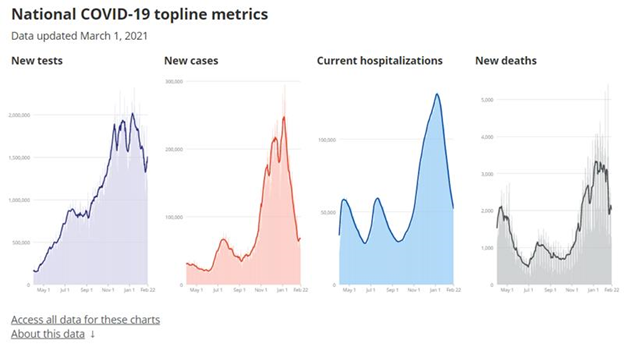

New daily case numbers of COVID continued to decline across the country last month, falling from over 291,000 in early January to approximately 50,000 on February 28th. Hospitalizations have also declined significantly so far this year, falling from an all-time high of 132,474 on January 6th to 47,352 on February 28th — a reduction of over 60%.[1] As the below chart demonstrates, new cases, hospitalizations, and new COVID-related deaths are all off from recent highs, although, sadly, the level of newly reported deaths remains elevated.

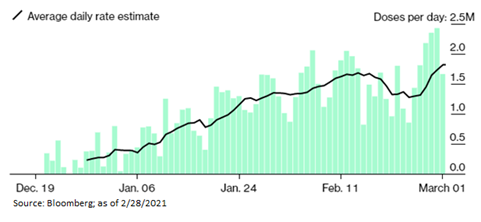

As we stated last month, we believe that these downward trends are attributable in part to the increasing number of Americans who have already had the virus or received the vaccine. As of the end of February, more than 75 million doses of vaccines had been administered, with over 15% of the U.S. population receiving at least one shot.[2] The pace of vaccine distribution has continued to trend upwards. As this graph indicates, while there was a slump due to winter weather, the U.S. is currently vaccinating approximately 1.8 million people per day:

At the end of February, the Johnson & Johnson (J&J) vaccine was approved, and 4 million shots were shipped immediately. The newly approved vaccine requires only one shot, compared to Moderna and Pfizer’s two-shot regimen, and Johnson & Johnson expects to deliver 100 million doses in March alone. Further, J&J has formed a partnership with Merck to produce as many vaccines as possible. This type of corporate cooperation reflects a collaborative approach to the fight against the virus. Public health officials currently estimate enough vaccines will be available in the U.S. for all adults by the end of May.

While the COVID statistics and vaccine developments are encouraging, risks do remain. New COVID variants have been identified in the U.K., South Africa, and Brazil, and most recently in the U.S. So far, existing vaccines are expected to provide sufficient protection, and the FDA recently approved an abbreviated approval process for booster shots aimed at new variants that would allow the medical response to be more flexible. [3]

Continued reopening throughout 2021 would likely result in a positive environment for most financial markets. While we believe a return to full lockdown is unlikely, investors should remain aware of that possibility and other unexpected events. The best positioning for investors, in our view, is broad diversification in their investment portfolios, alongside mental and emotional preparation for volatility.

Corporate Earnings

Earnings season wrapped up near the end of February as major U.S. companies finished compiling their Q4 2020 results. Corporate America had a strong end to the year, with 79% of companies reporting earnings that exceeded analysts’ expectations — well above the historical average rate of 61% of companies. In fact, it was the third-highest quarterly reading since FactSet started tracking the statistic in 2008.[4]

One of the biggest surprises was that the quarterly earnings of large-cap companies grew year-over-year, rising 3.9% compared to where they were in Q4 2019. Businesses and consumers remain remarkably resilient and, as we have seen throughout the pandemic, open to finding new ways to conduct business. The combination of adaptability, the boost provided by government stimulus, higher asset prices, and lower interest rates has helped consumer spending rebound.

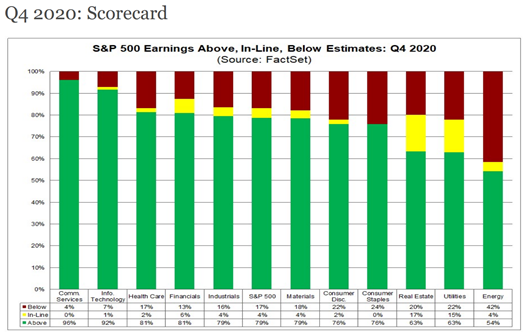

On the flip side, the strong growth in many areas pushed general expectations higher, making the earnings bar difficult for some stocks to hit. This “high bar” dynamic was an issue for many of the stay-at-home winners (e.g., Amazon, Home Depot, etc.), where concerns about the sustainability of earnings-per-share (EPS) growth have been exacerbated by the more recent improvement in coronavirus trends. Below is a chart of the best performing sectors compared to expectations. Perhaps unsurprisingly, technology and communication services are at the top.

These trends are encouraging, particularly with regard to the resiliency of businesses, at the same time we remain cautiously optimistic. From the financial markets’ perspective, equities have benefited from growing earnings, but that growth has been somewhat priced in after a strong 2020. Higher interest rates have benefited some sectors of the market recently, such as financials and energy but have hurt others, such as technology companies.

Closing Thoughts

The fiscal stimulus response to the COVID pandemic has been massive around the globe, and it is hard to understate the positive impact this will have on near-term economic growth. Interest rates are likely to rise modestly and remain a risk, but we do not think that higher rates will threaten economic growth in the near-term, nor that inflation will rise rapidly. However, higher interest rates, or the expectation of higher interest rates, may potentially have an impact on asset prices in the short-term. With that being said, we perceive higher rates as an indication of healthy economic growth and inflation, which historically has translated into positive performance for financial markets over the long-term. The number of COVID cases, hospitalizations, and deaths have been improving, and while economic and social restrictions associated with the virus remain a pressing concern for investors, especially as we continue to learn more about the variants, it appears that the recovery and re-openings are moving in a positive direction.

Company earnings continue to be positive, and we remain cautiously optimistic that corporations will experience a healthy bounce in profits this year. Our perspective and advice have not changed; while investors should prepare for short-term market volatility, we believe they are best served by compartmentalizing short and long-term needs and sticking with a personalized investment strategy that is aligned with their financial objectives, time horizon, and appetite for risk.

As always, we will continue to monitor market data closely and advise you of any significant developments that could impact your investments.

[1] National Data: Current Hospitalizations.

[2] Bloomberg, Covid-19 Vaccine Tracker.

[3] CDC, Variants of the Virus.

[4] Refinitiv, This Week In Earnings.

Related Posts

Insights: The Markets, COVID Developments, and Corporate Earnings

Sage Recognized by Barrons’ and The Financial Times

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events that were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2021 Sage Financial Group. Reproduction without permission is not permitted.