In response to worries about the spread of the coronavirus (COVID-19), global stock markets have continued to fall sharply this week, while the prices of core government bonds, widely seen as safe-haven assets in uncertain times, have risen steeply.

Although market activity is volatile, and additional incidents of the virus have been reported, our viewpoint about what investors ought to do in the present moment remains largely the same as it was when we reflected on Monday’s equity price declines: do not overreact. Our clients’ diversified portfolios are constructed to weather bouts of market downturn and volatility with their specific risk tolerance, time horizon, and investment objectives in mind.

What we know so far:

- The spread of the coronavirus is concerning, and it could and likely will spread further before it is contained, which means there will almost certainly be an economic disruption to global GDP growth in the first half of the year as a result.

- The rapidity with which equity markets have fallen into correction territory (i.e., declining 10%) may also be alarming to some. But it is important to remember that adjustments of this magnitude occur regularly, especially after valuations become slightly stretched as they had by the end of 2019 when the S&P 500 Index gained more than 30%. The specific trigger for the current correction may have been surprising, but the fact that a correction has occurred was a possibility we anticipated.

- To provide some perspective, the recent declines have not wound back the clock on equity performance more than a few months. The S&P 500 level is now back to where it was this past October.

- Exactly how the current coronavirus situation will play out is uncertain, however, we think that the eventual market reaction will likely mirror its reaction to prior infectious disease outbreaks.

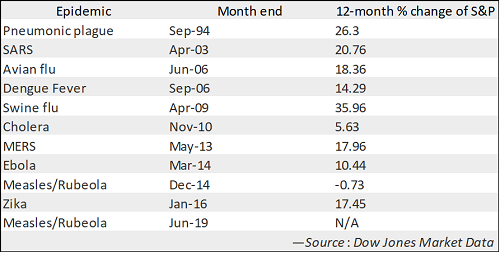

- In prior episodes of global health worries, near the height of initial worry, equity markets sold off and bond prices soared. Over a 12-month period, however, equity markets were extremely resilient. Near-term uncertainty gave way to longer-term recovery and expansion. Consider the table below, which we also included earlier this month in Sage Insights newsletter.

In Summary:

- The coronavirus has introduced worry and uncertainty among global investors, and it is always important to reassess emerging risks to portfolios as conditions evolve. But we also know that it can be tempting for investors to respond in an overly emotional way in such situations. Our clients’ diversified portfolios are constructed precisely with their risk tolerance, time horizon, and investment objectives in mind to weather bouts of market downturn and volatility.

- We would reiterate to clients the following: We are not complacent, but we also are not panicked. We do not know if the worst of the fears about and responses to the current coronavirus are past, but we believe that they will pass. Markets have shown over their history that volatility is more the rule than the exception and that events that prompt sell-offs tend to recede into the background over the longer term.

- We also want to take a moment and recognize the human aspect of this situation. We are saddened by the loss and suffering that so many people have already endured. We pray for the recovery of those afflicted and offer condolences to the families of victims.

As always, please do not hesitate to contact us if you would like to discuss anything.

Previous Posts

Our Perspective: On Yesterday’s Market Sell-Off and Coronavirus

Insights: Coronavirus Worries Stocks in January, But Lasting Economic Effects Likely Limited

The information and statistics contained in this report have been obtained from sources we believe to be reliable but cannot be guaranteed. Any projections, market outlooks or estimates in this letter are forward-looking statements and are based upon certain assumptions. Other events which were not taken into account may occur and may significantly affect the returns or performance of these investments. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur. These projections, market outlooks or estimates are subject to change without notice. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. All indexes are unmanaged and you cannot invest directly in an index. Index returns do not include fees or expenses. Actual client portfolio returns may vary due to the timing of portfolio inception and/or client-imposed restrictions or guidelines. Actual client portfolio returns would be reduced by any applicable investment advisory fees and other expenses incurred in the management of an advisory account. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Sage Financial Group. To the extent that a reader has any questions regarding the applicability above to his/her individual situation of any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Sage Financial Group is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Sage Financial Group’s current written disclosure statement discussing our advisory services and fees is available for review upon request.

Sage Financial Group has a long track record of citations and accolades. Rankings and/or recognition by unaffiliated rating services and/or publications should not be construed by a client or prospective client as a guarantee that s/he will experience a certain level of results if Sage is engaged, or continues to be engaged, to provide investment advisory services. Nor should it be construed as a current or past endorsement of Sage by any of its clients. Rankings published by magazines and others generally base their selections exclusively on information prepared and/or submitted by the recognized advisor. For more specific information about any of these rankings, please click here or contact us directly.

© 2020 Sage Financial Group. Reproduction without permission is not permitted.